Viewpoints: September 2020

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Big Money: The list of largest companies by revenue was released for 2020 and Walmart found themselves at the top for the 7th year in a row. Walmart, and the rest of the top four, generate more than $1 billion of revenue per day. According to the list by Fortune, it takes less than a month for Walmart to make as much as Starbucks makes all year. (Source: Fortune)

- Supply and Demand: This July, there were 400,000 fewer existing homes for sale when compared to July 2019, equating to a year over year drop of 21%. Even though supply may have been hurting, demand certainly was not. In the same year over year outlook (July 2019 vs July 2020), the median existing home price rose 8.5%. (Source: National Association of Realtors)

- First Time Home-buyers: Developing a realistic price target, be it in monthly mortgage payments or total home price, is paramount for first time buyers. Supply is down and demand is up (see above), but even more stressful is the fact 68% of home sales in July were on the market for less than one month. (Source: MarketWatch)

- West Cost Ablaze: Wildfires have been scorching 11 states in the West Coast all summer. According to the National Interagency Fire Center, fires have burned more than 4.7 million acres. In California alone, fires have burned through an area greater than the state of Connecticut. The effects have traveled across the entire US, as Ohioans saw the sun rising red through a smoky haze earlier this week. (Source: Wall Street Journal)

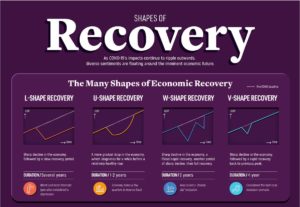

Chart for the Month – Visualizing an Economic Recovery

Trying to figure out if a world economy is recovering by looking at the data can be overly-complicated. We can better visualize economic and market recovery by going back to what we learned at 4 years old, the alphabet. In a blog post from April, “Market Recovery Alphabet Soup”,we discussed the common shapes of a market recovery – V, W, U, and L – and what each shape means. Visual Capitalist created a helpful graphic using data from the Conference Board of a survey of CEO’s around the world to illustrate the different types and opinions of economic recoveries.

Regardless of the shape of the eventual recovery, we stand by our time-tested belief that, over the long term, “the future is always the same”. Over shorter periods of time, investment returns and volatility can vary widely; however, long-term investors are rewarded for their time in the market, not for trying to time the market. Maintaining investing discipline, even during the most trying of times, by sustaining a diversified portfolio allocation consistent with your long-term goals combined with periodic rebalancing leads to beneficial long-term financial outcomes We remind clients to keep their next 7-12 years of anticipated cash distribution needs in stable assets such as cash, CDs, and short-term bonds.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.