Welcome to our February 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

By Drew Potosky, CFP®,

Posted: 2/20/2024

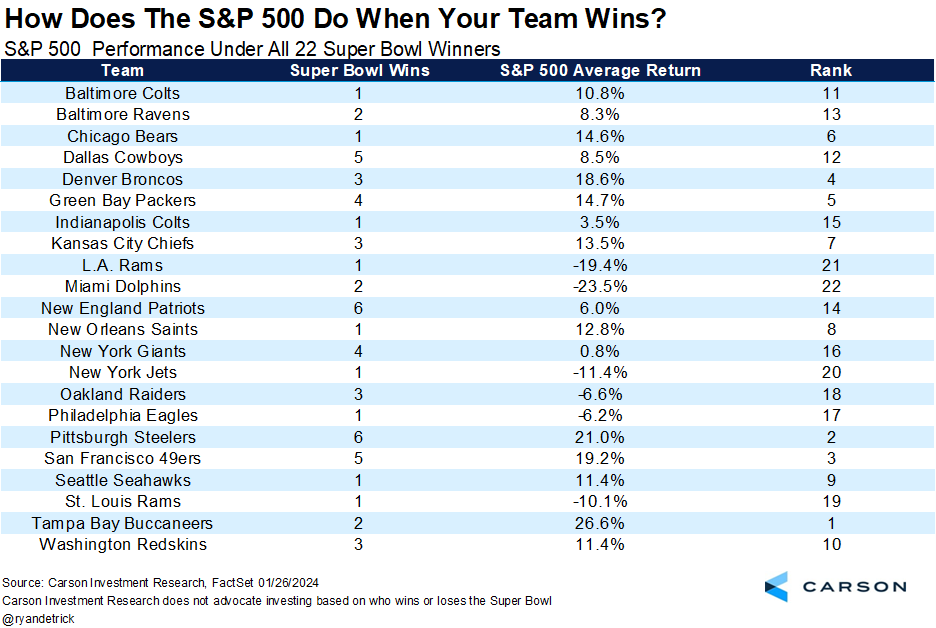

Super Bowl Winners and the S&P 500

The Kansas City Chiefs came away victorious after a last second touchdown in overtime and became the first back-to-back Super Bowl winners since the Patriots in 2003-2004. And none could be happier than Chiefs Fans, Swifties, and…all investors? In research compiled by Carson Group, when the Chiefs win the super bowl, the S&P 500 returns an average of 13.5%. But they go on to say, “when it is a single digit win in the Super Bowl, the S&P 500 is up less than 6% on average.” More importantly, Carson Group discloses they “do not advocate to investing based on who wins the Super Bowl” and we could not agree more!

Investing is Emotional

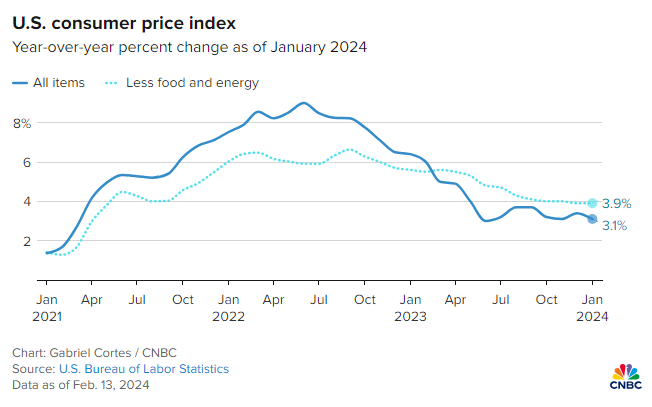

Last Tuesday the latest inflation reading was released and showed an increase to the CPI (consumer price index) of 0.3%. Expectations were a 0.2% increase. That 0.1% had the market in a tizzy. The market (S&P 500) opened down -1%, fell more to -2% before closing the day -1.37% lower than the day before. By the end of the day Thursday, the S&P had fully recovered. How can an unexpected 0.1% result in so much selling? Algorithmic trading accounts for around 60% of all trades in US equity markets and they can be pretty comprehensive. As a hypothetical example, if inflation reads higher than expected, it could result in interest rates staying elevated for a longer period delaying the first rate cut which has lately been bad news. The algorithms might have instructions to sell in this scenario. Then as more buyers enter the following days to buy the slight dip, the algorithms flip and start buying again. The average investor, on the other hand, sees headlines about higher-than-expected inflation and a bright red market snapshot. These can evoke strong emotions and lead to potentially poor decisions. It reminds me of the saying, a day late and a dollar short.

