Welcome to our May 2023 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Once we accept our Limits, we go beyond them

Take your pick of motivational ‘limit’ quotes. Congress is taking the debt ceiling talks to the wire. Janet Yellen has reaffirmed June 1st is the hard deadline to raise the ceiling as we are quickly reaching the borrowing and spending limits. Biden, McCarthy and other lawmakers have been working to come to an agreement to avoid a default, but the mood continues to swing from good to bad and back and forth. Many of the large financial institutions firmly believe an agreement will be reached to avoid a potential global financial crisis, though understand the risks.

- Vanguard – “It’s important to remember that volatility goes in both directions – up as well as down – and that the markets are efficient at processing news. Time in the markets is ultimately better for your portfolio than market-timing.”

- BlackRock – “While uncertainty around the debt ceiling can be unnerving for investors, we take comfort in the fact that the full faith and credit of the U.S. Treasury has always been honored, and BlackRock remains confident that a default on Treasury debt obligations is a very low probability outcome.”

- JPMorgan – “For investors, it may be tempting to move to the sidelines while debt-ceiling uncertainty remains. However, it should be recognized that this situation will, eventually, be resolved.”

- Goldman Sachs – “We do not expect a US default, but political brinkmanship makes the path uncertain.”

An Apple a Day

The Russell 2000 is a stock index made up of the 2,000 smallest companies by market capitalization. If you add all 2,000 market cap’s together, you get a total worth $2.7 trillion. Apple, a stock that is 1 company, is worth $2.71 trillion. Yes, earlier this month the market cap of Apple eclipsed the sum of all stocks in the Russell 2000 index.

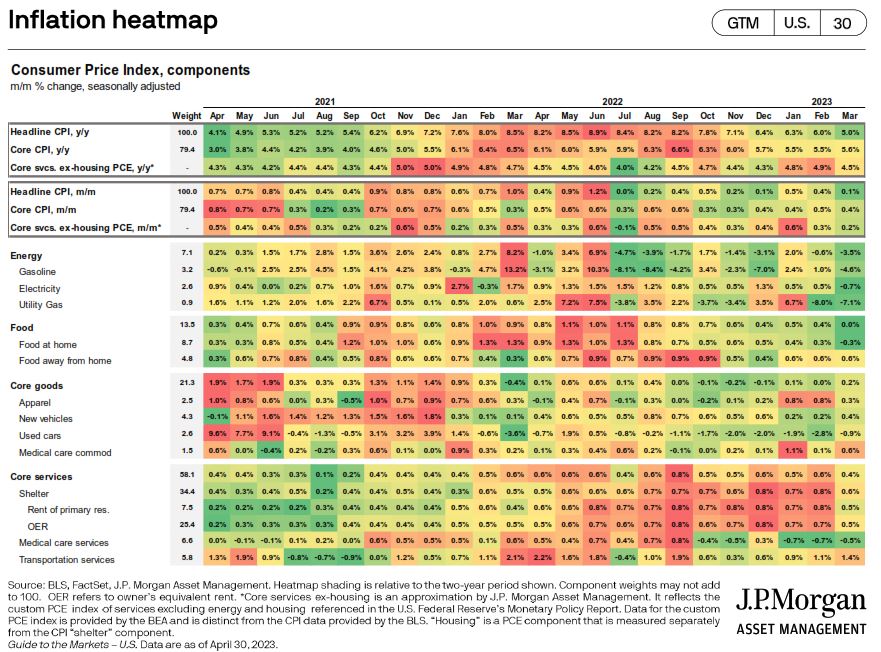

It’s Starting to…Cool Down

Below is the inflation heat map, updated as of the end of April. Energy, food, and core goods have continued to cool off in the inflation category, bringing the headline CPI (consumer price index) to 5.0% – slowly towards the long-term 2%-3% goal. Core services like shelter finally took a note from the rest of the inflationary measures and took a step back down. They’ve remained stickier, but we’re hopeful the recent numbers hold true.

