Viewpoints: May 2021

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Huge Sell-Off: The Crypto market and bitcoin experience a huge sell-off yesterday after a “parabolic run up”. The market is “feeling a little more pressure from global macro forces” and lost more than $460 billion in market value yesterday alone. (Coindesk)

- A New #1: GasBuddy, an app that provides real-time gas prices at stations near you, became the most popular download on Apple’s App store following the shutdown of the Colonial Pipeline. Gas prices along the south east coast reached $3 a gallon for the first time in nearly 7 years. (MarketWatch)

- Take it and Run: Hours after the Colonial Pipeline was taken offline due to a ransomware attack that left much of the south east coast scrambling for gas, the CEO confirmed a $4.4 million ransom payment. Days later, the hacking group responsible, DarkSide, told associates they were shutting down. (Bank Info Security and WSJ)

- No One is Hitting: Former Cleveland Indians and current Yankees pitcher Corey Kluber threw the season’s 6th no-hitter Wednesday night. For perspective, the 2018, 2019, and shortened 2020 seasons saw only 2 each. At this point in the MLB season, the league wide batting average (.236) is the lowest of all-time. (Baseball Reference and ESPN)

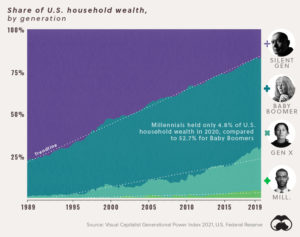

Generational Wealth

“It makes sense that Baby Boomers would hold the most wealth of any generation. They have had more time to accumulate assets, and the population of Boomers is roughly three times higher than that of the Silent Generation.

What’s more interesting, however, is the stark difference in wealth trajectories between Boomers and younger generations.

While Boomers entered the workforce in a prosperous post-WWII era, Millennials and Gen Z have either started their careers in the aftermath of the 2008 Financial Crisis, or in the midst of the COVID-19 pandemic.

To put it in perspective, when Baby Boomers were as old as today’s Millennials in 1989, they held 21.3% of U.S. wealth. That’s more than four times higher than what Millennials hold now.” –Iman Ghosh of VisualCapitalist

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.