Welcome to our November 2025 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

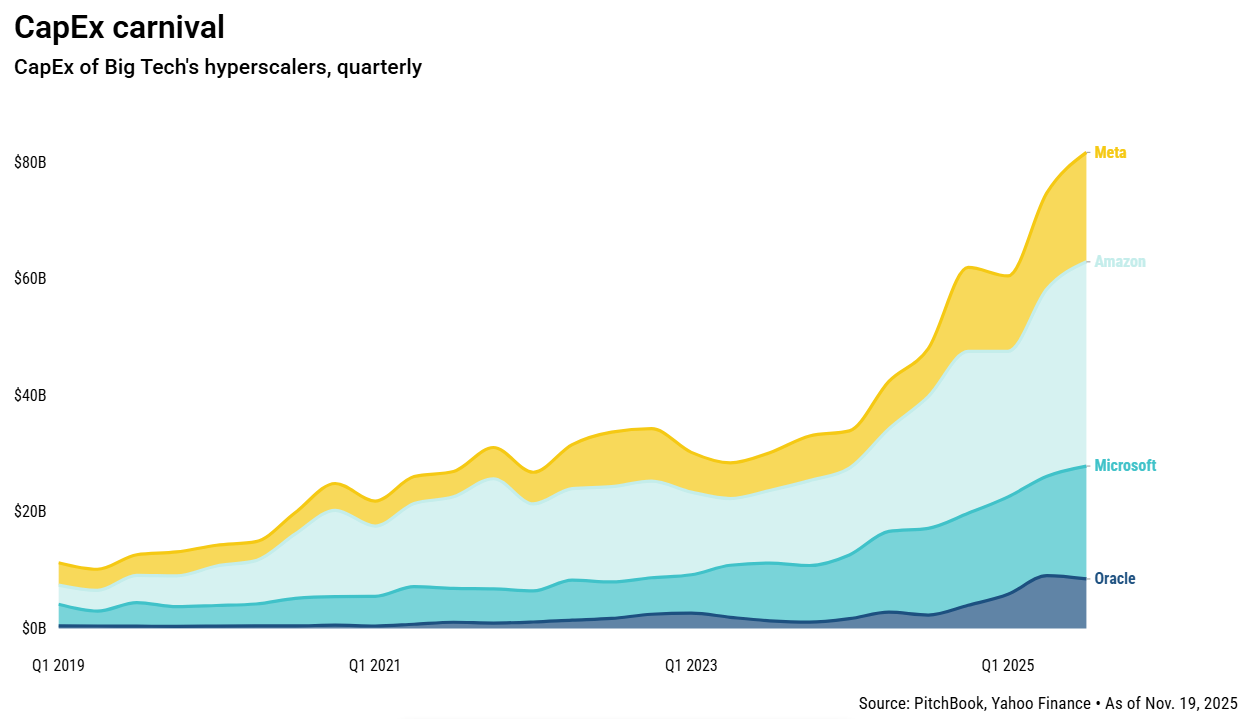

Precipitous CapEx

Since the end of 2023, capital expenditures from Meta, Amazon, Microsoft, and Oracle has tripled. This intense flood of capital companies is spending has led to excitement for the industry and worry over too much too fast. Capital Expenditure – CapEx – are funds a company spends to grow and expand their business. These dollars usually come from earnings but can be financed through debt or equity issuance. For the boom below, billions of bonds (debt) are being issued, and private capital (equity) is also dishing cash out. All together, these bets on future growth will require nearly $5 trillion to pay off, according to JPMorgan.

