Welcome to our September 2025 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

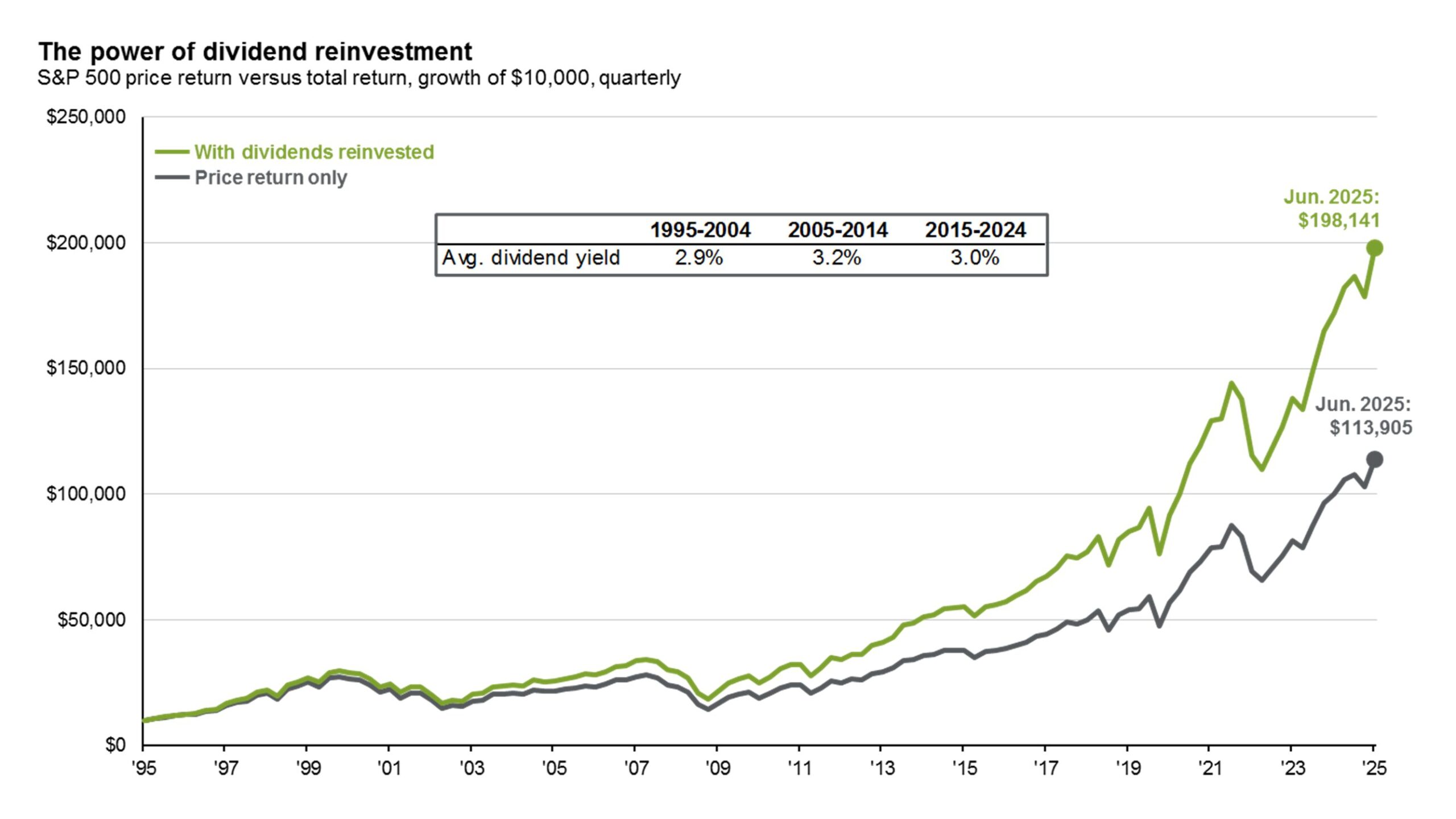

The Magic Math of Compounding

The long-term impact of reinvesting dividends is hard to ignore. Since 1995, a $10,000 investment in the S&P 500 with dividends reinvested would have grown to nearly $198,000 by mid-2025, compared to just under $114,000 for price return alone. That difference—over $80,000—isn’t the result of luck or market timing, but simply the compounding effect of dividends steadily reinvested over time. With average dividend yields of just over 2% over the past three decades, dividends have quietly provided a meaningful boost to total returns. For investors, this reinforces the importance of patience, discipline, and letting the magic math of compounding do the heavy lifting.

