Economic and Investment News Bits

- Commenting on the current market correction, economist John Mauldin notes “You might have a plan to buy stocks or become more aggressive when the index gets below a certain level, but when the market gets to that point, 1) you may not have the cash, and 2) you might be panicking. It’s nice to have a plan, but to paraphrase Mike Tyson, everyone has a plan until they get punched in the face.”

- Brown discolorations on apples might disappear if Okanagan Specialty Fruits wins approval for its new genetically modified seed type. Proponents say this could revolutionize the apple industry. Detractors site safety concerns and that a genetically modified apple could have a negative impact on the perception of fruit, which is traditionally seen as a health food. Can’t we live with an occasional brown spot on our apples?

- Cornerstone Macro observes four important leading U.S. economic indicators (gasoline prices, mortgage rates, corporate bond yields, and global short-term bond rates), and finds support for even stronger growth, and absolutely no recession, in this year’s final quarter.

- “As we head into the final two weeks of October, we are reminded of research dating to 1928 that the S&P 500 tends to peak in September, consolidate, and then begin to rally again in late October, reaching September’s peak in early December before climbing rapidly the final four weeks. Worries about a non-U.S. recession are legitimate, but if all roads lead to jobs, then the U.S. is fine. For the long-term investor, it is a no-brainer,” (Source: Federated Investors).

- With oil prices falling way below $90, a budget squeeze is unfolding among some oil producers. Institutional Strategist says Libya needs $90, Angola needs $98, Iran needs $140, Venezuela and Algeria $121, and Nigeria $119. Russia needs $107 a barrel and is already under pressure.

- The World Economic Forum published its annual competitiveness report, which assesses the strength of 144 countries’ twelve pillars, including government and private institutions, infrastructure, health, and primary and secondary education. It then ranks countries based on their overall ability to promote prosperity for their citizens. The top five nations are Switzerland, Singapore, the U.S., Finland, and Germany.

Thought for the week

“The problem with the future is that it keeps turning into the present.”

Bill Watterson, American cartoonist (b. 1958)

Thoughts for the Week

Market corrections are not something to fear. They are natural, normal, and to be embraced. “Stocks sometimes get ahead of themselves,” notes market strategist Jeffrey Buchbinder. “We see this pullback as normal within the context of an ongoing and powerful bull market and do not see its causes (European and Chinese growth concerns, the Islamic state militants, Ebola, the Russia-Ukraine conflict, etc) as justifying something much bigger.” Noting that the correction reminds investors that stocks do not always go up in a straight line, Buchbinder says the recent volatility does “not mean the bull market is nearing an end.” We agree with him. While we understand investors’ nervousness, what we are experiencing appears to be pretty normal at this time.

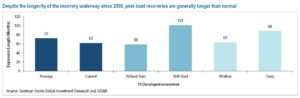

Graph of the Week (CLICK TO ENLARGE)

“The U.S. expansion, currently at 62 months, has outlived the average post-war U.S. recovery (60 months). Despite its longevity, our view is that the recovery still has room to run. Post-bust recoveries have historically been much slower than normal and have left substantial slack in the economy for longer than in a typical recovery. Looking across 13 developed countries for which we have expansion dates, the average expansion length since 1970 has been 72 months. But, the average expansion for post-bust recoveries is more than 100 months.” (Source: Goldman Sachs).

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.