Welcome to our September Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

- Patagonia: The founder of Patagonia, Yvon Chouinard, gave the company away. Instead of selling the company or taking it public, they have transferred all ownership shares into a specially designed trust and a nonprofit organization. The company is valued at $3 billion and earns around $100 million per year in profits. Under the trust, all profits are to be used to combat climate change and protect undeveloped land around the world. (Source: The New York Times)

- Inflation Data: Earlier in the week, August inflation data was released and it came in hotter than anticipated, increasing 0.1%. Though gas prices fell, most everything else became more expensive during the month. Dr. David Kelly with JPMorgan believes the continues disinflation of commodities (gas prices) will help bring prices down throughout the chain. (Source: JPMorgan)

- Railroad Strike Avoided: With the deadline looming, the largest freight railroads and union leaders came to a tentative agreement. With inflation already running hot, the agreement lifts what would have been a heavy weight to bear. Experts believe a strike would have cost the US $2 billion per day. (Source: WSJ)

- Since 2008: Mortgage rate officially passed 6%, the first time it’s been this high since 2008. Inflation paired with a hot real estate market has pushed home prices higher. Higher prices and higher mortgage rates mean many would-be homeowners can no longer afford it. The average rate has risen 3% since the end of 2021, adding about $550 a month to the cost of a $400,000 home. (Source: MarketWatch)

What’s happening in markets today?

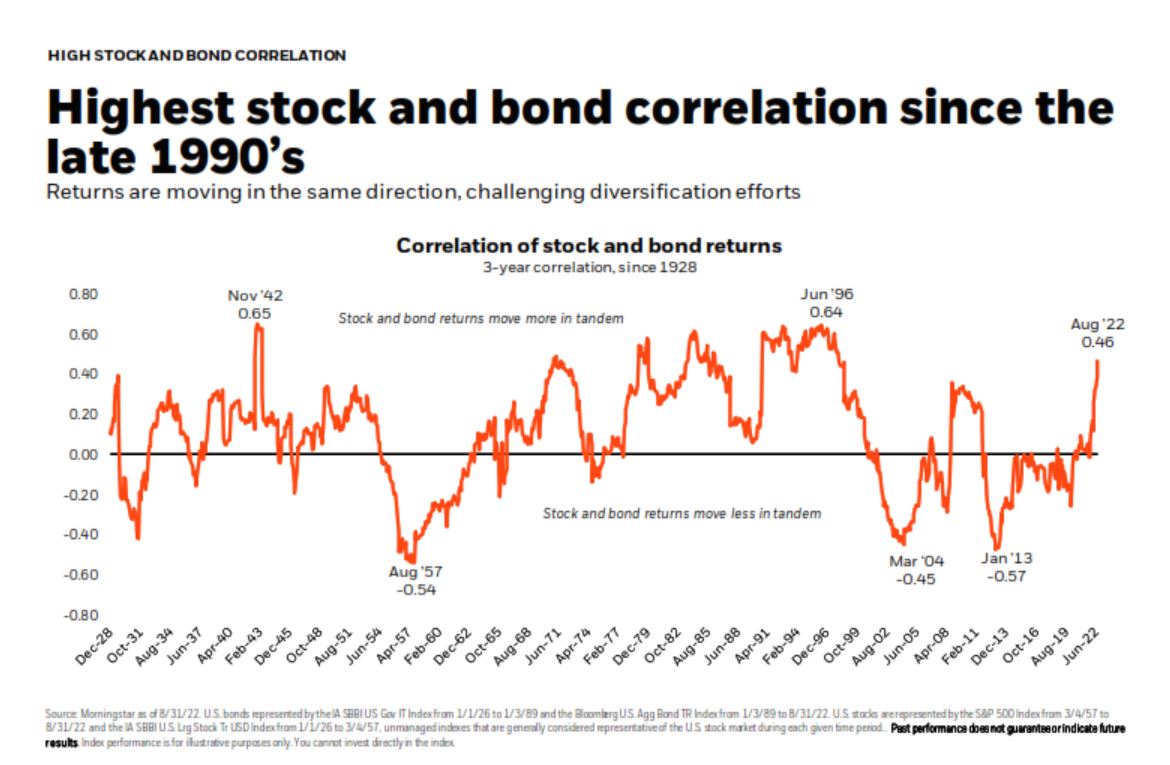

The bad news has been outweighing the good news in a significant way. Equity markets are down around the world due to a whole host of reasons, and fixed income is following close behind. Historically, when stocks are down, bonds are holding steady or up, and vice versa. This is because the correlation between the two is generally low. The movement of one asset class has little to no relationship to the movement of the other asset class.

- A positive correlation would mean stocks and bonds move in the same direction, and the closer to 1.0 it is, the stronger the relationship.

- A negative correlation would mean stocks and bonds go in the opposite direction, and the closer to -1.0 it is, the stronger the relationship.

- A correlation of 0 means there is no relationship. The movement of one asset class does not impact the other.

As of August – and for much of the year – the correlation between stocks and bonds has been above average, near 0.50. They are moving together. And since equities are down, it’s no surprise bonds have followed.

