Economic and Investment News Bits

- “If your investment pool represents the accumulation of your life’s work and retirement savings, your focus should be not on how much you can make but rather how much you can afford to lose,” (Source: Edward Studzinski, retired, Harris & Associates).

- The European Central Bank (ECB) is starting an aggressive QE next week, not unlike our own Fed recently ended, buying ($1.22 trillion USD) government bonds. Officials hope the program will boost growth as it did in the U.S. (Source: MarketWatch)

- “Smartphone, your days are limited,” said Huawei Technology Company CEO Ken Hu. The company’s move into smart bracelets and watches is just the beginning of a broader trend that could transform the phones in our pockets into an array of wearable objects and virtual reality devices. “It’s possible that all the things that we can see with our eyes could become wearables one way or another.”

- Citing Federal Reserve vice-chairman Stanley Fischer, who “worries that markets will start to see zero [interest rate] as normal”, commentators expect the Fed will commence a very gradual hiking cycle beginning with the September FOMC meeting. (Source: Allianz)

- The numbers are staggering. The equivalent of 29 million containers passed through the 30 busiest U.S. ports last year. If those containers (which then go to trucks and trains) were stacked end to end, they would stretch some 111,000 miles. The busiest ports based on container traffic are Los Angeles, Long Beach, New York, Savannah, and Oakland.

- Relocation involves a lot of decisions, not the least of which is the cost of purchasing a home in the new location. Mortgage resource HSH.com has identified the most affordable cities for purchasing a home. They are San Antonio, Orlando, Phoenix, Tampa, Atlanta, Detroit, Cincinnati, St. Louis, Cleveland, and Pittsburgh (most affordable).

Thought for the week

“If you can’t feed a hundred people, then feed just one.”

Mother Teresa, Albanian nun (1910-1997)

Economic Commentary for the Week

International capitalism requires a low-wage, high-growth economy to produce goods. South Korea, Taiwan, India, and especially China have taken much of this role over the last 30 years. But as their economies have grown, wages have increased substantially. No one country can replace China. Where are the next growth stories? Strafor Global Intelligence has identified what it calls the P16 (Post-China 16). They are Mexico, Nicaragua, Dominican Republic, Peru, Ethiopia, Uganda, Kenya, Tanzania, Sri Lanka, Bangladesh, Myanmar, Laos, Vietnam, Cambodia, Philippines, and Indonesia. “The process unleashed in the Industrial Revolution does not seem to be stoppable. In our view, this is the next turning of the wheel.”

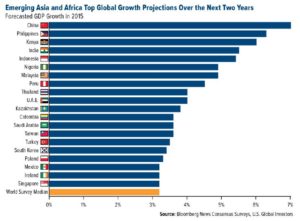

Graph of the Week (CLICK TO ENLARGE)

The chart above, from Bloomberg and U.S. Global, lists economies of emerging Asia and Africa in order of expected growth of Gross Domestic Product for the next two years. Note that even last-place Singapore’s 3.2% GDP growth is as good as the projection of the median return for all other countries. The study notes that investors have become increasingly more bullish with respect to India, South Korea, and Indonesia.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.