Welcome to our January 2025 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

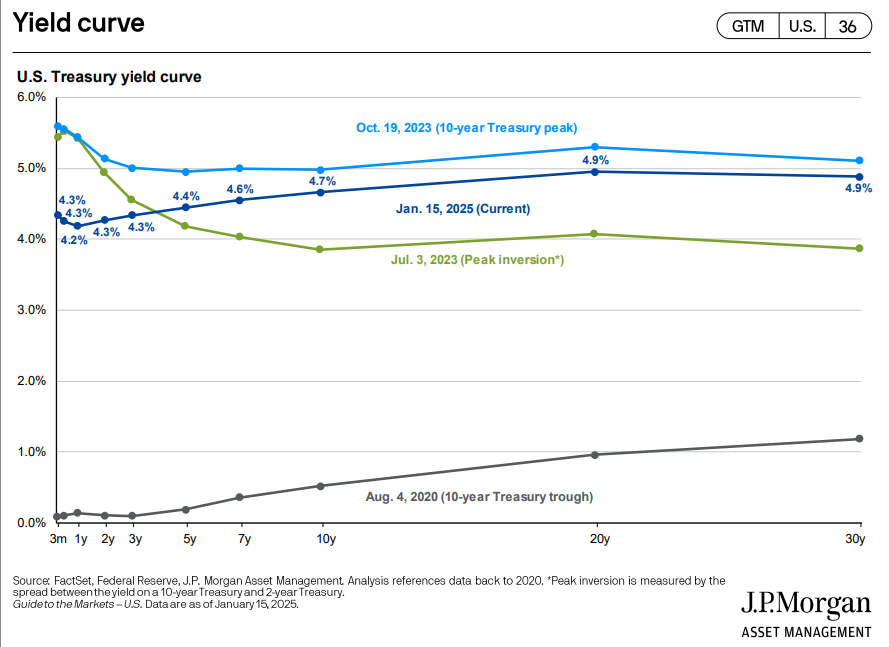

The Yield Curve is Back to Normal

After being inverted for the better part of the last 2 years, the yield curve is returning to normal. A ‘normal’ yield curve is one that is upward sloping – the interest rates are higher the further the maturity window stretches. Investors are compensated for taking the risk of holding a longer-term bond and feel they can weather the risk because their view of the economy is positive. The slope of the yield curve can show optimism (upward sloping or normal) or pessimism (downward sloping or inverted) in the economy. This shift back to normal is viewed as a positive change, but the impact on bond performance has been mixed. On the one hand, yields and dividends for intermediate bonds have stayed the same or increased. But on the other hand, as the longer end of the yield curve (the right side) has risen, the bond prices have fallen. Kurt Brown wrote about this relationship in the most recent January 2025 Market Commentary and is worth another read. “Many would expect bonds to also perform well with the Federal Reserve cutting interest rates. However, the aggregate bond index only gained 1.3% last year…” Click Here to read more.

