Viewpoints: May 2020

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- “Expert” Predictions: At the start of 2019, bond strategists predicted the yield on the 10-year Treasury would rise from 2.72% to 3.30% by the end of the year (an increase of 21%). The 10-year Treasury yield actually ended the year at 1.92% (a decline of 29%). At the beginning of 2020, bond strategists predicted the yield on the 10-year Treasury would stay roughly flat at 1.90% by the end of the year. As of May 15, 2020, the yield is only 0.64% (a decline of 66%). (Sources: Reuters, yCharts)

- Unemployment: At 14.7%, the unemployment rate is the highest since the Great Depression era of the 1930s. The jobless rate among women increased 11.5% compared to a 9% increase among men. April’s losses erased roughly all of the jobs added over the previous decade. (Source: Bloomberg)

- I’m On A Boat: Carnival Cruise Lines announced that some of its cruises could resume in August. Since that announcement, bookings shot up 600% compared to the three days before the announcement. Even more shocking, August 2020 bookings are up up 200% over prior year, pre-coronavirus August 2019 bookings. (Source: Fast Company)

- Corporate Bond Issuance Records: Companies sell bonds as a means of borrowing cash. In March 2020, the previous monthly record was smashed by over 1.5x when $262 billion of investment-grade corporate bonds were issued. That new record was short-lived. In April, $285 billion in new bonds were issued, including Boeing raising $25 billion alone, the sixth-largest single corporate bond placement on record. (Source: Guggenheim)

- Snacks On-Demand: Many consumers have discovered the convenience of online grocery shopping while sequestered at home. With consumer habits potentially changing permanently, Frito-Lay unveiled snacks.com, a website where you can order more than 100 of their products including chips, dips, crackers, nuts, and cookies. (Source: Adweek)

Thoughts for the Month

“The superior man blames himself. The inferior man blames others.”

“It’s the start that stops most people.”

– Don Shula, Ohio-born member of the Pro Football Hall of Fame and coach of the only team with a perfect, undefeated season in NFL history (1972 Miami Dolphins), (1930-2020)

Commentary – Changing Purchasing Behaviors

Data intelligence company Morning Consult surveyed consumers on how they anticipate their buying behaviors changing in a post-COVID-19 world. In their report, “Necessity, Desire and the Murky Middle – What’s Behind COVID-Era Consumption Boosts”, they share a broad range of findings on what we bought before the pandemic, what we’re buying during, and how we anticipate our buying choices changing after.

While more non-alcoholic beverages and healthy food are being purchased out of necessity, snack/junk food and alcoholic beverages are more highly desired “wants” during these times of social distancing and self-quarantining. Ready-made meals and personal care products have also seen a significant increase. Of all categories surveyed, healthy food is the category consumers report being most likely to purchase more of after the pandemic. Although we’re skeptical of self-reported intentions becoming actual changed behavior, 26% of those surveyed claim they plan to purchase less snack and junk food compared to 45% expecting to buy more healthy food post-pandemic.

As consumers think about how their spending patterns have changed, 44% say they have realized there are brands or companies they are spending less on that they’ve realized they don’t miss and can live without. While more pronounced for younger consumers (Gen Z) than Baby Boomers, all age groups anticipate changed purchasing patterns created during the pandemic remaining. It will be interesting to monitor in the months/years ahead to see which stores, services, and brands thrive now that consumers have more thoughtfully considered how they spend their hard-earned dollars and which fall out of favor or cease to exist entirely.

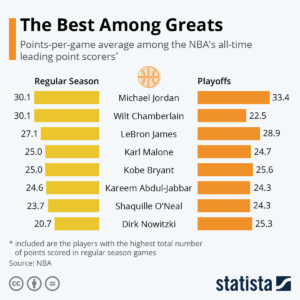

Chart for the Month – Top NBA Players

With many of us missing professional sports, ESPN’s 10-part Michael Jordan documentary, “The Last Dance”, has provided a nostalgic fix with an in-depth look at the Chicago Bulls dynasty’s final championship season in 1997-98. As this chart shows, “Air Jordan” is both the regular season and playoffs leader in average points-per-game (and the only NBA player to average 30+ ppg in the playoffs over his career). ESPN also ranked the top 74 NBA players of all time with “His Airness” ranked #1 overall.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.