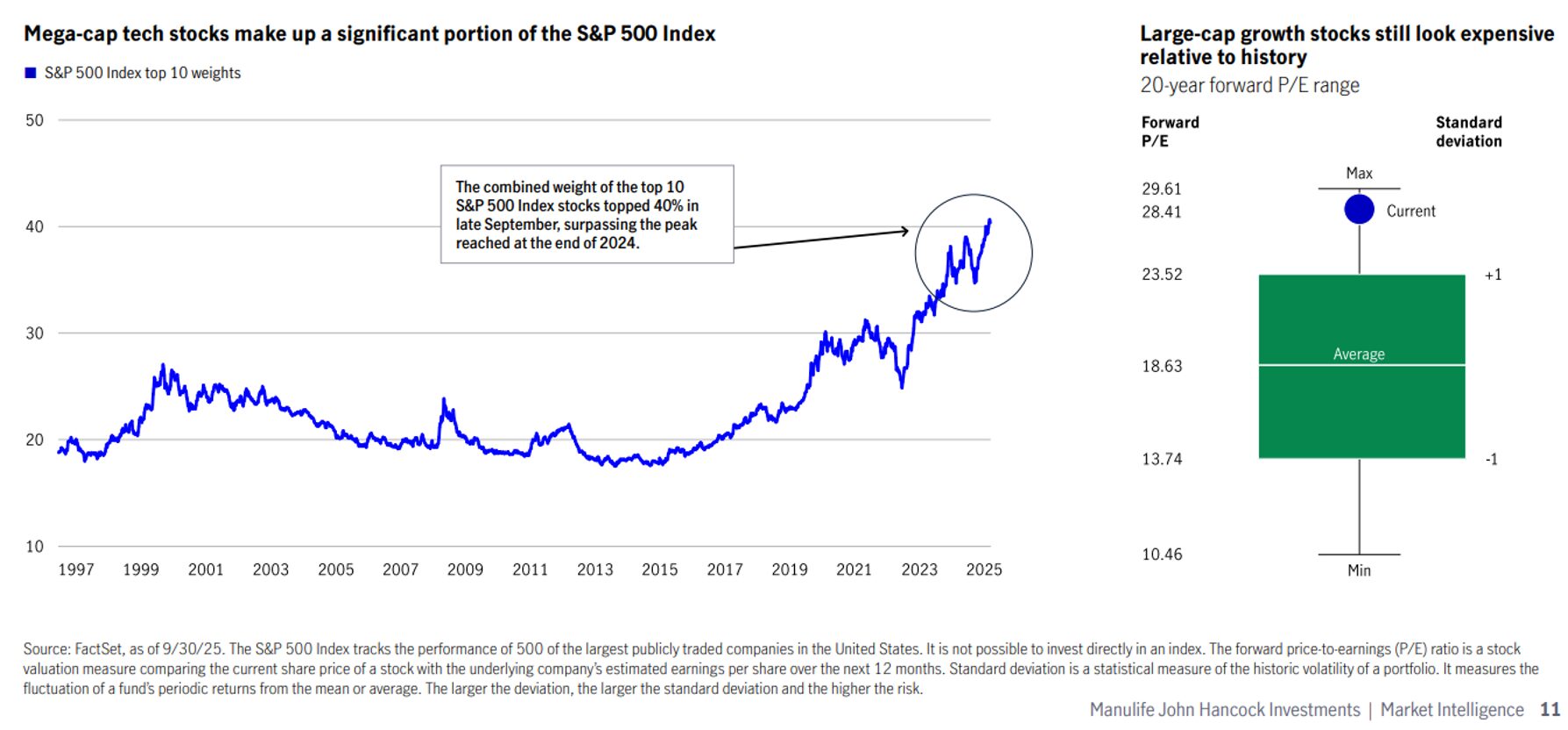

Heavy S&P Top Ten

Over 40% of the S&P 500 is made up of only 10 stocks. The S&P 500 index is a market cap weight index which means the size in the index is determined by the size of the company. If the collective market capitalization of the index is 100 and company A is worth 5, it would make up 5% of the index (5/100). With 10 stocks making up 40% of the index, a large allocation to the S&P may not be as diversified as once thought.

