Welcome to our February 2025 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Housing Market Hold Strong, But Buyer Demand Weakens

The housing market remains strong in terms of home prices, driven by supply and demand dynamics along with past and present mortgage rates. “Around two-thirds of borrowers are paying a mortgage rate less than 4%. This has strangled supply and pushed U.S. home values to record highs.”

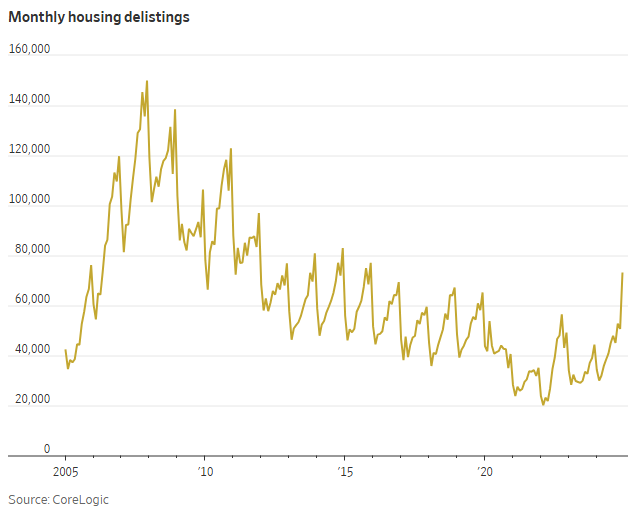

However, signs of change are emerging. In December, “Nearly 73,000 homes were pulled from sale after they failed to find a buyer in the final month of last year” — marking the highest number of delisting’s since 2015. While delisting homes typically rise seasonally in December, this surge suggests deeper challenges. Compared to the previous year, the number of homes for sale last month increased by 16%, yet 2024 saw the fewest home sales in 30 years. Sellers are active, but buyers remain hesitant. The current average 30-year mortgage rate of 6.87% may have something to do with it.

Fed Officials Still in Wait-And-See Stance

The current federal-funds rate is still sitting near 4.30% and officials have no immediate plans to make any changes. The latest labor data has remained steady while inflation ticked up slightly more than expected, both big reasons why no short-term change to interest rates is seen as needed. The economy is still chugging and prices are still rising quicker than targeted. In addition to the current data, the potential changes to trade (tariffs) and the immigration policy are seen as “potential sources that could hinder recent progress on inflation.” So unfortunately for borrows, there’s no rush!

International Stocks Still Ahead

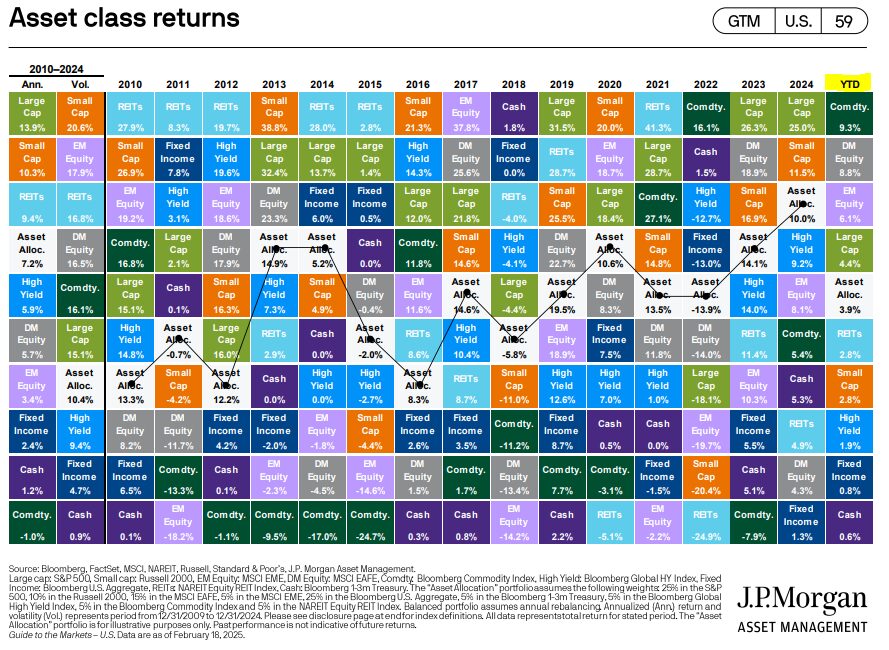

It’s still very early in 2025, but international stocks are still outpacing the US. Going into the year there was pessimism surrounding developed (Japan, United Kingdom, most of Europe, etc.) and emerging (China, India, Taiwan, etc.) markets. It’s possible the extreme pessimism has created perceived positive surprises that have helped boost prices. Additionally, the unknowns in the US with potential changes to policies under the new administration and the hit to AI and chips may have helped as well. Performance and rankings are liable to change day to day which is why we value the importance of diversification in portfolios.

Fun Little Points

- The National Retail Federation estimated a record $2.9 Billion would be spent on flowers for Valentines Day. Were YOU a statistic?!

- The Eagles victory over the Chiefs in Super Bowl LIX set a record for most unique viewers at 182.8 million. Kendrick Lamar’s halftime show also set a viewership record of 133.5 million people.

- MLB spring training will officially begin February 20th. Then, the defending champs Los Angeles Dodgers will face off against the Chicago Cubs to open the MLB season in Tokyo on March 18th and 19th. Traditional opening day with all 30 teams will be March 27th.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.