Economic and Investment News Bits

- While we expect the current $48 bbl to increase some during the year, even Saudi Arabia’s oil minister was quoted last week as saying we will not see $100 bbl prices in the foreseeable future. If low prices are here to stay, who benefits from this? Rather obvious are consumers, who can fill up at almost half the cost one year ago. Because lower income earners spend more of their income for gas than top earners do, we believe discount retailers, grocery chains, and restaurants could see a bump in sales.

- Non oil-producing countries of Western Europe, Asia, and Latin America also stand to benefit from lower oil prices. Two weeks is not enough time to suggest a trend is in the works, but we note that stocks from those economies are doing better than domestic stocks so far this year.

- “While investors can always say ‘This time is different,’ it is important to note that domestic stocks have never risen for seven years in a row,” (Source: Jeffrey Gundlach).

- Stating their case for an accelerating housing market in 2015, Goldman Sachs believes we are pretty much through the excess housing inventory and the weakness of household formation among younger people. Housing starts, they believe, will move significantly higher this year.

- In a surprise move last week, Switzerland’s central bank reversed course and removed the cap on the value of the Swiss franc against the euro. The move, done without any notice or discussion, resulted in the country’s currency soaring as much as 30% in one day. Swiss stocks lost about 15% in two days. As one Swiss CEO said, “This is a tsunami for our export industry, tourism, and for the entire country.”

- As Columbus prepares to host the NHL All Star Game this week, it may be surprising for some folks to know that for the first 25 years of its history (1942-1967), the NHL had only six teams: Boston, Chicago, Detroit, Montreal, New York Rangers, and Toronto. The 1967 expansion added six new franchises, another six teams in 1974, and a couple of teams every few years after that. The final expansion in 2000, added Nashville and Columbus for a total of 30 teams.

Thought for the week

“Do the right thing. It will gratify some people and astonish the rest.”

Mark Twain, American writer (1835-1910)

Wealth Idea for the Week

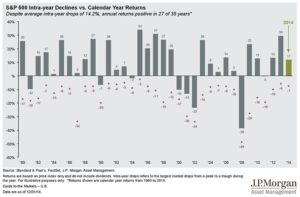

We cannot overstate the importance of seeing the forest for the trees when it comes to investing. The so-called experts tell us that 2014 was a great year for stocks and for bonds. They are not wrong, but they are also not telling the whole truth. With very few exceptions, the only stocks that had a truly positive year in 2014 were large cap domestic stocks, particularly those in the technology and health sectors. A very small number of stocks accounted for most of the index’s gain. And investors who were cautious with their bond holdings in 2014 also did not do particularly well. Folks who held on to their diversified allocation of domestic and international holdings ended the year with very low single digit gains. It is tempting, therefore, to abandon diversification for what must be a sure thing, right? How much can you handle a 30-40% loss in your portfolio? That is what should be uppermost in your mind, because that is what can happen in a bear market for stocks (graph below). We saw a tiny bit of what can happen in a short time just the last two weeks. Volatility has increased significantly and diversified portfolios showed their mettle.

Graph of the Week (CLICK TO ENLARGE)

The PDS investment team has been anticipating a correction in the stock market for some time. The chart above shows that there has been no intra-year drop of greater than 10% since 2011. The drop in 2014 was only 7%. Clearly we are overdue for a correction, but waiting until it happens to invest can be a futile effort, as we have seen for three years. A diversified portfolio will at least participate in some of the market gains, and should limit downside volatility, too.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.