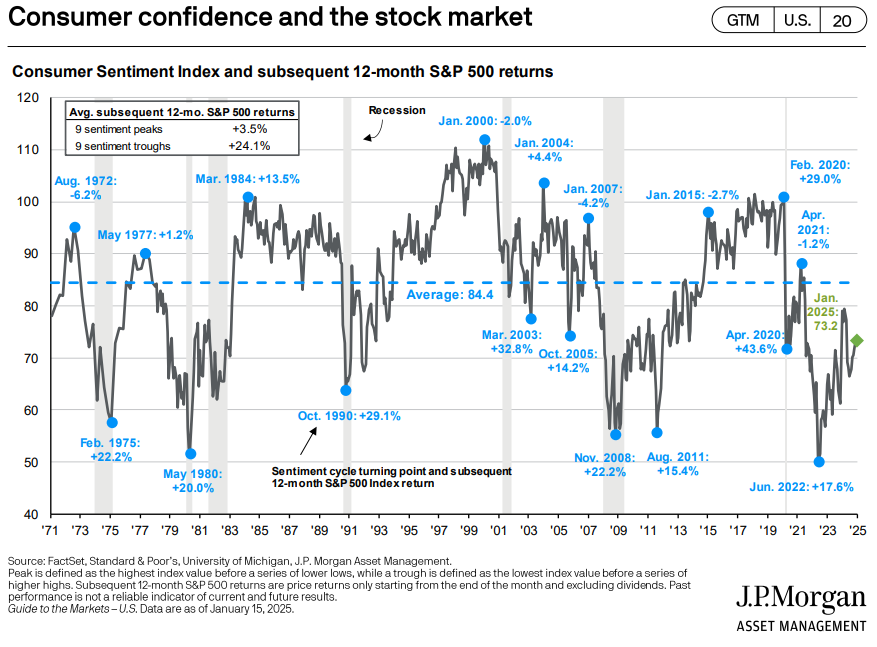

Consumer Confidence Below Historical Average

The stock market is never without risks – it’s just a matter of what and how many investors are focused on. Right now, a big focal point for risks is what may happen once the new administration takes over. How will an increase in tariffs impact GDP and inflation? What about an update to the immigration policy? Or will an easier view on regulation help valuations and provide tailwinds in the markets? The chart below distills consumer sentiment into one number and plots to create the below chart. As it stands, the current value of 73.2 is trending up but still well below the historical average of 84.4, indicating some concern for the economy. But this may not be a bad thing. The S&P 500 performance during periods of lower consumer confidence has largely been positive. Of course, there are never guarantees when it comes to the stock market.

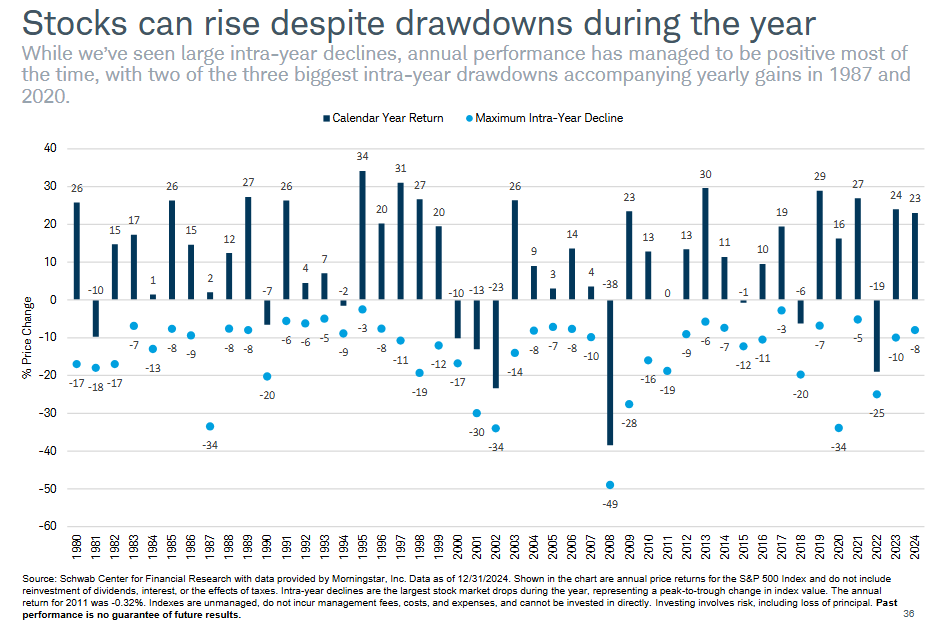

Volatility is Normal

Market drawdowns and corrections are a normal occurrence in the market. In the moment, a -10% loss hurts and pessimism hits fast. But despite large intra-year drawdowns, the market usually has a way of coming out ahead. The most important thing is to stay invested and stick to the long-term plan. Time in the market is better than trying to time the market!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.