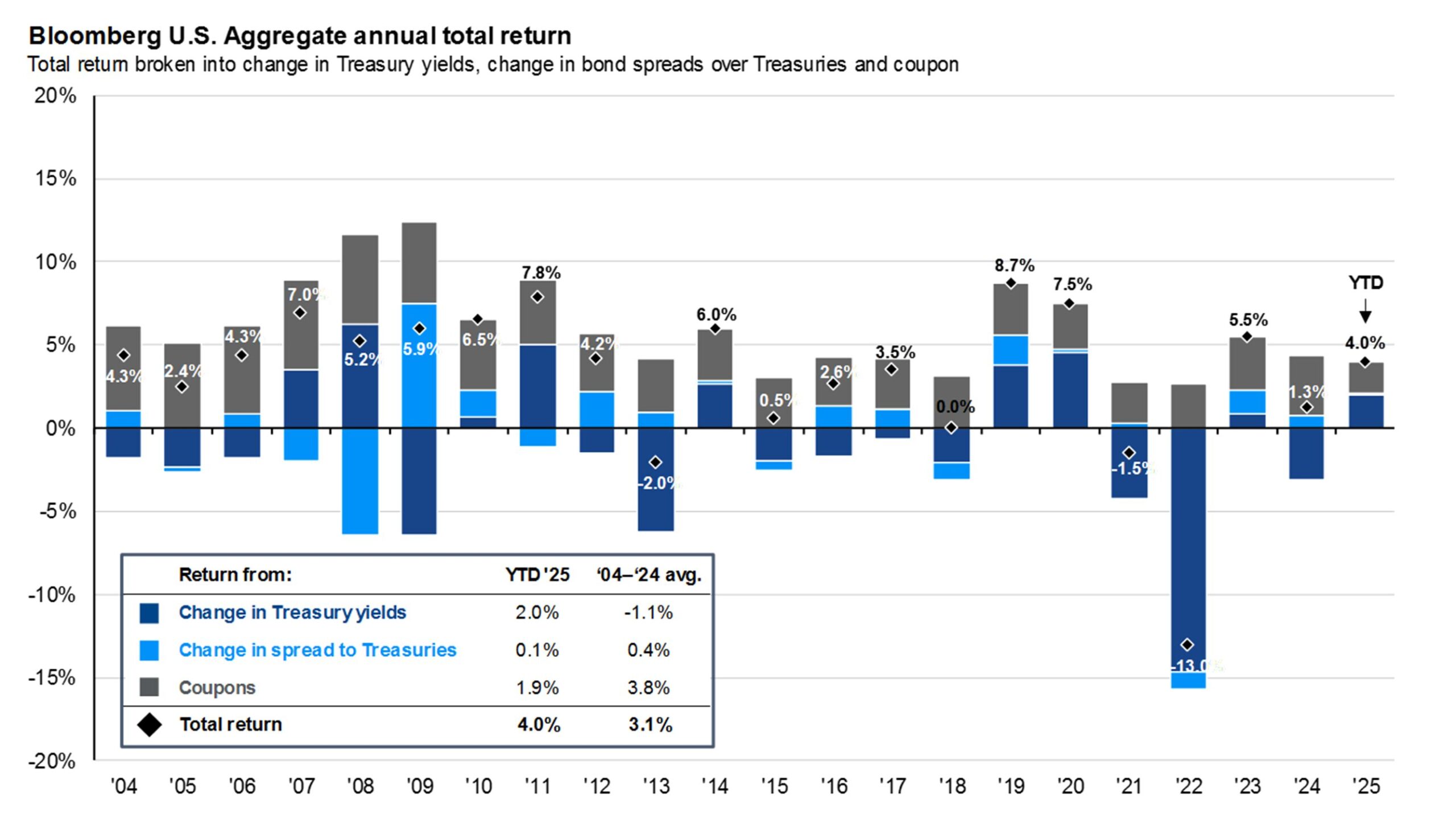

Components of Bond Fund Returns

After two of the toughest back-to-back years in bond market history, fixed income is showing signs of recovery. Through mid-2025, the Bloomberg U.S. Aggregate has returned 4.0%, already above its long-term average of 3.1%. Unlike the painful drawdowns of 2021 and 2022, this year’s gains have come from a healthy mix of sources. Yields have fallen—boosting bond prices and contributing positively to total returns—while steady coupon income and minimal movement in credit spreads have also helped.. The message for investors is bonds are once again playing their role as a stabilizer, providing both income and diversification after years where they were a source of frustration.

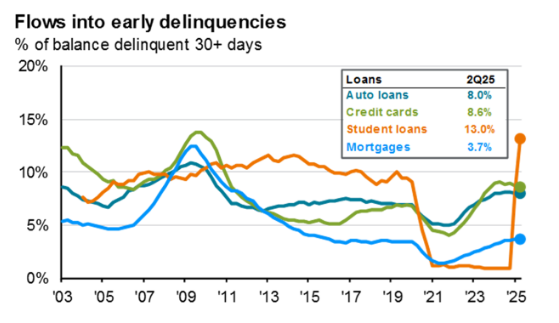

Delinquencies Trending up

Recent data shows a sharp uptick in early delinquencies across nearly every loan category. Student loans stand out with 13% of balances already delinquent (but that’s not surprising after required payments were paused), while credit cards and auto loans aren’t far behind at 8.6% and 8.0%, respectively. Mortgages remain comparatively healthier at 3.7%, but even they’ve been