Buying on Margin

In a recent post explaining what was happening with GameStop, we discussed what short selling is and how a stock can get squeezed higher. Remember, entering into a short position is one of the riskiest investments to make because the losses are infinite (stocks can only go down to $0 while they can go up forever). While the price of GameStop was seesawing, a second concern had begun to emerge. The risks of buying on margin.

What is Buying on Margin?

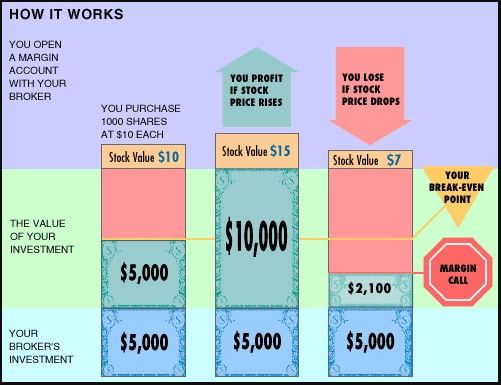

Margin is an account feature that allows the investor to borrow money from a broker in order to buy securities. The rules state the investor must fund at least 50% of the security purchase and the other half may be borrowed. Like any loan, the borrowed amount will need to be returned and interest on the loan is charged monthly to the investors account.

For example, an investor purchases 100 shares of GameStop stock trading at $100 in an account with margin allowed. Instead of using $10,000 of their own money, they’ll invest $5,000 on their own and borrow the remaining $5,000 to complete the transaction.

The next day, the stock is at $200 per share and the investor sells GME, now worth $20,000. $5,000 will be paid to the broker to cover the loan amount while the remaining $15,000 is the investors. In this example, the stock price doubled, but the investor actually tripled their initial $5,000 investment.

Consider the other side of the risk coin. Suppose the investor let emotions or greed get the better of them, or they simply missed the opportunity, and they continued holding the stock. Now, instead of selling at $200, they sell when GME is at $50 per share. The total $10,000 investment is now worth $5,000, and the borrowed amount still needs to be paid back. In this case, the stock price halved, and the investor lost 100% of their investment instead of just 50% after paying back the loan..

Understanding the Risks

Borrowing money to leverage your investments can just as easily magnify your losses as it can with your gains. If the value of the investments and thus the equity in your account falls below the maintenance margin requirement, the broker will issued a margin call.

Maintenance margin is the minimum level of equity needed in the account once the initial purchase is made. It’s usually 20%-30% of the equity provided. In the above example, the maintenance margin would be $2,000 (20% of $10,000).

A margin call is made when the equity balance falls below the maintenance requirement. When this happens, the investor will receive a call from their broker asking for more cash to be deposited back to the maintenance margin requirement. However, if a deposit can’t be made or is not made in time, the broker has full discretion to sell securities to raise enough cash to meet the necessary amount.

What This Means for You

In general, we at PDS do not recommend buying on margin. While it can be used as a way to leverage returns and attempt to beat the market, it’s easy to get caught on the wrong side of it. We prefer to keep it simple; invest the money you have instead of borrowing to speculate. Most of the accounts PDS manages do not have the margin feature available, and no accounts PDS manages have a margin balance.

Understanding different investment types and structures is imperative to understanding the risks associated with investing, and that can be stressful if it’s all on your shoulders. Since 1985, PDS Planning has worked with clients to eliminate that stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.