Welcome to our August 2025 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

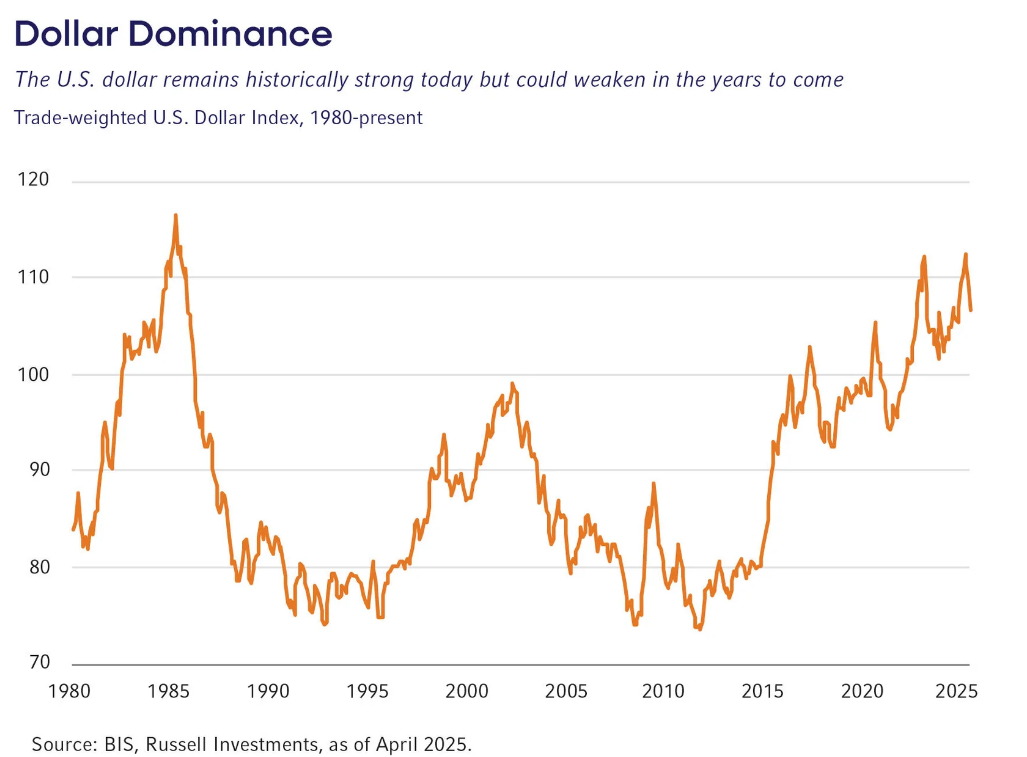

Dollar has Weakened, but Historically Strong

The weakening dollar has been a top story this year as we continue to learn what the impact of tariffs and trade will be. One result of a weakening dollar has been the outperformance of international stock over the US. The Vanguard Total US Stock Market Index (VTI) has grown 9.3% since the start of the year compared to the Vanguard All-World ex-US Index (VEU) growing an astonishing 22.0%! The uncertainty around the US economy has played a role in these lopsided returns, but the weak dollar has been just as important, if not more so. However, the chart below shows the long-term movement of the US dollar and, while weaker today, it’s still historically strong. It can surely continue lower, but America’s capitalistic approach and leading technology companies could set US stocks up for continued long-term success.

