Economic and Investment News Bits

- “We see the Iranian situation being brought under control. Whether this will be by military action and isolation of Iran or by a political arrangement with the current or a successor regime is unclear but irrelevant to the broader geopolitical issue. Iran will be contained, as it simply does not have the underlying power to be a major player in the region beyond its immediate horizons,” (Source: Stratfor Global Intelligence).

- Brazil boasts one-eighth of the world’s fresh water supply, but water supply issues persist. They are getting worse in major cities such as Sao Paulo, where water rationing will soon become a reality. The worst drought in fifty years, along with population growth, deforestation of the Amazon River basin, and consumer wasting of water are the causes. New reservoirs are in the works, but will take time to complete. (Source: New York Times)

- “Just as our phones became digital and cheap, healthcare will become digital and easily available. Maybe not as soon as we would like, but that is the future we are heading toward,” (Source: John Mauldin).

- Of the 8 million American homeowners, 47.5 million have a mortgage and 26.3 million do not, a 64/36% split. (Source: Census Bureau)

- The Best and Worst Run States is a study done annually by 24/7 Wall Street. Best states in the current report are North Dakota, Wyoming, Nebraska, Utah, Iowa, Alaska, South Dakota, Vermont, Virginia, and Minnesota. Worst states were (last place shown first) California, Rhode Island, Illinois, Arizona, New Jersey, Nevada, New Mexico, Florida, South Carolina, and Louisiana.

- The recent Chinese New Year ushered in the year of the sheep (or ram). Characteristics of this animal, according to ancient Chinese philosophy, are generosity, intuition, artistry, sensitivity, and compassion.

Thought for the week

“I believe alien life is quite common in the universe, although intelligent life is less so. Some say it has yet to appear on planet Earth.”

Stephen Hawking, British scientist (b. 1942)

Investing Commentary for the Week

Federated Investors offers the following observations: “Leading indicators [of the stock market] are bullish. With about 90% of S&P 500 companies reporting, expectations are for revenue, earnings, and earnings-per-share growth of 1.8%, 4.2%, and 6.4%. Excluding the struggling energy sector, the numbers are even better, at 4.3%, 7.2%, and 9.5%. With money velocity (the increase in the amount of money going into circulation from banks to consumers) at its lowest level since 1929 and exhibiting no signs of turning higher, the economy is unlikely to run away on the upside. This suggests that as long as deflation (NOT inflation) does not appear, stocks can trade at 17-19 times future earnings, the normal range for a 1-3% inflation environment.” Forward P/E is now at 17.1.

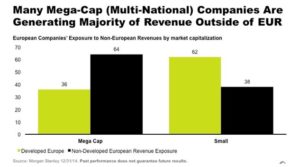

Graph of the Week (CLICK TO ENLARGE)

At one time, investors really focused on where companies were headquartered. However, as world trade has continued to increase, this has become much less important. Most large cap companies are now truly multinational. As shown above, 64% of the revenue from large cap European stocks comes from outside of developed Europe. Just over 40% of the S&P 500 revenue is generated overseas. These companies are now not only impacted by their home country’s citizens and governments, but from citizens worldwide (Source: Oppenheimer).

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.