Now that the Olympics have wrapped up, it created an incredible opportunity for the country to come together as one no matter the political affiliation and be proud to be an American. These elite athletes have dedicated countless days, weeks and years to their sports to be able to compete on the global stage, but how do the Olympics relate to investing today?

Global Diversification

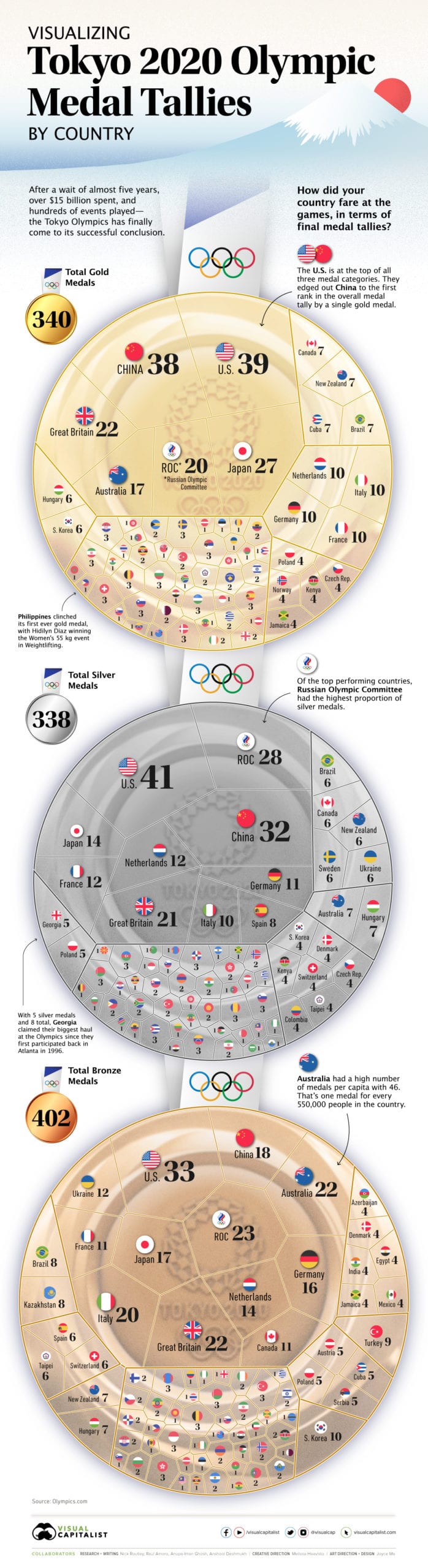

The U.S. won the total medal count at 113 with China in 2nd at 88 and Russia in 3rd at 71. However, the U.S. narrowly edged out China with 39 gold medals compared to China’s 38 and host country Japan’s 27. Even though the U.S. won the most gold, silver and bronze medals, the Olympics clearly showed that many of the world’s best athletes are outside of the states. The same applies to stocks today where some of the best companies are not based in the U.S. Investors often tend to have a home country bias where they focus the majority of their portfolios in domestic stocks and miss the opportunity to invest into these incredible international companies. Global diversification is paramount in today’s investing landscape.

Don’t Put All of Your Eggs in One Basket

Going into the Olympics, Simone Biles was the heavy favorite to win multiple gold medals. In particular, the women’s all-around individual event which goes to the best gymnast in the world. She was clearly ahead of the rest of the competition. Today, it may appear that Amazon, Apple or Tesla, for example, are best in class companies that could never lose. This may tempt investors to heavily shift their portfolios into one or two stocks that seem to be a “sure thing.” But unfortunately, as the world saw Simone Biles withdraw from most of the events, clearly the unexpected happened where she didn’t win a single gold medal. We prefer to spread some of this individual company specific risk by using low cost index funds rather than choosing one or two stocks to hopefully lead the charge.

Record Breaking

Many wondered whether the one year delay due to COVID would reduce the number of world records broken at this year’s Olympics. But again these elite athletes continued to push through and take down 20 world records across various sports this year. Despite all of the risks and unknowns in today’s economy, the S&P 500 has closed with 42 record highs so far in 2021.

Past Performance May Not Be Indicative of Future Results

Who would medal in the investment Olympics if we tallied the country results from the beginning of 2016, the year of the last summer games? Surprisingly, Taiwan would take home gold with a 270% return, the Netherlands silver with 239%, Kuwait bronze with 228% and the U.S. in fourth with 220%. The past results of these companies clearly didn’t suggest the Olympic winners, but we would also expect to see a potential new list of countries over the next five years as Taiwan and the Netherlands have clearly benefitted from their exposure to the semiconductor industry. Just like with Olympic athletes, many companies are dedicating significant resources to compete on the world stage for the next games.

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

5.1% |

34.3% |

15.1% |

13.0% |

| S&P 400 Index – Mid-Size Companies |

-0.8% |

45.0% |

11.6% |

11.1% |

| Russell 2000 Index – Small Companies |

-1.8% |

50.4% |

12.8% |

10.8% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

3.2% |

34.8% |

13.7% |

10.1% |

| MSCI EAFE Index – Developed Intl. |

2.9% |

30.3% |

9.4% |

6.1% |

| MSCI EM Index – Emerging Markets |

-4.4% |

20.6% |

10.4% |

3.6% |

| Short-Term Corporate Bonds |

0.5% |

2.2% |

2.4% |

2.0% |

| Multi-Sector Bonds |

2.1% |

-0.7% |

3.1% |

3.3% |

| International Government Bonds |

0.9% |

-1.6% |

0.3% |

-0.2% |

| Bloomberg Commodity Index |

6.6% |

40.3% |

3.9% |

-4.5% |

| Dow Jones U.S. Real Estate |

8.2% |

32.9% |

8.4% |

10.2% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.