Economic and Investment News Bits

- “The S&P 500 has fallen 3.1% this year as financial markets react negatively to a possible rate hike by the Federal Reserve later this year, along with less-than-robust reactions to company earnings. Although it was difficult to assign specific themes to various sectors this week, it was a heavy week for earnings releases. This was partially responsible for the out-performance in materials and consumer discretionary sectors and the underperformance in technology and staples sectors. It is too soon to know if a trend has started,” (Source: Frank Holmes).

- “Oil has made six major lows over the last 30 years, but all were V-shaped. Moreover, falling oil’s negative impact on corporate spending (capex), which accounts for 13% of domestic GDP, pales relative to its positive impact on consumers, who account for 68% of GDP,” (Source: Evercore ISI).

- “We are taking profits from a portion of our high-yield [bonds], U.S. dollar and U.S. equity positions. We have confidence that the U.S. will lead the next leg of global growth, but we see more upside in European stocks. As ever, risk management and diversification are key,” (Source: Goldman Sachs).

- Federal government outlays for Social Security, Medicare and Medicaid for fiscal year 2005 were 42% of total outlays. Spending for the same three programs for fiscal year 2015 is estimated to be 50% of total government outlays. Spending for the three programs in 2025 is estimated to be 54% of total government outlays. (Source: Congressional Budget Office)

- Thirteen U.S. states have economies larger than Greece. (Source: Financial Times)

- Amos Ives Root (1839-1923) was an Ohio businessman who developed innovative techniques for beekeeping during the late 19th He developed the first method to harvest honey without destroying the beehive. He founded a company in 1869 in his hometown of Medina, to manufacture beehives and beekeeping equipment, shipping up to four railroad freight cars a day. In 1928, the company transitioned to beeswax candles, and Root Candles is still owned by the Root family, run by the founder’s great-grandson.

Thought for the week

“If you could kick the person responsible for most of your trouble, you wouldn’t sit for a month.”

Theodore Roosevelt, American president (1858-1919)

Wealth Idea for the Week

“The complexity and questions that arise from the nation’s ever-changing tax laws are as certain as taxes themselves,” so says Wall Street Journal writer Tom Herman. “It’s extremely easy to make costly bloopers,” he says. Some areas deserve extra attention before filing this year. 1) New lines on the form because of the Affordable Care Act. 2) Potential credit for overpayment of Social Security tax if you worked for two or more employers. 3) Use of capital losses on investment sales to offset capital gains, and ability to deduct an extra $3,000 of losses against wages and ordinary income. 4) Reporting of IRA charitable transfers on the correct line of the return. 5) Higher standard deduction for those not itemizing. 6) The ability to deduct either state and local income taxes paid in 2014 or state and local sales taxes, but not both. The latter is a benefit to residents of Texas, Florida, and other states with no income tax. 7) A new, simplified calculation for claiming home office expenses, much less complex than the previous requirements.

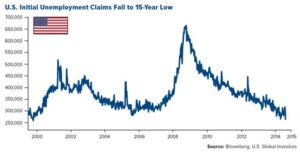

Graph of the Week (CLICK TO ENLARGE)

Last week, the Federal Reserve backed the view that it will raise interest rates sometime in mid-2015. The Fed’s view is undoubtedly influenced by initial jobless claims, which have historically been a strong leading indicator for the economy. As the chart above shows, initial jobless claims are at their lowest level since 2000. The Fed will try to raise interest rates when it can, while the economy is improving, to allow for more flexibility in monetary policy. After all, if the economy turns course with rates at zero, there is no place for the Fed to move.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.