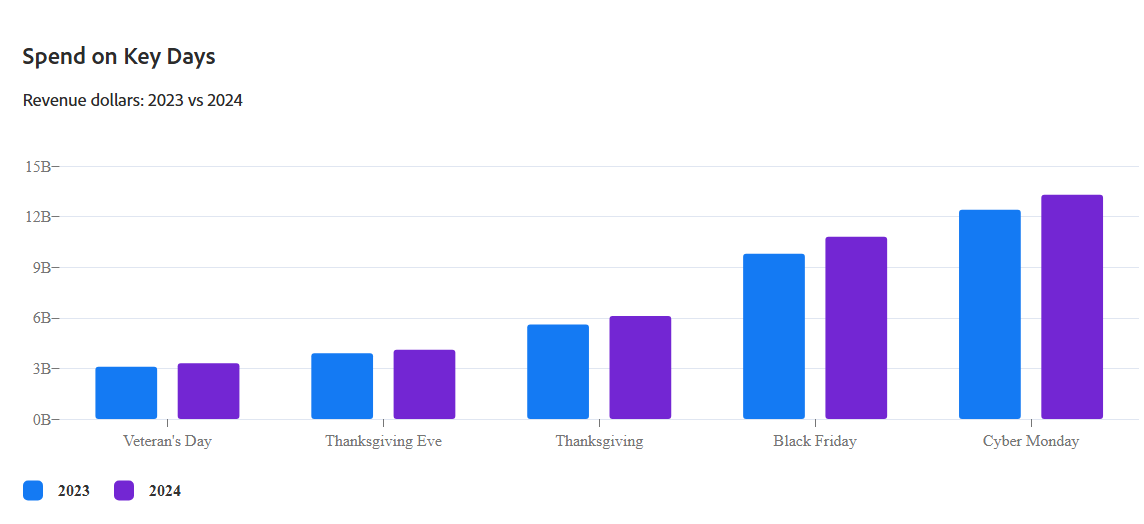

The Black Friday and Cyber Monday deals were too good to pass up and it looks like most people agreed. According to Adobe Analytics, Black Friday shoppers spent $10.8 billion and Cyber Monday shoppers doled out $13.3 billion – the single biggest shopping day of all time.

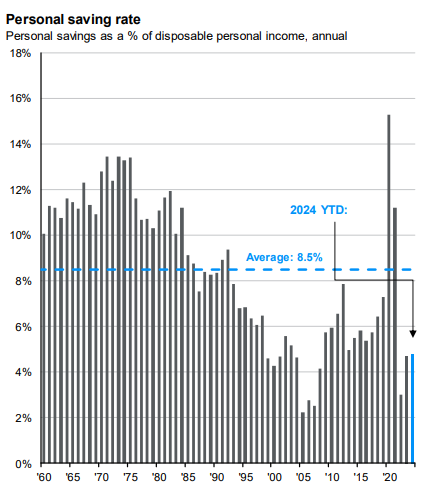

Taking the spending at face value, the general consensus shows a rosier outlook from the lenses of inflation, interest rates, and jobs. Consumers’ willingness to spend potentially depleted savings [link] could point to optimism and comfort. Looking under the hood may paint a different picture. The personal savings rate of about 4.5% YTD is well below the long-term average of 8.5% and below the shorter-term average of about 5.5% since 2000. Paired with the data showing excess savings having been depleted back in May of this year, do American’s have $13.3 billion to spend?

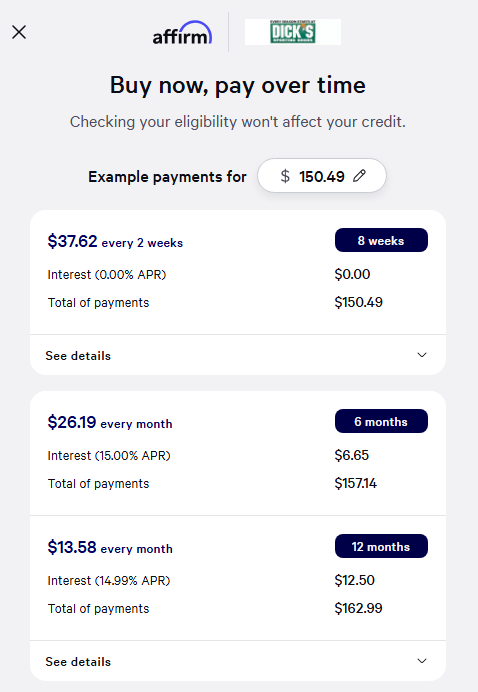

With the adoption of buy now, pay later [BNPL] apps, affordability is less of a concern. On Cyber Monday alone, nearly $1 billion was spent using BNPL apps like Klarna, Affirm, or Block. If you’ve bought anything online you may have seen it when checking out. Buying a pair of running shoes at Dick’s Sporting Goods?

It’s essentially a short-term loan with no credit checks and usually there’s no interest IF payments are made on time. In an article posted on Charles Schwab, “multiple missed payments could mean multiple fees. You may even be charged interest on a late fee. But that’s not all. Some BNPL plans do report late payments to the credit bureaus and may even turn you over to a collection agency.”

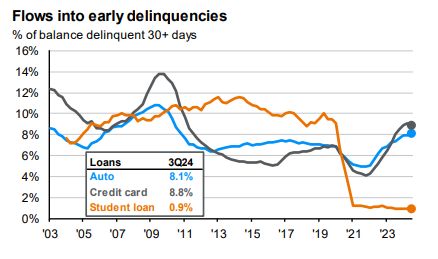

A chart from JPMorgan shows flows into early delinquencies for Auto and Credit Card loans have been increasing since late 2021. In conjunction with a report from the Federal Reserve Bank of New York claiming “customers spend 20 percent more when BNPL is available, with less creditworthy customers being most responsive to BNPL offers,” the health of consumer spending may not be as robust as first thought.

I admit this sounds very negative, but it’s just a small piece that makes up the entire economy. The stock market continues to show strength and increased breadth among S&P 500 constituents. Inflation continues tracking toward the long-term target of 2% and interest rates are slowly being worked down as planned. In most markets, there is good and there is bad and it’s important to be aware of both the good and the bad. At PDS, we always remain open to new and updated information so we can adjust views accordingly. We continue to monitor client portfolios for any rebalancing or tax savings opportunities and wish everyone a very Happy Holiday season!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.