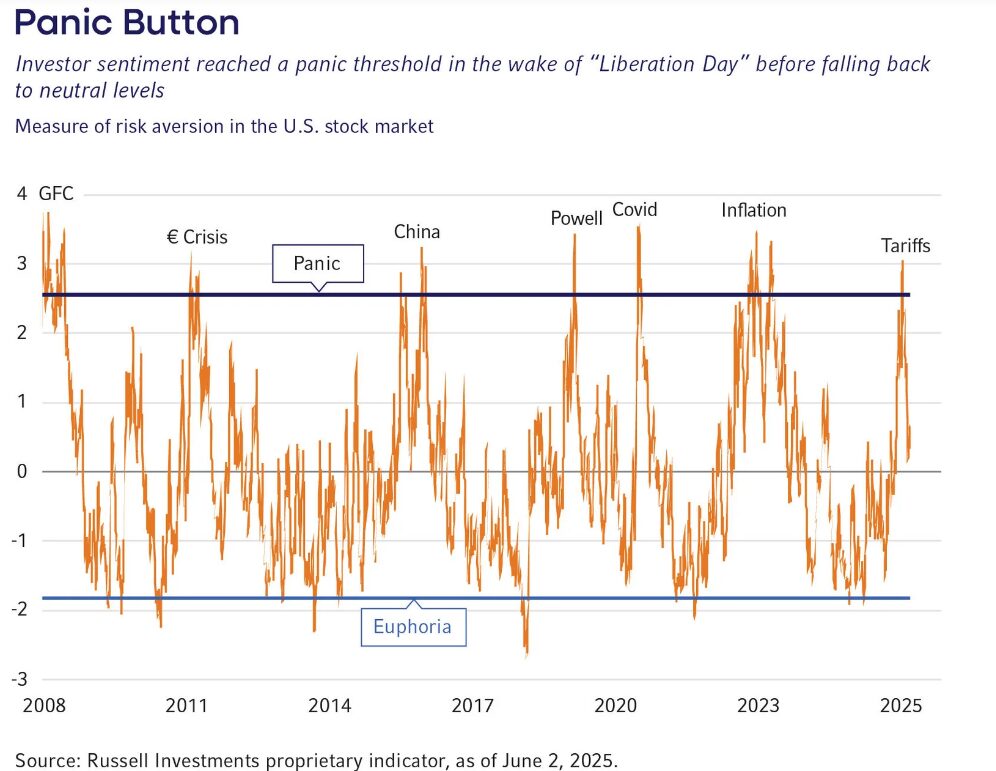

Sentiment Back to Normal

If you ever need confirmation that investors constantly give themselves whiplash, look no further than the chart below. From Panic to Euphoria, there’s always something to worry about or get excited about. Most recently (as we’re all aware of by now) have been tariffs. More specifically, the ‘liberation day’ tariff announcements back in April. Markets had one of the sharpest selloffs in history and investors panicked. Since then as trade deals have been discussed and struck, and the worst of the liberation day tariffs paused or reversed, the emotions have subsided, and market sentiment has back to normal.

