Welcome to our November Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

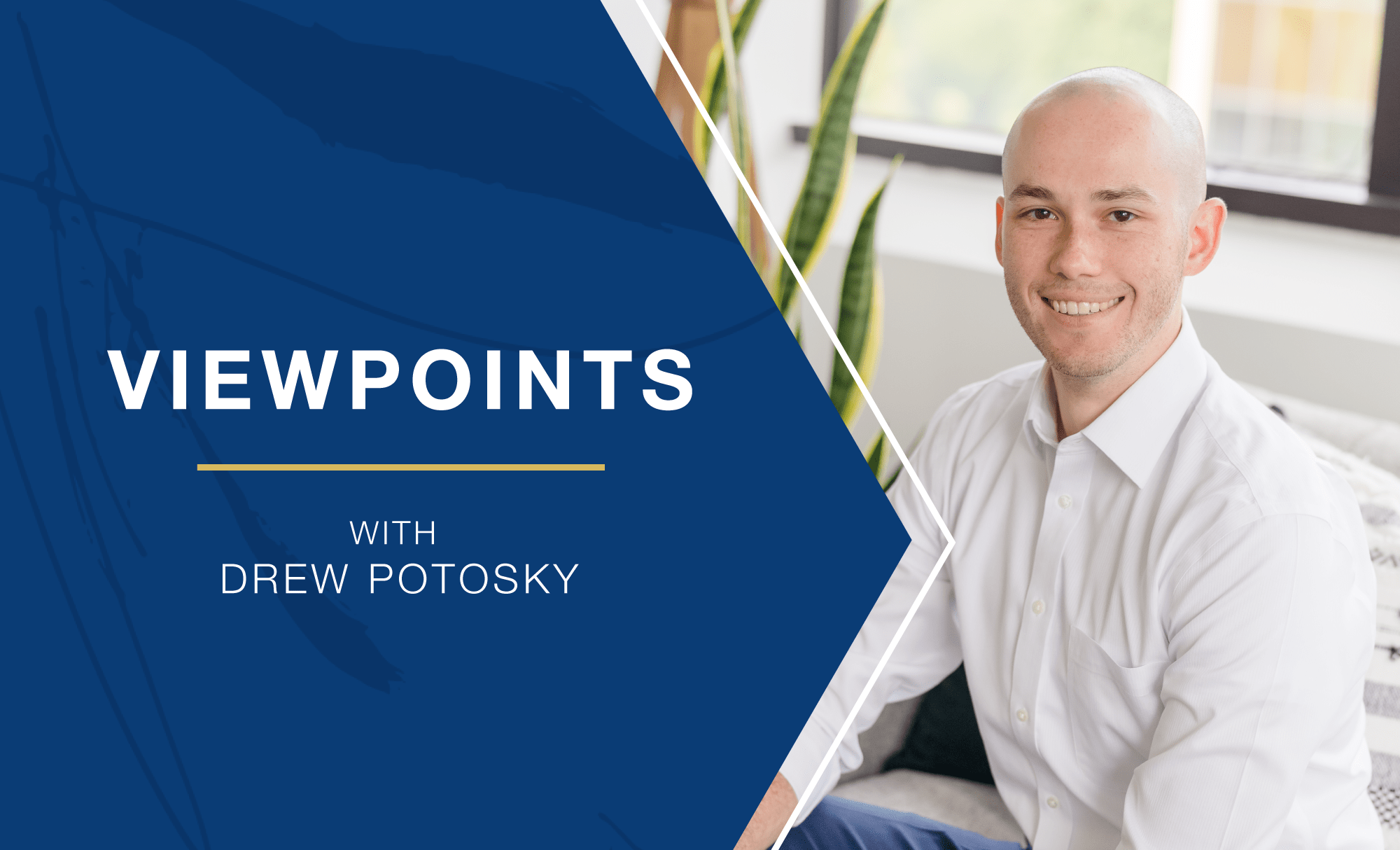

US Inflation

Inflation remains high, but reports show it eased up as the year-over-year inflation reading dropped to 7.7% from 8.2%. It’s the first sign the Fed’s interest rate hikes are working. Investors rejoiced and market roared higher with the idea that those pesky rate hikes could finally slow down, or even start coming back down. Markets have since leveled off, returning to their new-normal level of volatility, after St. Louis Fed chair reminded us there’s still a long way to go. (Source: Wall Street Journal)

