Economic and Investment News Bits

- New home sales surged 18% in August to a much higher-than-expected annual rate of 504,000. The Econoday forecast was 465,000. Also last week, the government issued its revised GDP numbers for the second quarter of 2014, showing the economy grew at an annual rate of 4.6%. The Fed tapered monthly bond buying to $15 billion last week in their seventh consecutive $10 billion cut, staying on track to end the program in October.

- In one of the more bizarre events last week, PIMCO’s founder and long-time bond fund manager Bill Gross announced he was leaving PIMCO and would be managing a bond fund for floundering Janus Funds.

- 28% of Medicare expenditures are generated by Americans in the final 6 months of their lives. 80% of deaths in the U.S. are by Medicare beneficiaries. (Source: Medicare).

- Under Armour, the apparel and shoe company founded by a former University of Maryland football player, experienced strong back-to-school sales for 2014. Strong shoe sales during the back-to-school season are expected to account for approximately 20% of the firm’s footwear sales for the year. While Under Armour has a relatively small footwear market share (4%) and continues to battle Nike for market share in the basketball space, the company had more top-selling shoes than Adidas, Skechers, Converse and Brooks. (Source: Bloomberg)

- A new report from WalletHub says there are 26 key metrics that determine happiness, ranging from job security to safety to sports participation. The resulting list of 10 Happiest States (from #10 to #1) is Idaho, South Dakota, Hawaii, Iowa, Wyoming, Nebraska, Colorado, North Dakota, Minnesota, and Utah. The key take-away is that money alone does not buy happiness, but we already knew that.

- 20% of the world’s natural gas is produced in the S., the largest producer on the planet. (Source: U.S. Energy Information Administration).

- “Our current call is for the S&P 500 to reach 2,100 by year end,” (Source: Federated Investors).

Thought for the week

“A committee is a group of the unprepared, appointed by the unwilling to do the unnecessary.”

Fred Allen, American comedian (1894-1956)

Upcoming Educational Event

Investing in U.S. Energy Independence will be the topic of PDS Planning’s next client education event on Wednesday, November 5. Troy Shaver, from Dividend Assets Capital LLC, who also manages the Goldman Sachs Rising Dividend Growth Fund, is our featured speaker for the evening. Troy has more than 30 years of investment experience, and with a degree in geology from Dartmouth University, he is uniquely qualified to assess our nation’s coming energy independence. Troy’s knowledge of the many different shale energy regions of the world, but specifically here in the U.S. (he is well versed on eastern Ohio’s Marcellus Shale potential) is amazing. This will be a great opportunity for our clients to gain insight into the energy revolution that will shape the nation’s economy for years to come. Invitations will be sent as the event date gets closer, but please put this on your calendar. Join us at 6 PM for hors d’euvres, with the program starting at 6:30.

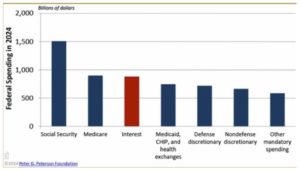

Graph of the Week

“In less than 10 years, the third-largest U.S. government expense will be interest on debt. The other three are all so-called entitlement programs. Discretionary spending is becoming an ever-smaller part of the budget. Social Security, Medicare and Medicaid now command nearly two-thirds of the U.S. budget and are growing. Ironically, polls suggest that 80% of Americans are concerned about the rising deficit and debt, but 69% oppose Medicare cutbacks, and 78% oppose Medicaid cutbacks. At some point in the middle of the next decade, unless big changes are enacted (higher taxes, cuts or changes to benefits), entitlement spending plus interest payments will be more than the total revenue of the government. The deficit we are currently experiencing will balloon.” (Source: John Mauldin)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.