Bitcoin: Blockchain, Mining, Energy

It’s no secret that Bitcoin and cryptocurrencies in general have gained significant popularity and notoriety over the last 12 months. Most notably because the return has been an astronomical 430% over the time period, but also due to companies such as Tesla, MicroStrategy, and Square investing a collective $3.9 billion earlier this year. For anyone invested in Bitcoin or following the asset, this last year has not been without its ups and downs.

What is Bitcoin?

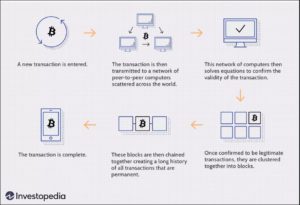

Bitcoin is a decentralized digital currency. All transactions made with bitcoin are noted on a public ledger and verified by a network of computers. Many people and companies are working to verify transactions instead of just one entity, making it decentralized. The public ledger of bitcoin transactions are stored in the blockchain.

What is the Blockchain?

Think of it simply as blocks being stacked on top of each other, one after the other, with each block containing different transactions. The massive network of computers mining the bitcoin are responsible for verifying each public transaction on the ledger. Once a block is full, it needs to be closed and another block opened for the next round of transactions. In order to close the block, and incredibly complicated math equation must be solved. Whoever is responsible for solving the equation is awarded bitcoin as payment.

While the bitcoin blockchain network is public, it remains completely anonymous. Each user is assigned their own specific public key. A long string of numbers and letters attached to each transaction instead of the users name or username.

For more information and explanation on blockchain and how it can prevent large scale attacks, click the links below.

What is Mining?

Mining is the process of solving a complex math problem required to close a block and add it to the chain. There are about four billion possibilities to sift through in order to solve the problem, thus confirming the necessity for equally complex and powerful computers. Miners who successfully solve the math problem are awarded their payment, currently worth 6.25 bitcoin. In dollars today, approximately $315,000.

However, mining doesn’t come without its own costs. Building these super computers and mining facilities is very expensive. Not only the upfront costs, but the expenses related to powering the systems is in a class of its own. If people and companies want to increase their chances of solving the equation first, they need more computers. More computers means more electricity.

Using data from the University of Cambridge’s Bitcoin Electricity Consumption Index, VisualCapitalist put together a visual and chart of bitcoin’s power consumptions compared to other companies, states, and even countries. The bitcoin mining network consumes more electricity than the entire country of Norway. Considering this massive power need, there is hope the bitcoin mining network will be a boon to global transition to renewable energy. To learn more about the relationship between bitcoin mining and renewable energy, click here.

Working With a Professional Advisor

One of the primary benefits of working with a professional advisor such as PDS Planning is our ability to provide discipline and guidance. Bitcoin and cryptocurrency in general is still being figured out. Bitcoin itself can’t be reliably used to pay for items and it remains one of the most volatile and risky assets in the market. While it may provide diversification benefits due to lack of correlation, it can also greatly increase the risk to portfolios. Most financial institutions still do not offer the ability to purchase cryptocurrency through personal accounts. Because of these issues, PDS does not believe it belongs as a staple in client accounts. But as always, we are continuing to monitor the ever changing markets.

Since 1985, PDS Planning has worked with clients to eliminate that stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.