trending upward since 2021. While the spike looks alarming at first glance, it’s important to remember these levels are still below the extremes seen during the 2008–2009 financial crisis. Rising delinquencies can reflect growing consumer stress, but they also highlight how credit markets tend to reset during periods of higher interest rates and economic transition.

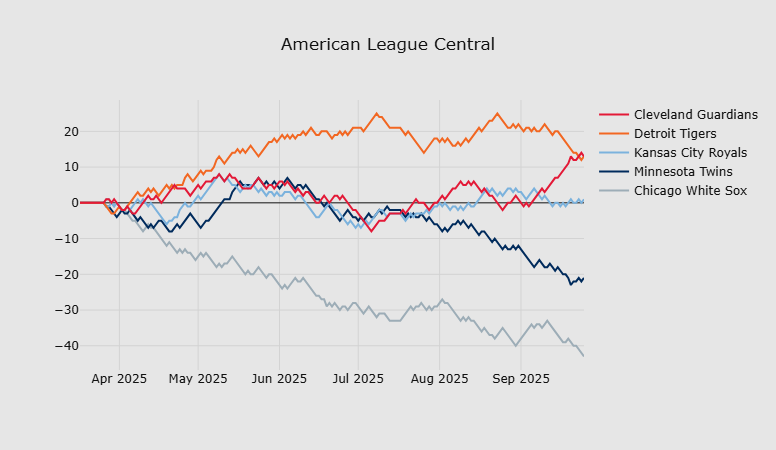

Baseball is Fun!

As recently as September 4th, the Guardians were 11 games back from first place in the division. But after going 18-6 (so far) in September and winning 5 of their last 6 against the Detroit Tigers, they’re now tied for the lead in the AL Central. If the Guards can hold on to win the division, it would be the largest divisional comeback in MLB history. Or one of the worst collapses, depending on how you look at it. Cleveland finishes the season this weekend at The Jake (Progressive, whatever) against the Rangers in what could be one of the wildest Septembers in baseball history! The Reds have gotten into the mix on the National League side, fighting for the final Wild Card spot which wide open. Go Baseball!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.