Economic and Investment News Bits

- To Brexit or not to Brexit? United Kingdom voters will decide June 23rd whether to remain in the European Union or leave. The consequences for Britain should they exit are many, including currency devaluation, reduced access to trading partners, more foreign investment dollars leaving the nation, and even a new Prime Minister. Initially, damage control will be a priority. Pro-EU groups are hoping the result will be similar to the 2014 Scottish independence referendum, where undecided voters swung the vote to remaining in the U.K.

- For what it is worth, the S&P 500 has increased an average of 3.7% in the six months before a presidential election when the incumbent party wins. The increase is only 1.1% when the incumbent party loses the election. (Source: Ned Davis Research)

- Government outlays for Medicare have increased 9.8% annually over the last 40 fiscal years, rising from $13 billion in 1975 to $546 billion in 2015. Meanwhile, inflation, as measured by the Consumer Price Index, has increased 3.7% annually over the same period. (Source: Department of Labor)

- “We have seen this before – a stealth bull market. Despite negative corporate earnings, weak economic growth, and the prospect of a Fed rate hike, U.S. markets rallied through May. Many fretful investors continue to miss out as they await a crash that never comes,” (Source: Voya Financial).

- Investors should “evaluate their quality mix, and consider favoring a tilt toward shares in companies with sustainable dividend yields and toward high-quality, shorter-term bonds,” (Source: MFS Advisors).

- The Cleveland Cavaliers team salary for one year is $107 million. The Ohio State University athletic department spent $154 million last year. The Ohio Arts Council budget as approved by the General Assembly is $27 million for the entire state for two years.

Thought for the week

“I have not failed. I’ve just found 10,000 ways that won’t work.”

Thomas Edison, American inventor (1847-1931)

News to College Graduates

A recent article by CNNMoney.com tells graduates “there is a lot about personal finance that you were probably not taught. From earning a paycheck to paying rent, utilities, student debt, and other areas, here are some surprises coming your way. # 1 Your take-home pay is less than you thought. After taxes, Social Security, Medicare, 401k contributions and other benefits, your actual pay will be much less than you expected. #2 Rent is a budget killer. Try to spend no more than 30% of your monthly income on housing. #3 Yes, you have to have health insurance, although you can remain on a parent’s plan until you turn 26. #4 Student loans must be paid. Federal student loans give you a six-month grace period after you leave school before you start paying. Private loans may start payments immediately. #5 You need to have an emergency savings. Try to sock away as much as six months of cash flow expenses in a bank account.

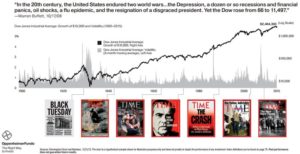

Chart For June (CLICK TO ENLARGE)

Our thoughts and prayers go out to all of those impacted by the Orlando shootings. Each generation has faced challenges like the global depression, two world wars, the Cold War, assassinations of Presidents and now terrorism. Yet throughout all of these events, the global markets continue to climb higher. Why? “Because in spite of our shortcomings, the human race is remarkably resilient, as well as masterful investors and innovators, always striving to make a better place for themselves, their families and societies.” (Source: Oppenheimer Funds)

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.