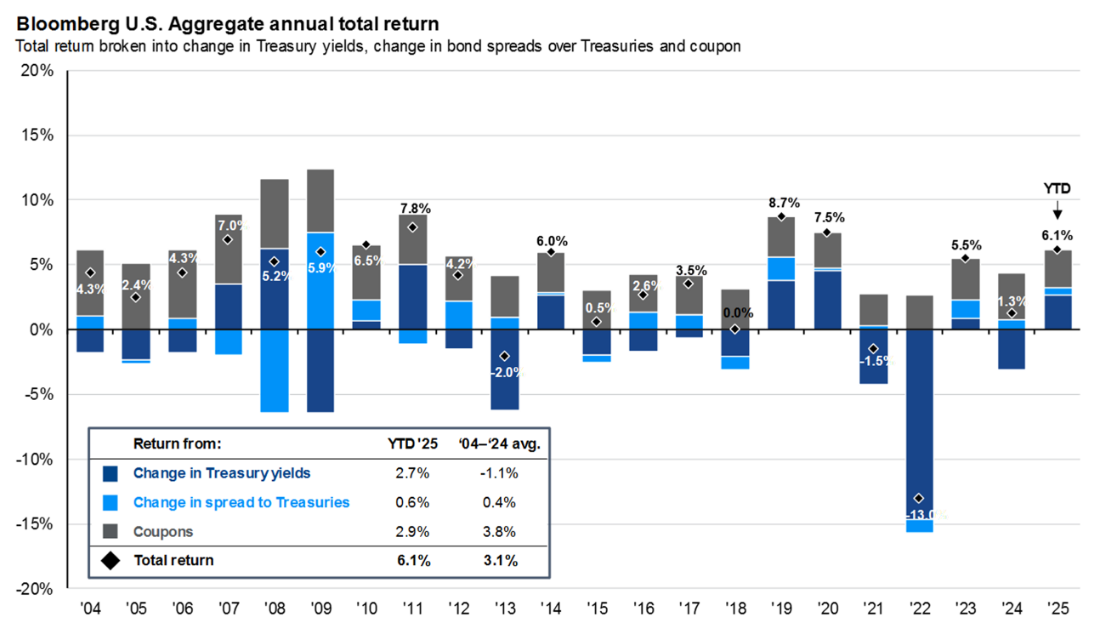

Where Do Bond Returns Come From?

After a rough 2021 and 2022, our opinion of bonds as a diversifier and downside protector has strengthened in the current environment. The Fed has slowly brought the Fed Funds rate down, and bond prices should continue to benefit due to the inverse relationship between yield and price. In addition, the high starting yield (AGG yields 3.85%) will continue to generate a solid rate of income and add to the total return.

Bond returns the sum of the price return and interest earned. If dividends yield 3% for the year and the price goes up 3%, your 1-year rate of return is 6%. For bonds, we think that’s pretty good!

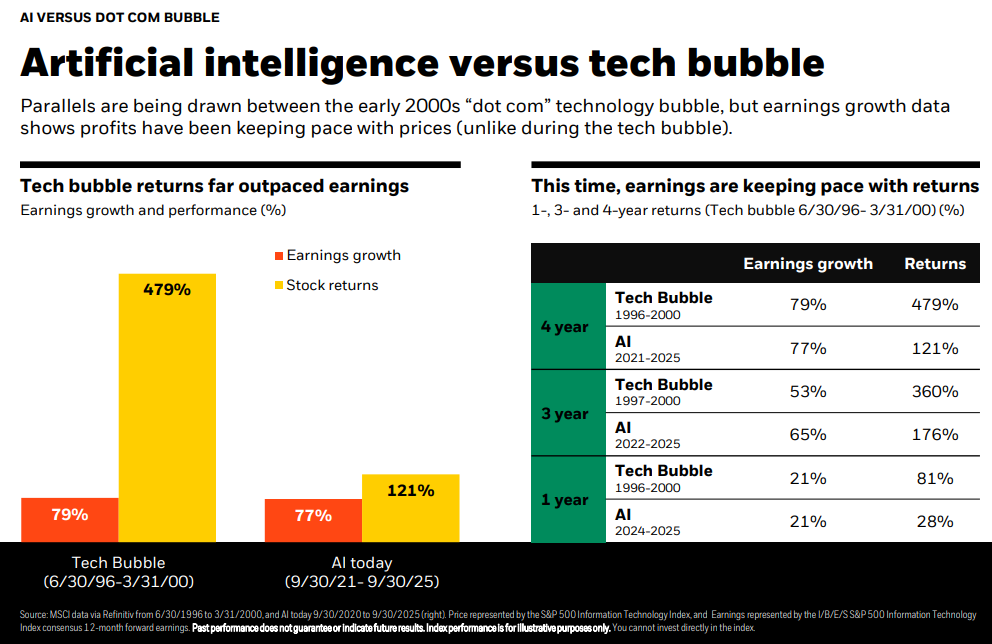

How Does the AI Rally Compare to the Dot Com Bubble?

This comparison has made headlines a number of times over the last few weeks and, while the AI craze is cause for some concern, we don’t think the comparison to the Dot Com bubble holds much weight today. Returns have been massive for AI, but they’re much more in line with earnings growth than we saw during the late 90s and 2000.

Jerry Rice is a Legend

Earlier this month after visiting a Bay Area elementary school, Jerry Rice and his wife paid off $667,000 in student lunch program debt across 103 schools nationwide. Jerry was quoted saying, “Helping these kids is a victory bigger than any trophy I’ve ever won. No child should ever step into a classroom hungry. Our responsibility is to plan strong seeds for the next generation to thrive.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.