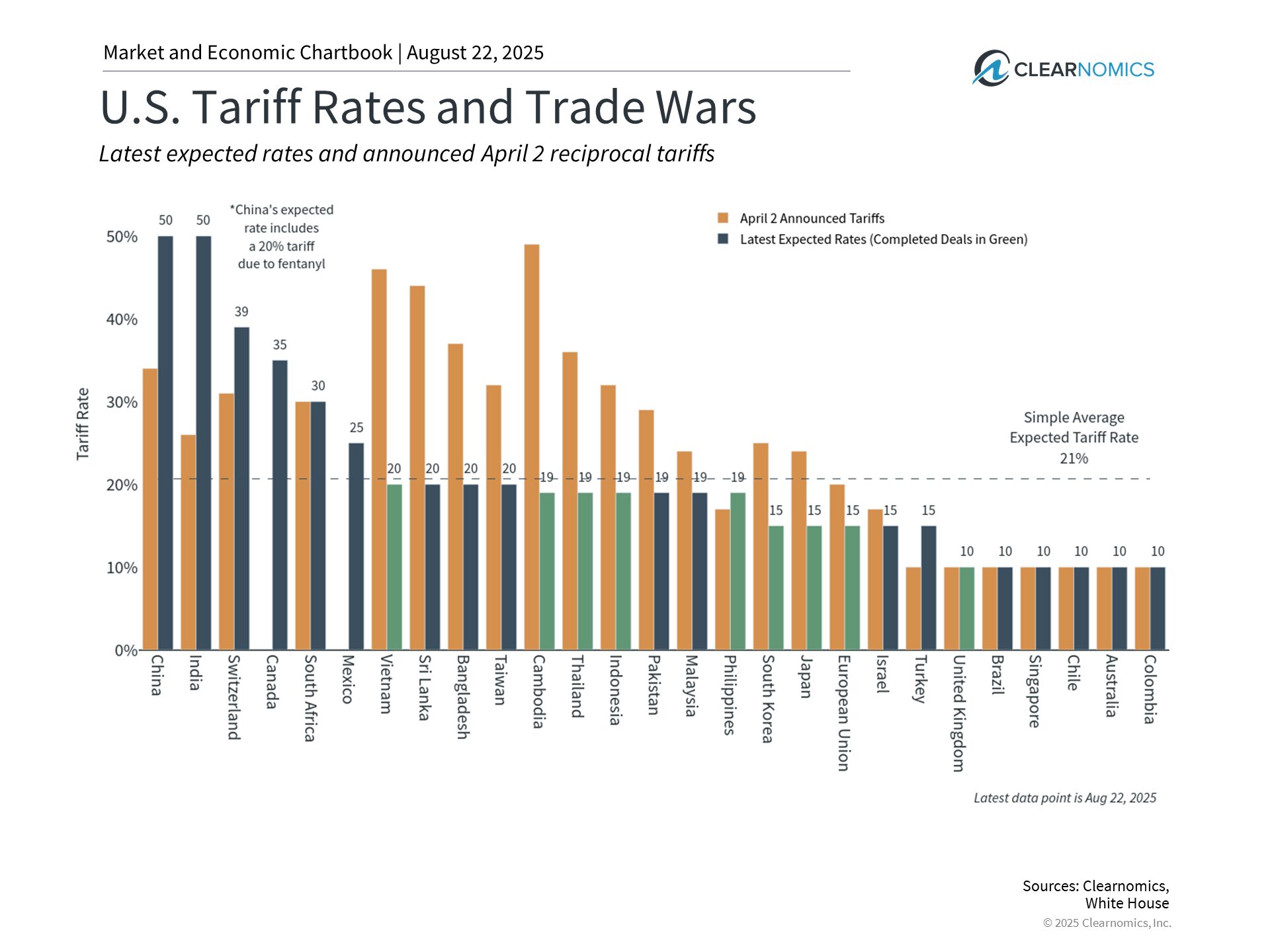

Speaking of Tariffs – Latest Expectations

The orange bars in the chart below show the liberation day, April 2nd, tariff announcements. These were quickly stepped back after markets reacted negatively and new deals and rates were implemented. The bars in green show the completed deals while the blue bars show the latest expectations with most less than the April 2nd announcements. Time will tell the impact these have on markets, the economy, and trade in the US and across the globe.

