October 2020 Financial Markets Summary

Emotions are running high around the country with the upcoming election. Many are wondering how this will impact financial markets. The reality is elections come and go and things don’t tend to change too much. The status quo normally prevails. The world will continue to turn and Apple will continue to make smartphones. That’s not to say that elections don’t have consequences – they do. But is worrying about the outcome going to change anything? And is changing your portfolio going to improve your ability to reach your long-term goals? We urge investors to not allow their emotional biases around election season to dictate their portfolios.

Predictions and parallels to past elections are coming in every day. Invesco’s Brian Levitt sums this up well in their recently released 10 truths about the election no matter who wins shown below.

- Markets have performed well under both parties. The S&P 500 has delivered an average annual return over the past 75 years, through both Democratic and Republican administrations.

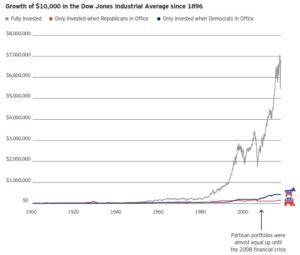

- Investors are better off staying fully invested. The best performing portfolio over the past 120 years was one that stayed fully invested through both administrations. Partisan portfolios which only invested when a Democrat or Republican were in office significantly underperformed.

- We do not radically re-engineer the US economy. Significant changes take time and require control of Congress in today’s extremely partisan world.

- The historical narrative is not as you remember it.

- Signature legislation accomplishments are infrequent, and the impact is not always as expected. Predictions and assessments about the ultimate impact of legislation are often far removed from the actual results.

- Predictions tend to be wrong. Practically all polls suggested that Trump didn’t have a chance in defeating Clinton.

- Monetary policy matters more. For all the focus put on the executive branch, we would argue that it is monetary policy that matters more. The old adage holds true: Don’t fight the Fed.

- It’s okay if you don’t like the President. The market doesn’t care. It’s hard to discern any direct relationship between a president’s popularity and the health of the US economy and the performance of financial markets.

- No, this is not the most vitriolic election. While political debates and sound bites make for contentious TV today, fortunately, nothing in recent memory compares to the personal vendetta between sitting vice president Aaron Burr and former treasury secretary Alexander Hamilton.

- Don’t confuse partisan politics with market analysis and keep your eye on one indicator. Regardless of who you favor, don’t let your favorite election indicators, or the ultimate result, disrupt your financial plan.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

|

2020 YTD |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

4.1% |

13.0% |

11.9% |

11.4% |

| S&P 400 Index – Mid-Size Companies |

-9.8% |

-3.8% |

6.3% |

8.8% |

| Russell 2000 Index – Small Companies |

-9.6% |

-1.0% |

6.5% |

8.4% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

0.5% |

9.6% |

10.0% |

8.4% |

| MSCI EAFE Index – Developed Intl. |

-7.1% |

0.5% |

5.3% |

4.6% |

| MSCI EM Index – Emerging Markets |

-1.2% |

10.5% |

9.0% |

2.5% |

| Short-Term Corporate Bonds |

2.7% |

3.3% |

2.4% |

2.0% |

| Multi-Sector Bonds |

6.8% |

7.0% |

4.2% |

3.6% |

| International Government Bonds |

4.2% |

3.6% |

3.5% |

0.6% |

| Bloomberg Commodity Index |

-12.1% |

-8.2% |

-3.1% |

-6.0% |

| Dow Jones U.S. Real Estate |

-12.1% |

-11.4% |

6.6% |

8.7% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.