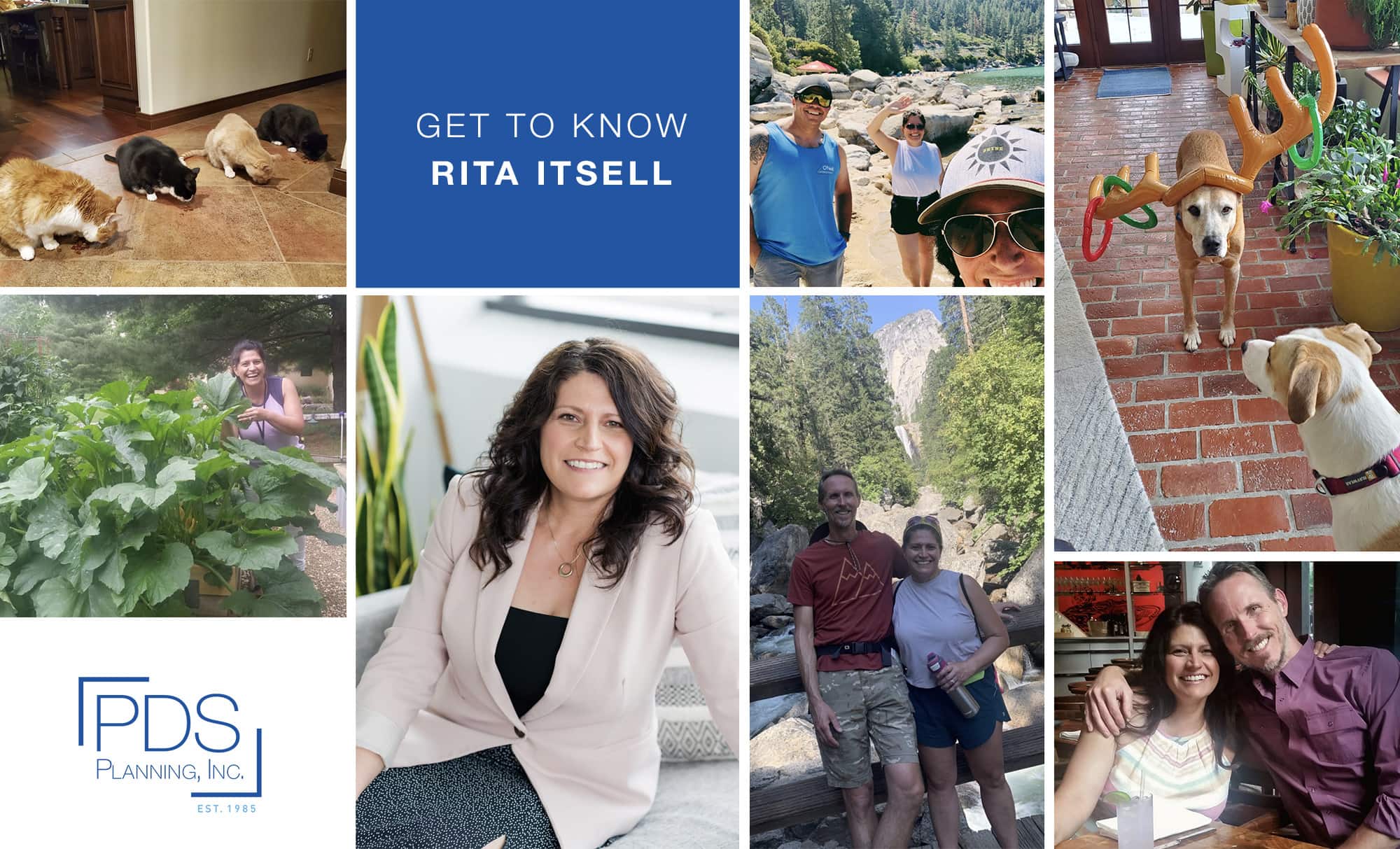

PDS Planning Employee Spotlight – Rita Itsell

Managing Principal of PDS Planning, Rita Itsell took a nontraditional path through her educational and professional careers which have influenced how she approaches her work and relationship with her clients.

Rita ultimately received her B.S. in Finance from Franklin University after nearly nine years of coursework – mostly at night – at a variety of institutions that she attended as she moved across the country with her husband before finally landing in Columbus. She actually began her career in agriculture, helping farmers with their cash grain marketing and personal finances.

In her role as a Wealth Manager, Rita leans on this experience as she works with clients to help them address their personal financial goals through face-to-face meetings and ongoing client communications. Her experience, she says. “helps me value and communicate with folks in a variety of ways and to meet them where they are.”

It is in her role as Managing Principal that she is responsible for overseeing the company finances, setting the short- and long-term strategic goals for the organization, and working with the staff to address the operations of the business.

At PDS, we are proud to have a team of forward-thinking leaders and to count Rita among them. We recently had the opportunity to talk with Rita about her career with PDS, as well as about how she spends his time away from work.

How do you think PDS is different from other financial planning firms?

We have always focused our energy wholly on the outcome for our clients rather than the amount of assets or fees they would be able to bring to the firm. We have built so many long-term relationships focusing on caring rather than just revenue.

I have always been a buyer of value, meaning I have to receive something directly in return for what I am giving up or paying. I always found it hard to align that thought process with any other fee structure than a flat-fee model which is what PDS has been offering our clients for the last 20 years.

What do you see on the horizon for the financial planning industry?

I think our industry will see a transition in how the consumer approaches evaluating financial advisory services. With the increased consumer education toward our industry, I believe the consumer is becoming more knowledgeable in how to value services and that the outdated commission or percentage of assets fee structure doesn’t translate to value in their personal financial growth. But rather having the support and knowledge that impacts the outcome of a more informed financial decision.

Tell us about your family.

My husband and I are high school sweethearts getting ready to celebrate 35 years of companionship and 29 years of marriage and we still enjoy spending time with each other. We live outside the city and have space that accommodates the members of our family – the four-legged ones.

When you are not working, how do you like to spend your free time?

I am a creative person by nature so having a balance of right-brain and left-brain activities helps keep me centered and focused. I always have a project going that allows me to separate from my day to day. As a routine, I continue my long time obsession with health and fitness through gardening, exercise and regular reading on the subjects.

Share your involvement with PDS Cares.

The giving nature of our charitable fund “PDS Cares” is something that we talked about starting long before the program was actually created. It aligns with the philosophy of PDS, giving back to the community. I like knowing that not only can we make contributions but that our staff can make charitable gifts through PDS Cares, as well.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.