Economic and Investment News Bits

- A 65 year-old couple retiring in 2014 will need about $220,000 in today’s dollars to pay out-of-pocket health care costs during their retirement years. The $220,000 assumes the couple qualifies for Medicare but does not require nursing home care. (Source: Fidelity)

- The Human Development Index, published annually by the United Nations, ranks nations according to their citizens’ quality of life rather than strictly by economic numbers. Criteria include life expectancy, school enrollment, educational attainment, and adjusted real income. Top countries in 2014 are Norway, Australia, Switzerland, Netherlands, U.S., Germany, New Zealand, Canada, Singapore, and Denmark.

- “The 10-year Treasury bond yield is now 2%, and the yield on 30-year Treasury bonds recently hit a new all-time low at 2.44% – the lowest yields in the history of the United States. Against that backdrop, the rules about investing for income are very different today than they were in the past and why I believe that 2015 is going to be the Year of Dividend Stocks,” (Source: Mauldin Economics).

- In 1914, John Willys acquired the Electric Auto-Lite Company. He then bought the Russell Motor Car Company of Toronto in 1916 and the Duesenberg Motors Company of New Jersey in 1917. The company struggled in various formats until the U.S. War Department’s interest in a lightweight truck resulted in the first production of the Willys MB, better known as Jeep, began in 1941. Today’s Jeeps bear little resemblance to the original. Once a part of American Motors Corporation, then Renault, the company is now owned by Fiat Chrysler (FCAU) and is produced in Toledo.

- Don’t get concerned about China. Yes, GDP should come in around 7% this year, a bit lower than 2014. But compared to the giant 11% gains in GDP of years ago, the current growth is fueled in large part by consumer spending, not by government programs. This is a huge positive trend. (Source: Trading Economics).

- Top investing sectors for the year to-date are biotechnology & health science stocks, followed by Chinese and Asian stocks. Diversified international and emerging market stocks are next.

Thought for the week

“The wide world is all about you. You can fence yourself in, but you cannot forever fence it out.”

J.R.R. Tolkien, English novelist (1892-1973)

Energy Commentary for the Week

According to Bloomberg Markets, the timing for inventors and investors may finally be right. Wind turbines accounted for 45% of new U.S. power production last year, while solar made up 34% of fresh capacity worldwide. Storing this energy when the sun isn’t shining or a breeze isn’t blowing has remained an expensive hurdle, but battery believers say that is changing. Having invested more than $5 billion in the past decade, they are racing to get new technologies to market, betting new batteries can hold enough clean energy to run a car, home, or campus; store power from wind or solar farms; and make dirty electricity grids greener by replacing generators and reducing the need for more fossil fuel plants. In the race to mass produce new batteries and lower the costs to consumers, there are four power players: Seeo, Aquion, Tesla, and Ambri.

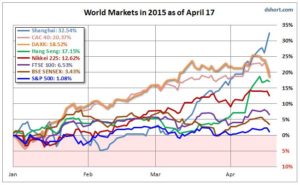

Graph of the Week (CLICK TO ENLARGE)

Many investors bailed on international stocks and jumped into the U.S. market after its strong 2014 return. However, this chart shows how quickly the trend can change. The S&P 500 is up just over 1% for the year. This doesn’t compare to China returning 32%, France 20%, Germany 18%, Hong Kong 17% and Japan 13%. Who knows if this is the start of a longer term trend, but the U.S. market has outperformed international for the past six years. Maybe it is international’s time?

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.