Economic and Investment News Bits

- Strong U.S. jobs growth in May sent markets scurrying to calculate the odds that the Fed will boost short-term interest rates this year. The result was a sharp jump in the value of the dollar and higher Treasury bond yields. On the downside, utility stocks and other high-dividend stocks saw outflows last week, reversing a five-year trend. The average utility stock lost more than 4%.

- The concept of loss aversion demonstrates that the average investor prefers avoiding losses about three times as much as accumulating gains. As stocks trade at elevated valuations, interest rates appear poised to move higher, and world currency markets reflect differences among central banks, investors will likely see their ability to handle volatility under pressure. (Source: Goldman Sachs)

- The most recent data from Airports Council International shows the eight busiest airports in the world to be #1 Atlanta Harstfield, #2 Beijing International, #3 London Heathrow, #4 Tokyo Haneda, #5 Los Angeles International, #6 Dubai International, #7 Chicago O’Hare, and #8 Paris Charles de Gaul.

- “We could easily, of course, have a normal, modest bear market, down 10-20%, given all of the global troubles we have. The bubble territory for this is about S&P 500 at 2250 (currently at 2092), but foreign markets are of course to be preferred if you believe our numbers,” (Source: GMO’s Jeremy Grantham).

- In an effort to stop the SEC from requiring commission salespersons and their brokerage, insurance, and bank employers to adhere to a fiduciary role with investors, the financial lobbying industry is working overtime. In a statement, the industry said “consumers would be confused and would not understand the meaning of fiduciary” (putting client interests first).

- June is ranked 11th out of 12 months for average total return for the S&P 500 the last 25 years. Only August has produced a worse average performance. The best performing stock in the S&P 500 year to-date (Netflix NFLX) has gained 85%. The worst (Fossil Group FOSL) is down 35%. (Source: BTN Research)

Thought for the week

“When a thing is done, it’s done. Don’t look back. Look forward to your next objective.”

George C. Marshall, American army general (1880-1959)

A Little Perspective

As you might imagine, prices for gasoline differ greatly around the world, depending not only on whether a country is an oil producer. Prices also reflect the amount of tax governments have added to the basic price to fund medical, retirement, and other social programs. As of June 1, Saudi Arabia had the lowest average price for unleaded gas at $0.58 per gallon. Most Middle East oil countries were close behind. Average price in the U.S. was $2.95. Norway has the most expensive gas at $7.76 per gallon.

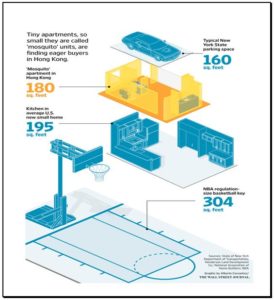

Chart of the Week (CLICK TO ENLARGE)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.