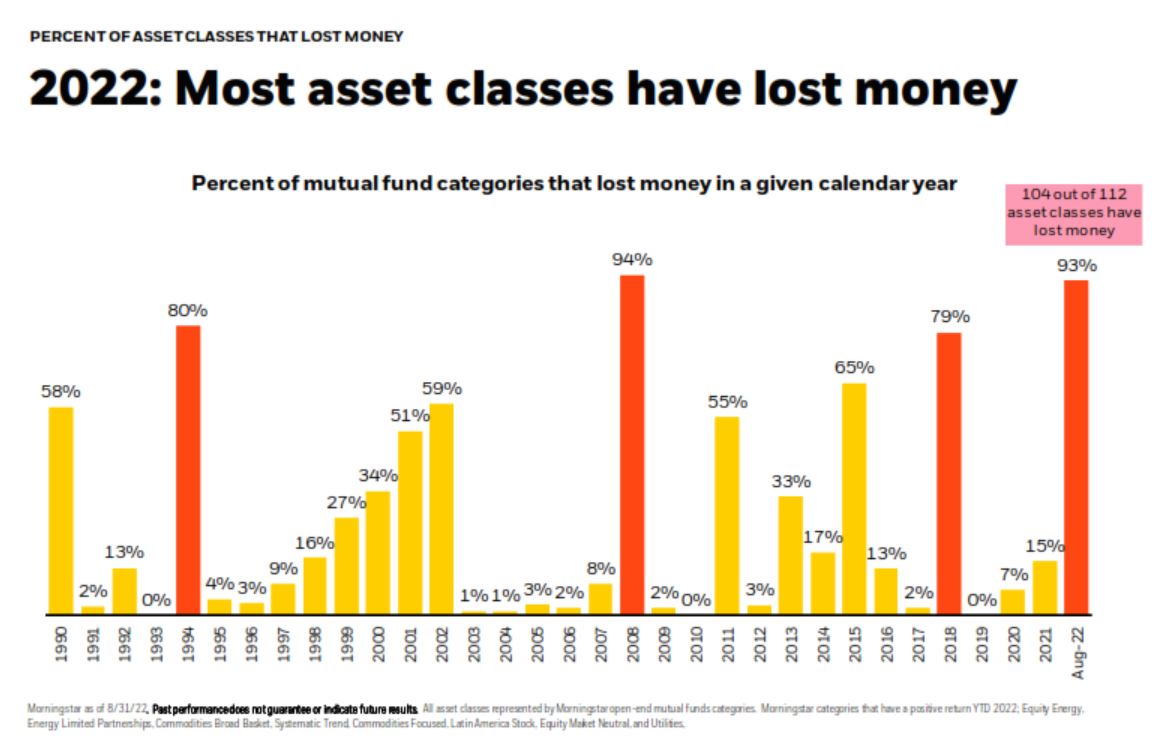

Correlation provides a piece to the explanation, but in reality there are so many factors at play. So many, in fact, that 93% of all asset classes have a negative return year to date. As the chart below shows, 104 out of 112 asset class have lost money. And moving through the chart, it isn’t unheard of for a year like this to happen, but it is uncommon.

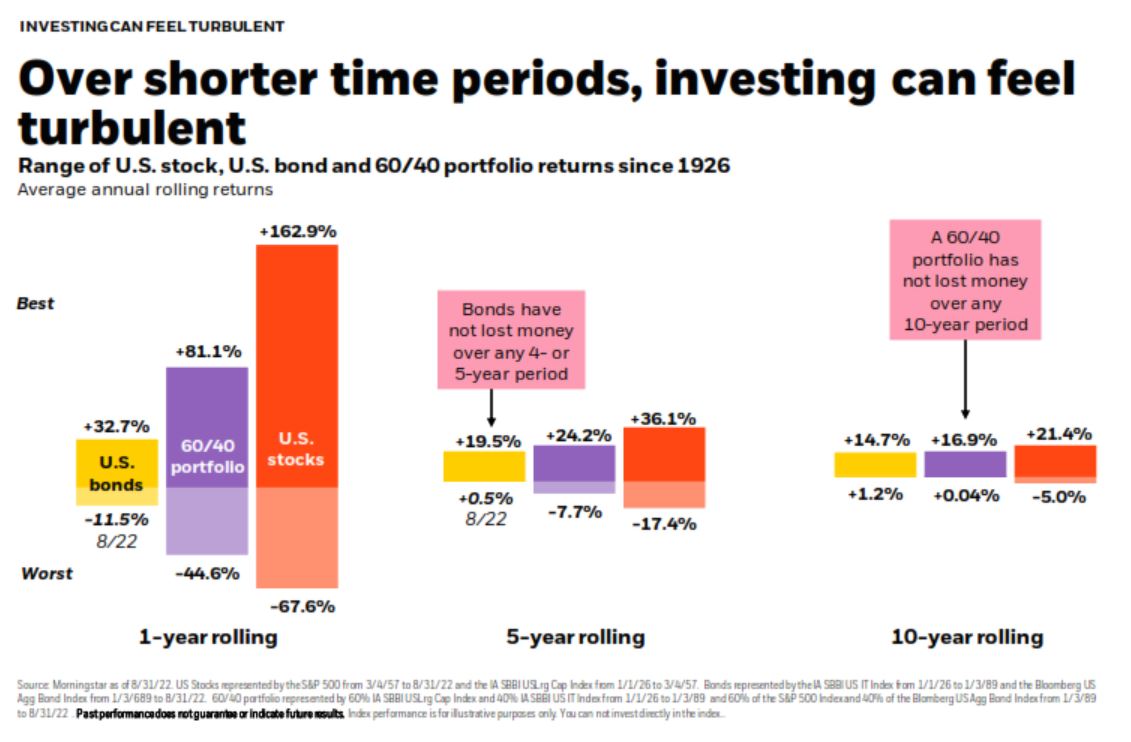

Investing right now can be pretty difficult since there is nowhere to hide. But that’s thinking about investing in the short-term. Over shorter periods of time, asset class returns can vary widely; however, long-term investors are typically rewarded for thoughtful portfolio diversification.

While we may experience continued seemingly random sprints of price volatility, rest assured the future is always the same. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.