Welcome to our June Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

- Gas Prices: The average price of gas in the U.S. topped $5 last week. When adjusted for inflation, that’s up more than 50% from only a year ago. With soaring prices, many assume the local corner gas station is raking in the profits. However, an article published in Barron’s by Avi Salzman and Marc Lajoie found the opposite. Gas stations are making less money today (25 cents gross profit per gallon) than they were in December last year (46 cents gross profit per gallon). (Click to download pdf of full source article: Barron’s)

- AEP Ohio: More than 170,000 Columbus area residents were left without power beginning Tuesday afternoon. According to AEP, severe storms Monday damaged transmission lines feeding power into Columbus. This, along with the hottest days of the year, put extreme stress on the power grid increasing the risk of further damage. Because of this, AEP initiated ‘rolling blackouts’ across the Columbus area leaving residents without power until an estimated time of Thursday at 11:59pm. More than 34,000 are still without power statewide, but only about 4,000 in Franklin County. AEP said they expect the repairs will allow the power grid in Columbus to operate as it normally would, even as temperatures rise. (Source: AEP and 10 WBNS)

- Mortgage Rates: Yesterday Jerome Powell and the Fed announced a 0.75% increase to interest rates. Take a look at our post On Interest Rates for a helpful reminder. As the fed funds rate continues to increase, and as the US Treasury yields continue to grow, savings rates are increasing. But so are borrowing rates. The average interest rate for a 30-year fixed-rate mortgage reached 6.28% this week. At the end of December the average was near 3.11%. This difference in interest rates costs homeowners in a big way. On a $300,000 loan, paying 6.28% instead of 3.11% results in an extra $570 per month mortgage payment which then amounts to $6,840 more per year and $205,319 more over the 30 year loan. (Source: CNBC)

- Renewable Texas Energy: Electricity demand in Texas beat their 2019 record and surpassed 75 gigawatts last Sunday. Where previous weather events and electricity demand has led to blackouts across the state, this time the power grid has been holding up well. According to data analysis from several experts, the reason this time is different is in large part to strong performance from wind and solar power. Those two sources generated 27 of the 75 gigawatts needed during Sunday’s energy peak. Nearly 40% of the total. Texas has been growing their zero-carbon electricity sources and those (wind, solar, nuclear) accounted for 38% of the state’s power in 2021. (Source: CNN)

Market Predictions

Originally published January 14, 2021

“The only function of economic forecasting is to make astrology look respectable.” – John Kenneth Galbraith, Economist

THE 2021 MARKET PREDICTIONS ARE IN, AND THEY’RE PROBABLY WRONG.

Every year, the top investment banks, research institutions, and market analysts make their predictions on where the S&P 500 (stock market) will close the year. They have mountains of research at their disposal, a slew of economic indicators, and they still get it wrong most of the time.

Take 2008 when the markets fell 38% as an example:

- “Stocks will reach new record highs at some point during the upcoming year.” – Robert C. Doll, Vice Chairman and Chief Investment Officer of Global Equities at BlackRock (January 2009)

- “It is hard for us, without being flippant, to even see a scenario within any kind of realm of reason that would see us losing one dollar in any of these [credit default swap] transactions.” – Joseph Cassano, AIG financial products head (August 2007)

- “The Federal Reserve and Congress have delivered a ton of economic stimulus, and that stimulus is set to juice up an economy that has been weak, but not terrible. If everything goes according to plan, the economy will grow faster in the second half of the year, and a recession will have been avoided.” – Kevin Hassett, American Enterprise Institute (June 2008)

Or 2017 when the markets rose 19%:

- “However, we see a down market in H2 [second half] 2017, hence our year-end 2017 target of 2,300 (3% gain).” – Credit Suisse

- “Our mid-2017 target is 2,250 while our preliminary 2017 year-end target is 2,325 (4% gain).” – Citi

- “We think that, fundamentally, risks for equities in 2017 are likely to be higher compared to this year (year-end target 2,400. 7.5% gain)” – JPMorgan

What’s the point?

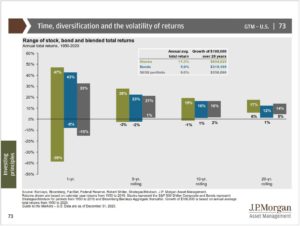

No one has a crystal ball. No one can predict the future. It’s cliché, but true. When analyst forecast’s starting hitting inbox’s and making headlines, simply ignore them. If there is one key takeaway from learning the poor track record of predictions, it’s to remember the importance of a diversified allocation. Over shorter periods of time, investment returns and volatility can vary widely; however, long-term investors are rewarded for their time in the market, not for trying to time the market. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes.

“Today’s headlines and tomorrow’s reality are seldom the same.”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.