September 2020 Financial Markets Summary

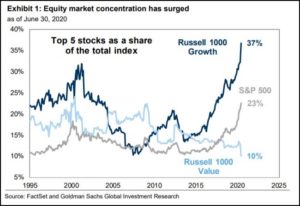

The S&P 500 Index has historically been one of the best representations of the United States stock market. This is a market capitalization weighted index of 500 large companies in the U.S. Market capitalization weighted is a technical term meaning the larger the company, the larger the respective company weighting within the index. This results in the largest companies having the most significant impact on the overall index return.

Despite all of the negative news, the S&P 500 has recently hit its all-time high. Wouldn’t you then expect the majority of the stocks within the S&P 500 to also be at their all-time highs? Not in 2020! According to Michael Kantrowitz from Cornerstone Macro, the average stock within the S&P 500 is 28% below its all-time high. In fact, 115 of the S&P 500 stocks are 50% below their all-time highs.

The index has not been a true reflection of domestic stocks this year since it is currently driven by just a handful of names focused in the technology sector. Amazon, Apple, Facebook, Google (Alphabet) and Microsoft currently account for almost 25% of the entire S&P 500 Index. To take it even further, the overall value of Apple ($2.3 trillion) just exceeded the value of the entire German stock market. These large companies have really boosted the S&P 500 return this year as they have continued to rally throughout the pandemic by as much as 90%.

However, Charles Schwab’s Jeffrey Kleintop suggests that “even though the biggest market-cap stocks have outperformed by a wide margin this year, the outperformance by the biggest U.S. stocks is hiding a change in leadership by the average stock: the average international stock has been outperforming the average U.S. stock.”

International stocks have lagged domestic stocks by a fairly wide margin over the past 10 years, but we remind investors to not abandon them within portfolios and chase the recent large cap domestic performance. Now may be as important as ever to maintain a diversified allocation. COVID-19 and the elections will continue to result in volatility that could tempt you to make an emotional decision with your portfolio, but we urge investors to maintain discipline by staying the course and rebalancing their portfolios.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

| 2020 YTD | 1-Year | Average | Average | |

| S&P 500 Index – Large Companies | 8.3% | 19.6% | 12.1% | 12.8% |

| S&P 400 Index – Mid-Size Companies | -6.6% | 2.4% | 6.3% | 10.3% |

| Russell 2000 Index – Small Companies | -6.4% | 4.5% | 6.1% | 10.0% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) | 3.6% | 15.4% | 9.8% | 9.8% |

| MSCI EAFE Index – Developed Intl. | -4.6% | 6.1% | 4.7% | 5.9% |

| MSCI EM Index – Emerging Markets | 0.5% | 14.5% | 8.7% | 3.7% |

| Short-Term Corporate Bonds | 2.7% | 3.3% | 2.4% | 2.0% |

| Multi-Sector Bonds | 6.9% | 6.5% | 4.3% | 3.7% |

| International Government Bonds | 4.4% | 1.7% | 3.7% | 0.9% |

| Bloomberg Commodity Index | -9.0% | -3.9% | -3.1% | -5.0% |

| Dow Jones U.S. Real Estate | -10.0% | -7.6% | 7.5% | 9.4% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.