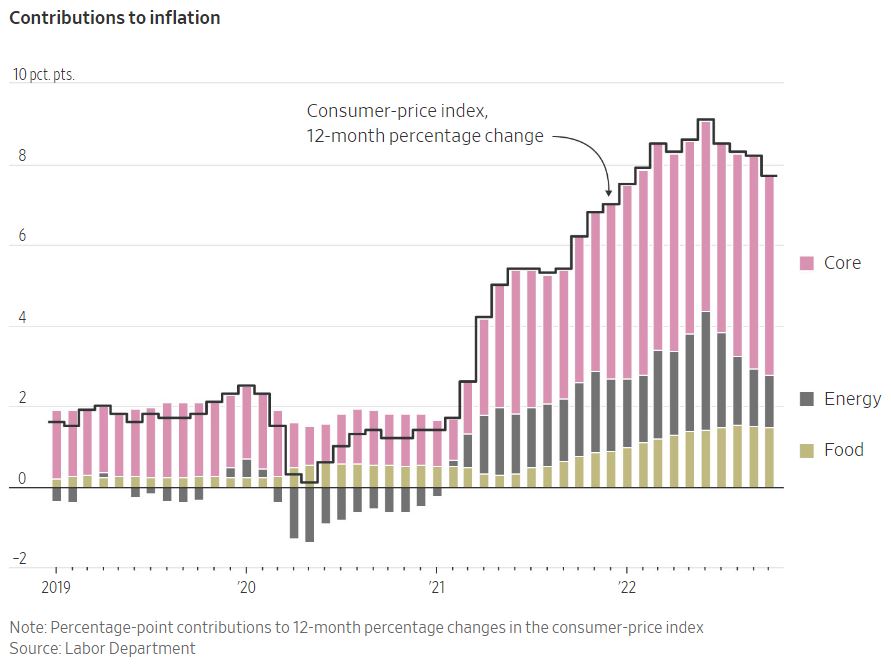

Global Inflation

Easy money and economic stimulus drove the economy forward during the pandemic, but now the negative effects of this are being felt through inflation and GDP slowdowns. Central banks around the world are mirroring the Fed’s work by raising interest rates and trimming balance sheets to try and get the widespread inflation contained. Everyone’s goal is a soft landing, but only time will tell if global recessions can be avoided. (Source: Schwab Q4 Chartbook)

Prime Minister Carousel

45 days after taking office, Liz Truss was out as the British Prime Minister, the shortest service in history. During those 45 days, the pound reached record lows against the dollar, bond yields ripped to their highest levels since 2007 leading to Bank of England intervention, and tax cuts for the highest earners were walked back. Despite all of this, Truss is still being offered the benefits all other PM’s have received in the past. Namely, she can claim what’s called the Public Duty Costs Allowance, currently set to a maximum of 115,000 pounds per year. Former PM’s have not always claimed the full amount and the public won’t know until figures are published next year. The new Prime Minister, Rishi Sunak, officially took over on October 25th. (Source: BBC and Barron’s)

It’s Chaos Compared to Enron

The once third largest cryptocurrency exchange, FTX is bankrupt. The company dropped in value from $32 billion to bankrupt in a matter of days, dragging former CEO Sam Bankman-Fried down with the ship. CoinDesk released a report that Bankman-Fried’s hedge fund, Alameda Research, was founded using a native FTX token FTT, not a fiat currency. This raised red flags for many at the amount of undisclosed leverage being taken. This ultimately led to a run on FTX and the token FTT, and there wasn’t enough cash on hand to issue withdrawals for all the request. Days later, the Bahamas regulators froze all company assets and seized $400+ million.

The company is now being run by John J. Ray III, a lawyer who helped creditors recover money after Enron. He described FTX, “a workplace ruled by chaos, with lax financial reporting, incomplete record-keeping, and questionable management practices.” This situation is still evolving and new information is being released by the hour. (Source: Investopedia and Barron’s)

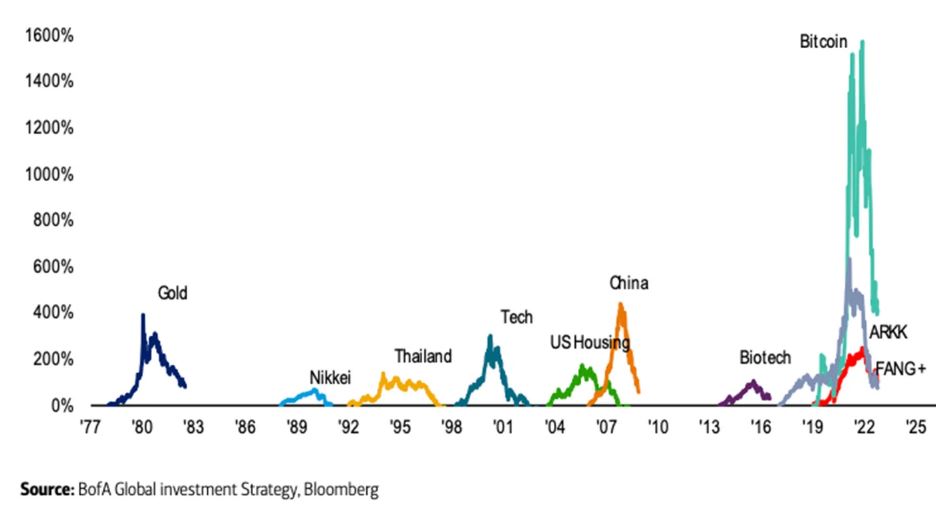

Crypto Bubble

Bitcoin and other cryptocurrency has taken a deeper dive after the news about FTX. Bitcoin has dropped 75% since the peak in November. See below for a great visual on how it compares to other bubbles. (Source: Fortune)

