Economic and Investment News Bits

- The U.S. economy has grown strong enough to support a hike in interest rates, Federal Reserve Bank of Cleveland President Loretta Mester thinks. “The federal funds rate should be lifted from zero for the first time since the end of 2008. The economy is moving back to more normal territory, and as it does monetary policy should begin to do so, too. The trip out of the Great Recession hasn’t broken any speed limits, but there are accumulating signs that the economy is building momentum and that, this time, a pickup in speed will be sustained because the underlying fundamentals have improved.”

- Investors are increasing risk in their portfolios too much, according to Vanguard Group, Inc. “Investors have raised their stock exposure to unusual levels in an effort to offset what they perceive to be low returns in bonds and in diversification in general. Some are pressuring their advisors to increase that exposure. Last year’s 13% gain in the S&P 500 Index have led many investors to forget the pain they felt when the stock market plunged 53% from October 2007 to March 2009.”

- International Living magazine’s 2015 list of Best Foreign Countries for Retirement was released last month. Top nations are (in order) Ecuador, Panama, Mexico, Malaysia, Costa Rico, Spain, Malta, Columbia, Portugal, Thailand, Italy, Uruguay, Belize, Nicaragua, and New Zealand.

- Where do people go when governments act irrationally? “Thus far this year, gold, U.S. Treasury bonds, and the U.S. Dollar index have all outperformed the S&P 500 Index,” notes Guild Investment Management. Increased volatility in the markets has also helped natural resources, real estate, selected emerging markets, domestic mid and small cap stocks, and dividend-paying international stocks out-perform the S&P 500.”

- The average American watches 34 hours of TV per week, or 9 years in an average life span.

- A study by Bloomberg, the International Monetary Fund, and the World Economic Forum lists the most-promising frontier markets in the world: Saudi Arabia, Estonia, Slovakia, Lithuania, Bahrain, Slovenia, Bulgaria, Vietnam, Kazakhstan, and Romania.

Thought for the week

“It’s tough to make predictions, especially about the future.”

Yogi Berra, American baseball player and coach (b. 1925)

Planning Idea for the Week

A recent college planning article in wealthmanagement.com highlights Five Secrets Colleges are Keeping From You. 1) Marketing material can be meaningless. In order to generate more applications and thus have higher rejection rates for ranking purposes, schools routinely send out marketing materials to students who have no hope of getting in. 2) Schools cannot get enough applications. The current Common App allows students to send one application to countless schools. Again, the more applicants, the more rejections, and a much smaller acceptance percentage. 3) How you list colleges on the FAFSA can hurt you. Some schools give less aid to students who put their institution at the top of the FAFSA list, assuming they do not have to offer as much money since the student is eager to attend. 4) It’s all about location. Universities located in major metropolitan areas, particularly on the East and West coasts tend to be much less generous with financial aid. 5) Rich students enjoy an advantage. In one survey, 19% of admission directors admitted they admit less-accomplished rich students over more-impressive candidates that need financial aid.

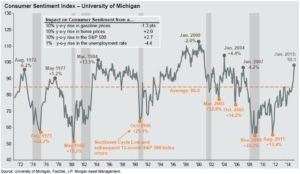

Graph of the Week (CLICK TO ENLARGE)

The above chart illustrates how low consumer confidence is often a predictor of strong stock market returns. For example, confidence reached a low point in November, 2008. The market gained more than 22% in the following 12 months.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.