500 Hits 5,000

Earlier this month the S&P 500 eclipsed the 5,000 mark for the first time ever, marking an all-time high for the widely known index! What does it mean?

Nothing.

Aside from being a new high, 5,000 is just a nice round number to cling to. It’s otherwise irrelevant. The milestone makes for great headlines and does signify increasing prices (and hopefully portfolios), but don’t let the noise distract from the signal.

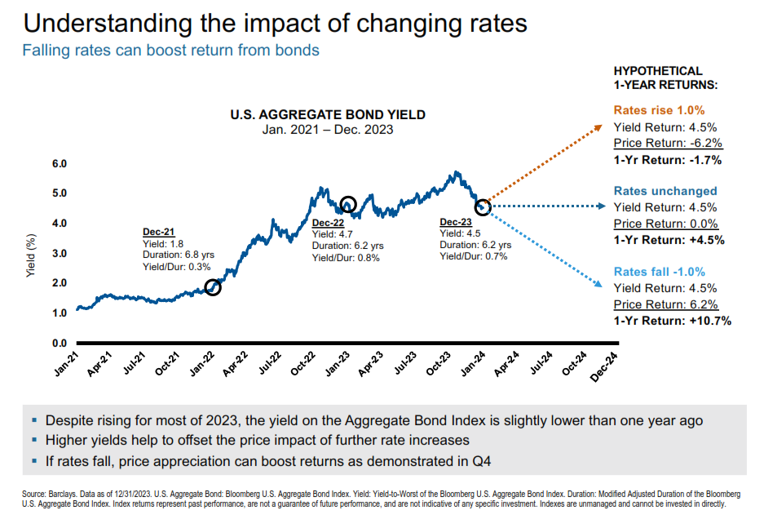

Impact of Changing Interest Rates

The economists and wider market participants are still expecting the Fed to begin cutting rates sometime this year – it’s only February remember. The relationship between interest rates and the price of bonds inversely correlated. When interest rates go up, the price of bonds go down as we saw in 2022. And when interest rates are cut, the price will go up*. The image below depicts what would happen to the US Aggregate bond index should interest rates: Ride 1.0%, remain unchanged, and fall -1.0%. When we think about rate cuts, math is in the favor of continuing to hold bonds.

*There are two components to the yield earned in fixed income: yield return and price return. The yield return is the coupon or dividend. When interest rates rise, it will mean newly issued bonds will have a higher coupon rate attached to it and thus a higher yield for the investor. For previously issued bonds to meet market demands of higher yield, the price of the bond needs to fall. Bonds are issued and redeemed at par value, $1,000.00. The following bonds are equal in yield to maturity:

- Bond ABC with a coupon of 5% priced at $1,000.00 maturating in 1 year. YTM =5%

- Bond XYZ with a coupon of 2% priced at $970.00 maturing in 1 year. YTM =5%

The bond with the lower coupon can’t match current yields with the 2% coupon, so the price needed to fall. Since the bond will mature at par value, $1,000, there will be a 3% price return on top of the 2% coupon matching the yield for the higher coupon bond.

Baseball Season

This Thursday the 22nd is the official start of the 2024 Spring Training season when the Padres play the Dodgers. The same two teams will kick of the start of the MLB regular season on March 20 in South Korea. The rest of the 28 teams and official opening day is set March 28th. Nearly a month away! The Guardians start on the west coast and won’t play in Cleveland until April 8 when the White Sox come to town. Cincinnati, of course, begins the season at home against the Nationals.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.