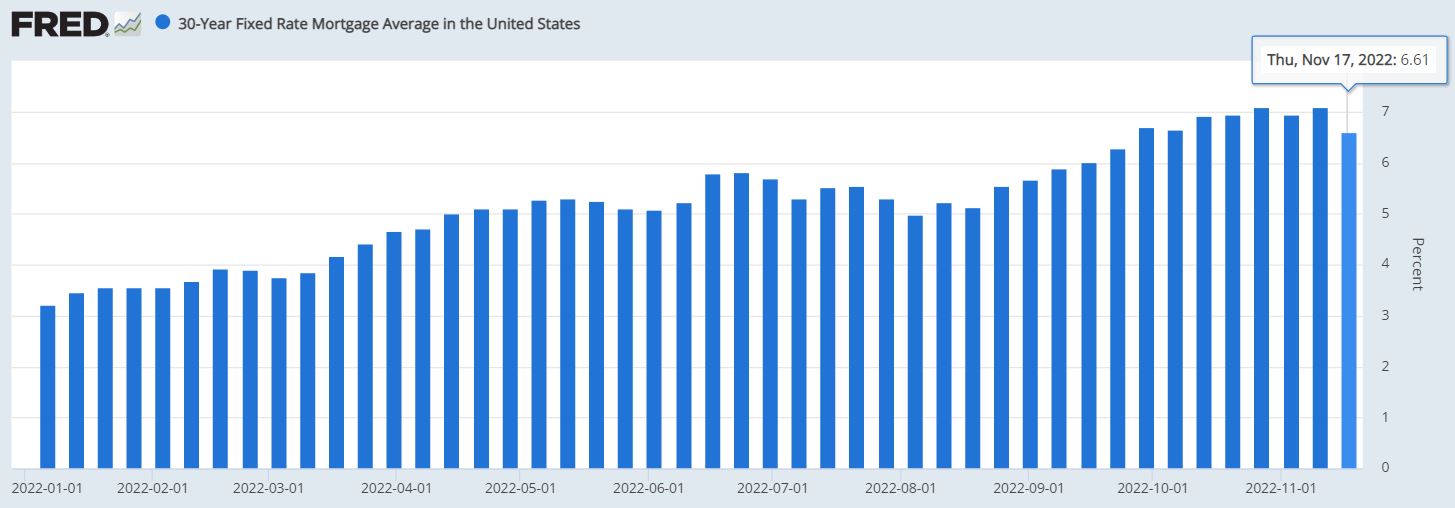

Mortgage’s Sharp Dip:

30-year mortgage rates dropped sharply last week, from an average of 7.08% down to 6.61%. On a $400,000 home, this would represent about $130 saved per month. Following the decrease, economists saw the mortgage applications index jump nearly 3%. (Source: Money.com)

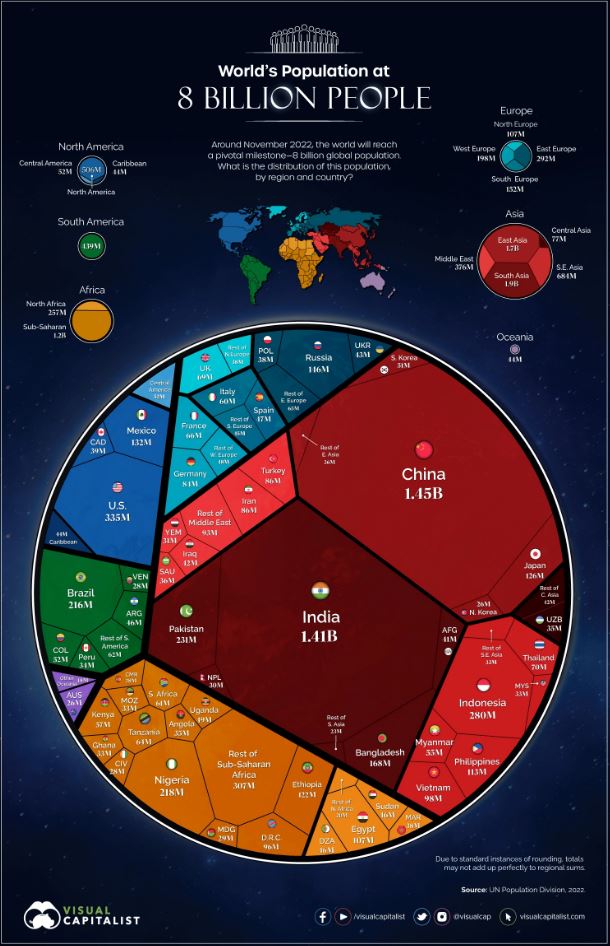

8 billion:

It’s estimated that we reached a new milestone this month – the world population reaching 8 billion people. In 48 years, the world population doubled in size. (Source: Visual Capitalist)

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.