Economic and Investment News Bits

- ”Continued low interest rates are supporting stocks. Expect the Dow to trade in a range between 17,000 and 18,500, with 20,000 possible by year end. A weaker U.S. dollar would help lift stocks, since the 20% gain in the dollar is equal to the Fed raising interest rates by 0.50%,” (Source: Jeremy Siegel, the Wharton School of Business).

- American multi-national companies [think McDonalds, Apple, Abbott and others] lost $27 billion when they converted their 2014 foreign sales (made in non-dollar currencies) back into U.S. dollars. (Source: FIREapps)

- “The truth is the Japanese government is passing on the pain of 25 years of running up debt to Japanese savers and retirees. I think the value of the yen is likely to drop another 50% (at least) before Japan can allow the market to set interest rates. They are going to print more money than any of us can possibly imagine,” (Source: John Mauldin).

- The world’s first hydrogen-powered tram was recently unveiled in China, with hopes that it will alleviate the pollution that has plagued China’s major cities. The tram has the look of a bullet train but has no pollution, its only by-product being water. The fuel cells can be refueled in three minutes. (Source: Bloomberg)

- There are plenty of factors to consider when you are trying to find the worst city in America. The worst cities are subject to high unemployment, crime, and a general lack of prosperity. But perhaps the best yardstick has to be the satisfaction of the city’s residents. According to a Gallup poll, here are the 10 worst cities, according to the residents who live in them (10th to worst city): Spartanburg, SC; Rockford, IL; Evansville, IN; Bakersfield, CA; Fort Smith, AR; Hickory-Lenoir-Morganton, NC; Beaumont-Port Arthur, TX; Mobile, AL; Huntington-Ashland, WV-OH; Charleston, WV.

- CNNMoney’s college survey found Colorado School of Mines topped the list of state colleges with the best return on investment, followed by Georgia Tech, VMI, and UC Berkeley.

Thought for the week

“The price of greatness is responsibility.”

Winston Churchill, British statesman (1874-1965)

Investing Commentary for the Week

It is often tempting to make a change in an investment portfolio. However, experience has taught us, that most of the time it is better to do nothing. Obviously if a holding is problematic (significant loss, management issues, a change in the investor’s situation), doing something may be warranted. But the temptation to increase dollars in whatever has been doing particularly well at the time can be a big mistake. The S&P 500 out-gained all other major indexes in 2014, while developed international stocks mostly lost value. The story is very different in 2015. Through March 27, the S&P 500 Index is up less than 1% and the Dow is in slightly negative territory. By contrast the international EAFE Index has gained more than 6%. In 2014, companies like AEP provided investors a return of more than 34%. This year, like most large utility companies, AEP is down.

Asset allocation is important to the long-term health of investors. Changing the allocation each year (or more often!), in an attempt to guess the best places to put money, is fraught with potential disaster. Accept the fact that there will be some holdings in a diversified portfolio that might do poorly in any given year. Just as bonds might now appear too boring, we should remember these same boring investments helped save the bacon during the last recession.

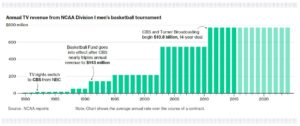

Graph of the Week (CLICK TO ENLARGE)

Now that we are down to the Final Four, we take a look at the financial impact of the NCAA tournament. This chart shows how the TV contract has ballooned over the past 35 years. CBS and Turner Broadcasting pay about $770 million per year for the broadcasting rights. (Source: Bloomberg)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.