Market Recovery Alphabet Soup

As we all continue coping with the immediate health, economic, and financial market impacts of the coronavirus pandemic, we thought it would be helpful to look forward to the eventual recovery, particularly from a financial markets perspective.

Of course, we do not intend to minimize the loss of life and potential long-term health impacts this pandemic has caused from a human perspective. We are simply trying to gain a better understanding of how financial markets might behave as we emerge from this crisis. With many global economies essentially being shut down due to mandated shelter-in-place orders, how markets respond will be determined by a number of factors including when economies reopen, how we as consumers adjust our spending habits, how quickly employment recovers, and the resulting impact on corporate earnings and their long-term future outlook (which are some of the primary drivers of market prices).

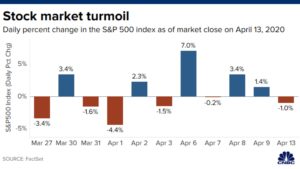

To put the current financial markets into perspective, on March 23rd, 2020, the S&P 500 had tumbled nearly 35% from its all-time high reached a month earlier. After additional government stimulus, the S&P 500 gained 12% last week, it’s best weekly gain since 1974.

Currently, the S&P 500 is still roughly 20% off the February record highs with near-record volatility over the past month.

Many “experts” are using an alphabet soup to help visualize their attempted predictions of the potential “shape” of the recovery.

“V-shaped Recovery”

The best case scenario with a steep plunge followed by an equally sharp recovery. Essentially thinking of our current shutdown as an “economic pause” where the economy immediately picks back up where it left off once social distancing restrictions are lifted. This type of optimistic recovery would be characterized by an unleashing of pent-up demand aided by the massive fiscal and monetary stimulus, both those policies already employed and additional stimulus potentially still to come.

“W-shaped Recovery”

A double-dip, where the markets recover (“bear market bounce”), then decline again, then eventually recover. Potential scenarios include lockdown restrictions being lifted only to be followed by a reemergence of coronavirus cases, or lingering effects of high unemployment, corporate bankruptcies, or new economic impacts such as high inflation.

“U-shaped Recovery”

A slower recovery taking more than a couple quarters. Perhaps in our post-coronavirus shutdown world, the lockdowns’ impacts will be felt for a while after they are lifted. For example, slowly easing social distancing restrictions with some industries continuing to suffer (i.e. travel/tourism, large social events such as concerts, movie theaters, festivals).

“L-shaped Recovery”

Market plunge followed by a much slower recovery. Currently appears unlikely for the U.S. as the cause would likely be continued increased coronavirus cases and extended lockdowns, but countries initially impacted by coronavirus (i.e. China) are beginning to bring their economies back online. Potentially a concern for emerging markets economies that have less potential for large government stimulus and often rely heavily on commodity exports.

“Swoosh or Tick/Check Market Recovery”

Sharp downturn followed by gradual recovery as lockdowns are eased over time and consumers are less likely to spend or invest and more likely to save.

“Y-shaped Recovery”

A short-term surge in growth followed by a slower period of growth. Suggested by Charles Schwab’s Liz Ann Sonders, taking into account “fault lines seen in the economy before the COVID-19-related economic implosion” including 1/3 of US Small Cap companies having negative pre-tax income and 25% of US Large Cap companies having negative year over year earnings per share growth.

Regardless of the shape of this recovery, we remind investors that, over the long-term, “the future is always the same”. Maintaining investing discipline, even during the most trying of times, by maintaining a diversified portfolio allocation consistent with your long-term goals combined with periodic rebalancing leads to beneficial long-term financial outcomes.

PDS Planning continues to be available to both our existing clients and prospective clients who can benefit from the financial planning and investment management services we provide. Please contact us if you have any questions or would like to discuss ways we may be able to assist you in providing clarity during these uncertain times.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.