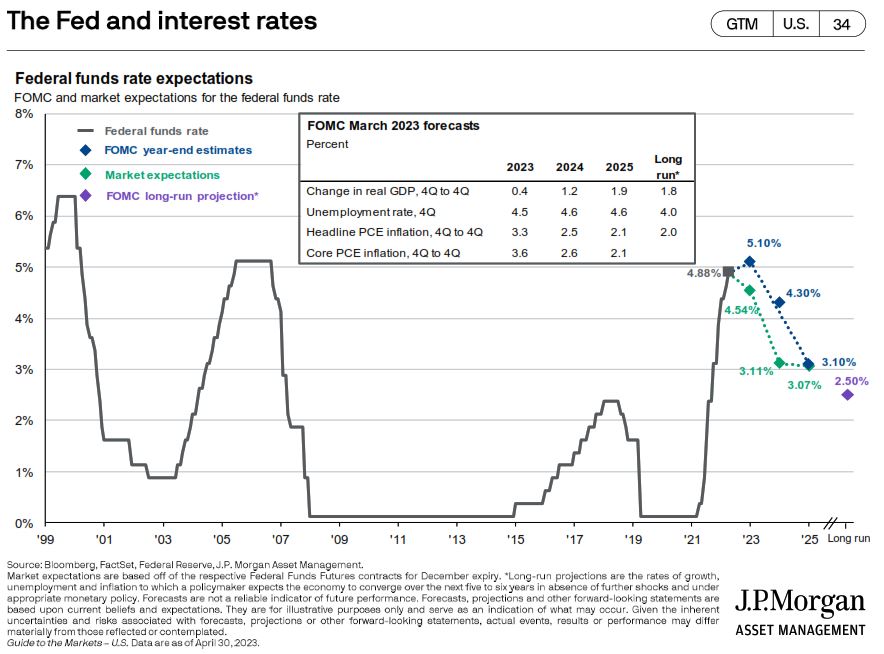

If You’re Still Interested

The debt ceiling may have further impact on interest rates, but the most recent data on the federal funds rate shows an expectation for rates to pull back in the next 12 months, following the current inflation track. It’s been a tricky line to walk, balancing interest rates and their impact on inflation and the economy. And the tight rope act isn’t yet over. There will likely be a popular call for rate cuts if inflation continues to fall, but the Fed needs to be careful with any economic and spending stimulation for the chance to jolt inflation higher.

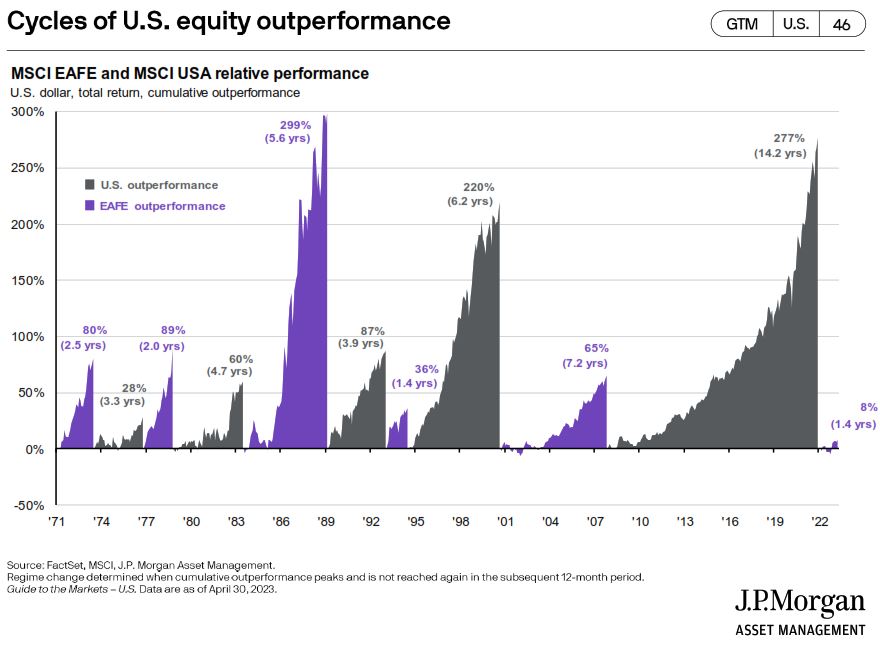

Slow and Steady

After more than a decade of US stock outperformance, international equities have slowly but surely begun leading the charge. According to the visual below, international stocks have added 8% to what domestic stocks have done. The constant back and forth between US and international stock outperformance serves as a great reminder of the importance of diversification. It’s impossible to predict when performance will flip, so diversifying stock ownership across the globe allows investors to take advantage of outperformance – whether it’s domestic or international.

A (not so) Fun Baseball Stat

Teams are now 1/3 through the baseball season and the Guardian’s catchers remain historically awful offensively. Since the start of the 2018 season, the Guardians/Indians catchers rank dead last in weighted runs created plus (wRC+) with 65 according to FanGraphs. The metric is a measure of total offensive performance, adjusted for park effects and scaled so 100 is average. The score of 65 means the Guardians catchers create -35% less runs than average. 2023 has been no different. Before this last weekend against the Mets, Cleveland catchers had not recorded a single hit in the month of May. Cam Gallagher finally broke his 0-34 streak at the plate and Mike Zunino was not far behind.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.