Welcome to our July Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

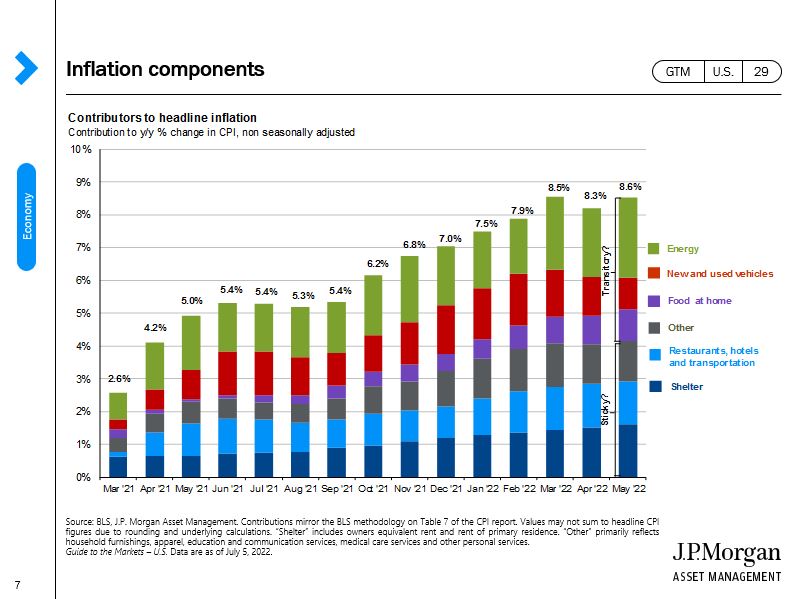

- Even More Inflation: June 2022 consumer prices came in 9.1% higher than June 2021. Even worse, prices for food have increased 10.4% year-over-year, outpacing the already high average inflation. According to Joseph Glauber from the International Food Policy Research Institute, “fruits and vegetables are up about 8%, dairy products are up 13 and a half percent, meat and poultry and fish are up about 12%.” (Source: Barron’s)

- A Strengthening Dollar: The value of a US Dollar has been increasing compared to other currencies around the world since the Fed has begun raising interest rates. The rising interest rates make the US look more attractive to outside investors and those inflows have helped to push the dollar higher. A strong dollar is beneficial for American tourists, the companies that cater to the American tourist, and to US import companies. It hurts European companies and the US companies that have a sizeable footprint in other countries. An 8% to 10% jump in the dollar causes US company profits to drop by 1% on average. (Source: July 18 Morning Brew)

- Housing Starts Take a Breather: According to the US Census Bureau, single-family housing starts and applications to build fell 2%, the lowest levels since 2020. Builder sentiment fell dramatically in July, and there are still concerns and issues with supply bottlenecks. It’s clear the increasing mortgage rates are starting to have an impact on supply and demand. (Source: Bloomberg)

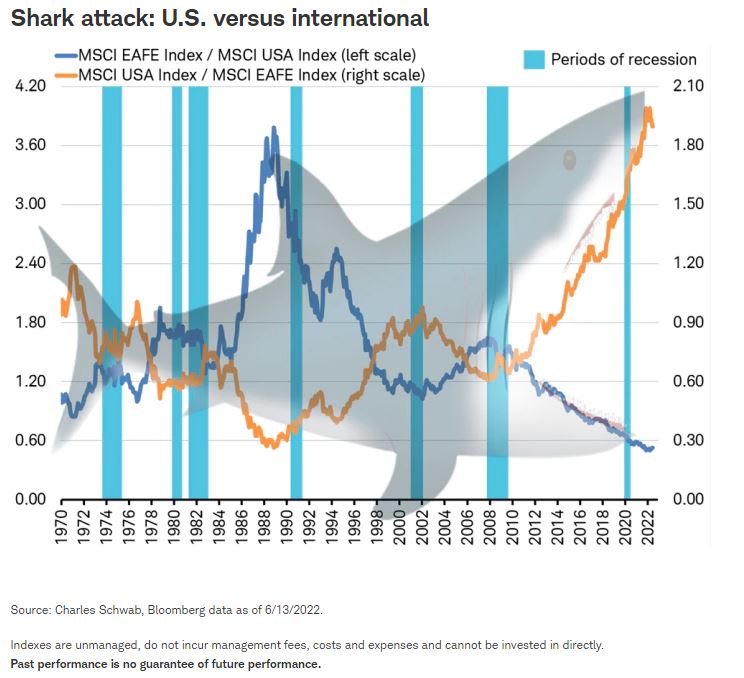

- Jeffrey’s Shark Bite: When the blue line is rising in the chart below, it means international stocks are outperforming US. When the orange line is rising, US stocks are outperforming international equities. Jeffrey Kleintop of Charles Schwab explains, “The shark’s massive jaws are open wide again, having been extending for more than 10 years. This time markets appear to be prepared to take a bite out of the relative performance of the U.S. stock market. We could see another shark attack as international stocks begin to outperform.” Over shorter periods of time, asset class returns can vary widely; however, long-term investors are typically rewarded for thoughtful portfolio diversification. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes. (Source: Charles Schwab)

Diversification: U.S. vs. International Stocks

Originally published April 27, 2020

In the midst of the current market turbulence, many of our clients are paying more attention to financial markets and their investment portfolios than they otherwise typically might. Rather than allowing headlines to influence our emotions, at PDS Planning we rely upon longer-term data and historical context to put the current environment into perspective and allow us to make more informed decisions.

In light of clients’ rekindled interest and heightened awareness, we thought it would be helpful to review some investing basics through the lens of our time-tested belief that “today’s headlines and tomorrow’s reality are seldom the same.” By sharing our objective outlook, we hope to alleviate some of our clients’ short-term emotional anxiety while achieving better long-term financial results for them. Be sure to read our previous “Diversification: Stocks & Bonds” post for more information.

Diversification

Diversification means investing in a wide variety of assets within a portfolio. The goal of diversification is to limit exposure to any single asset or risk. An easy way to visualize diversification is the typical portfolio pie chart with each slice of the pie representing a different asset class (ex. U.S. Large Cap Stocks, International Stocks, U.S. Bonds). A diversified portfolio has more slices resulting in each slice being smaller, thus spreading out your risk.

Global Stock Diversification

In much the same way investing in both stocks and bonds helps to diversify your overall investment portfolio, including a mix of both U.S. and International stocks (or equities) helps to reduce risk and provide more diversified sources of return.

But what is the “right” mix of U.S. to International stocks in a portfolio? Many investors exhibit “Home Country Bias” which is the tendency to own a substantially larger amount of stock from their own country than from other countries. This is a worldwide phenomenon and not unique to U.S.-based investors.

We believe long-term equity investing should more closely reflect “how the world works” rather than an arbitrary global mix of stocks skewed by where you live. The trickier part is determining your view for “how the world works”, whether it be through economies, stock markets, or wealth.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.