May 2020 Financial Markets Summary

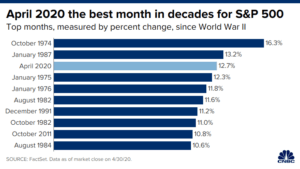

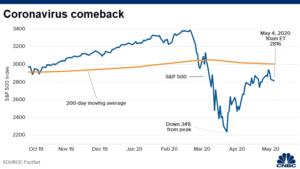

April was a strong month for markets (in fact, the best month since January 1987) as the number of new COVID-19 cases started to plateau, prospects of a potential vaccine improved and plans to reopen economies were laid out. However, we wanted to look at this through a longer-term perspective. The global coronavirus outbreak has changed everyday life in profound ways – and will likely reshape our future as well.

BlackRock’s Tony DeSpirito identified five areas of change that we could see for years ahead:

Technology to power a low contact world

“The crisis turbocharged trends already in motion: remote offices, online education, online gaming and streaming.” Many companies now realize that a portion of their staff can work from home and be just as productive. This will put pressure on commercial real estate as companies reduce their office footprint. Telehealth technology continues to boom as doctors recommend this alternative, but still effective solution in this social distancing environment.

Global vs. local debate

This pandemic has caused companies to reevaluate their long-term push towards globalization. “Supply chains will need to diversify to enhance their resilience.” However, this could result in higher inflation as companies shift from their current concentrated supply chain with low cost labor.

Company balance sheets reconsidered

Many investors analyze company balance sheets to see how they were impacted during previous recessions. However, the COVID-19 restrictions have not only hurt revenue, but nearly eliminated all revenue for some industries. Air travel is down 95% from a year ago and brick and mortar retail has really struggled, especially those without an online presence to name a few. “We expect entities with ample cash could be positioned to make some extraordinary deals with companies that are cash needy in the wake of the crisis.”

ESG accelerated

COVID-19 has made a dramatic negative impact on so many lives and economies, but the silver lining from this pandemic could be around global pollution. With many factories and vehicles idle for the past month, this has resulted in drops in air pollutants to levels not seen in at least 70 years. This could bode well for ESG (environmental, social and governance) related investments as more capital is shifted to these themes to benefit society.

Slow ease back to leisure

We will likely see the leisure industry under significant pressure at least until a vaccine is in place. Many will be cautious to fly, stay in hotels and gather in large groups for quite some time.

We expect financial markets to maintain their heightened levels of volatility over the near-term as markets continue digesting the health and economic impacts of COVID-19. We remind investors to avoid letting their emotions influence their investing decisions, to maintain a diversified allocation that is consistent with your long-term goals, and to periodically rebalance portfolios. Additionally, keeping 7-12 years of anticipated income needs from your portfolio in stable assets such as cash, CDs and short-term bonds is a prudent strategy to weather ongoing uncertainty.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

| 2020 YTD | 1-Year | Average | Average | |

| S&P 500 Index – Large Companies | -9.90% | -1.10% | 6.90% | 9.20% |

| S&P 400 Index – Mid-Size Companies | -20.20% | -16.50% | 1.90% | 6.90% |

| Russell 2000 Index – Small Companies | -21.40% | -17.60% | 1.40% | 5.90% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) | -13.90% | -6.30% | 4.00% | 6.70% |

| MSCI EAFE Index – Developed Intl. | -17.80% | -11.30% | -0.20% | 3.50% |

| MSCI EM Index – Emerging Markets | -16.60% | -12.00% | -0.10% | 1.30% |

| Short-Term Corporate Bonds | -0.40% | 2.10% | 1.70% | 1.90% |

| Multi-Sector Bonds | 4.90% | 10.80% | 3.80% | 3.90% |

| International Government Bonds | 1.50% | 5.00% | 2.70% | 1.50% |

| Bloomberg Commodity Index | -24.50% | -23.10% | -9.10% | -6.80% |

| Dow Jones U.S. Real Estate | -17.50% | -9.10% | 4.40% | 7.60% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.