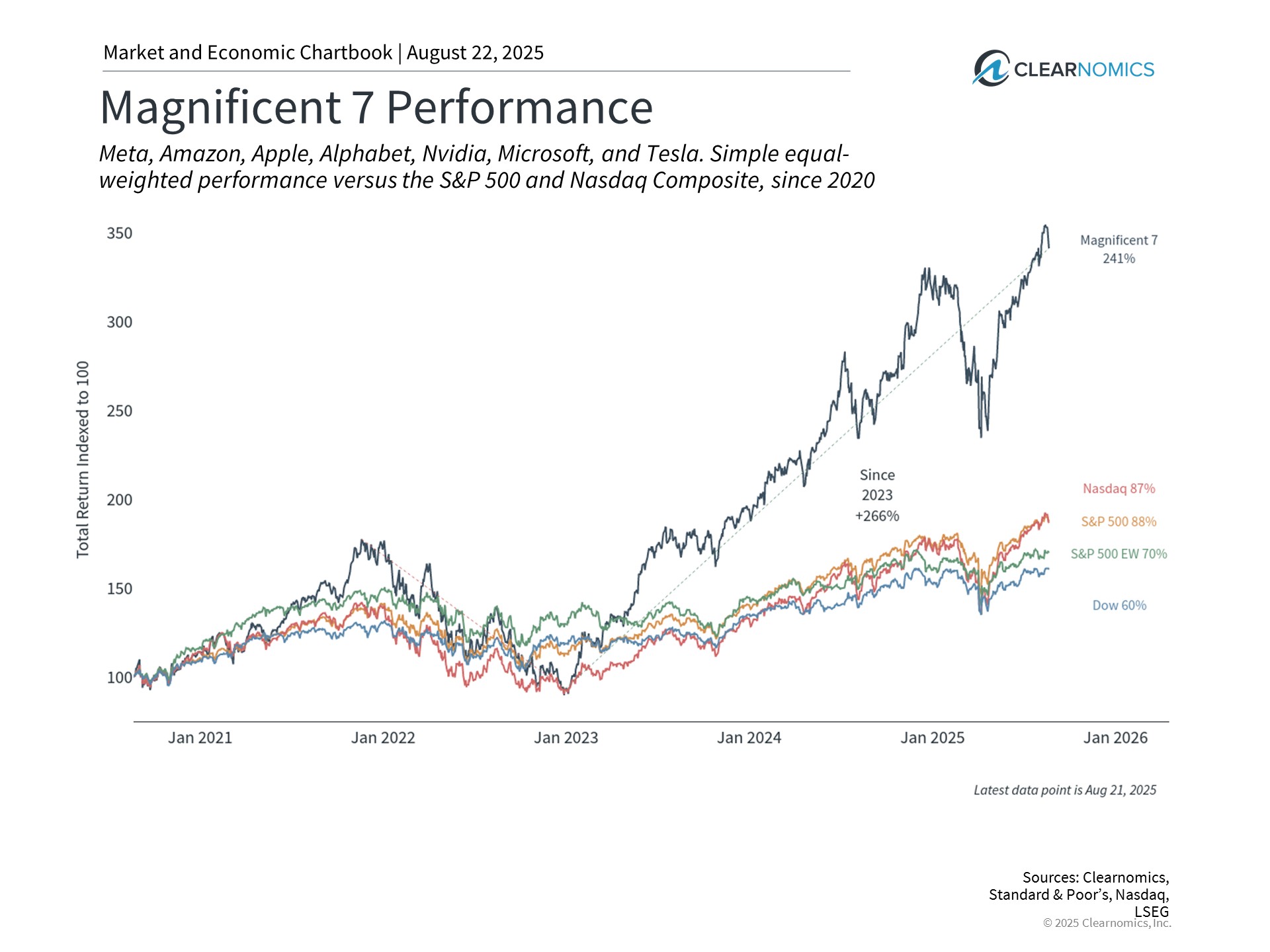

The Magnificent 7 Is Still Relevant

Without the returns of the Magnificent 7 (Meta, Amazon, Apple, Alphabet, Nvidia, Microsoft, Tesla), market performance would have been much more muted. But without the performance of the Magnificent 7, market performance would have been much less volatile. During the initial market pullback in 2022, the Magnificent 7 lost nearly half of their value. As such, volatile technology stocks play an important role in diversified portfolios but are risky as standalone investments. Most of these companies have had their hands in the Artificial Intelligence pot and it shows – in both performance and volatility.

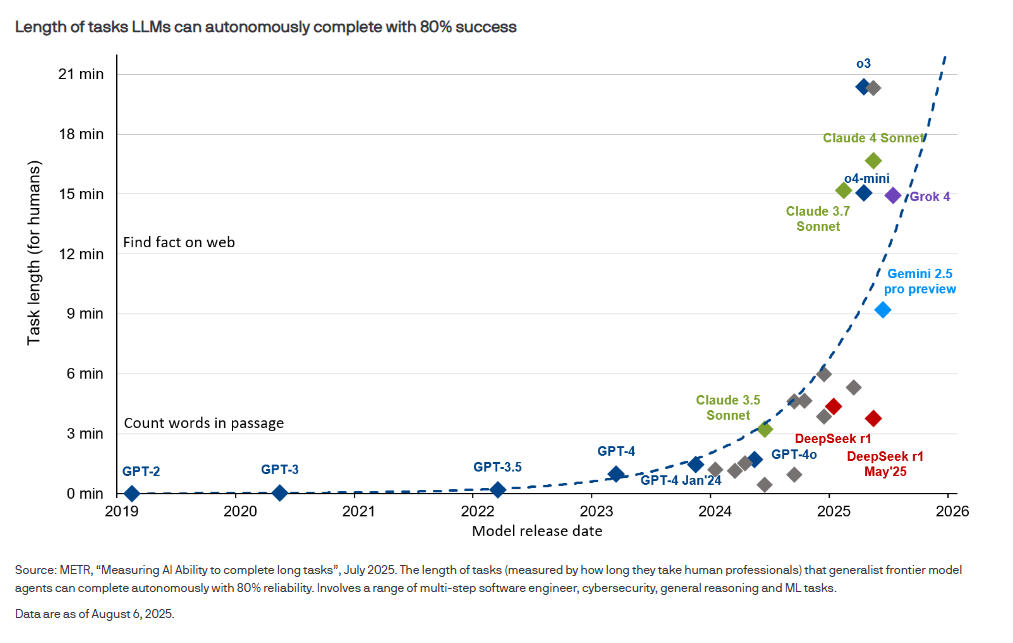

The Impact of AI and Jobs

AI has been a talking point for at least the last 12 months and many expect this trend to continue. Tech companies are all in and investors are flooding this area of the market with dollars, both in the public markets and private. It can be fun to play with programs like Chat GPT to create a funny picture or to even help write an email, but there is a worry that the continued development will take jobs away from people that need them. Data collected by JPMorgan seen on the chart below make the case, fortunately, jobs are mostly safe right now. They write, “AI agents are becoming increasingly useful, but even the best-in-class models can only reliably automate tasks that take humans up to 20 minutes to do.” The best-fit line is trending exponentially, but so far, so good.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.