Welcome to our August 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

By Drew Potosky, CFP®,

Posted: 8/23/2024

Where We Are Today

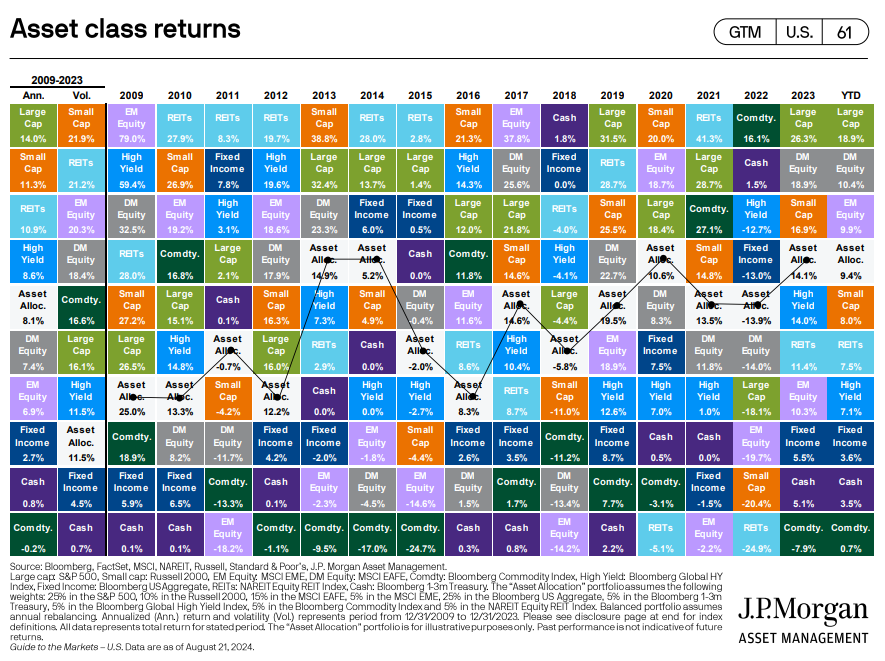

The chart below is a busy one, but really interesting once your eyes adjust. Each column represents one calendar year of returns where each box in the column is a different investment type. There’s US Large Cap, Developed Markets (International), Small Cap stocks, bonds, etc. These boxes are sorted from the largest asset class return at the top to the worst performer at the bottom. Going all the way back to 2009 on the left to year-to-date performance on the right, you can start to get an idea how asset classes perform year to year and begin to see there’s no pattern to one outperforming another. This is one of our favorite charts to look at when we talk about diversification, which is often!

The 2/10 Briefly Un-Inverted

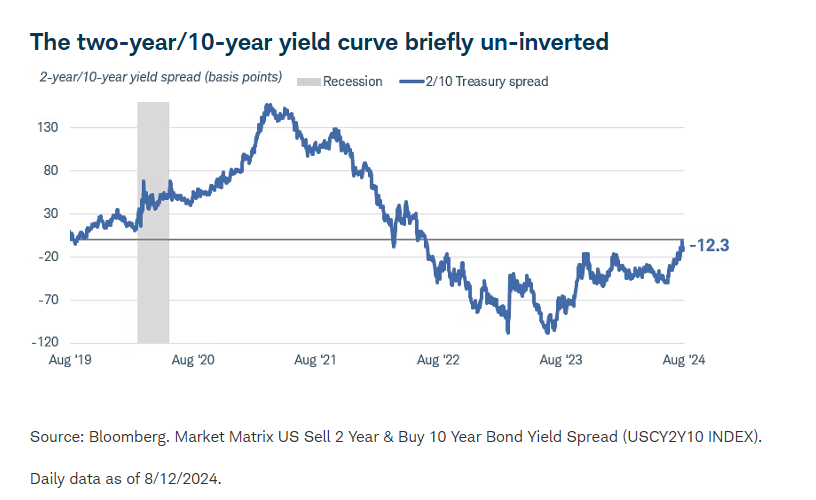

The last couple weeks have been busy in the stock and the bond market. The unemployment data print came in softer than expected and led to concern the Fed waiting too long to cut interest rates. Stocks prices fell precipitously leading to a correction in the Nasdaq and near correction in the S&P 500. At the same time, the 10-year US Treasury yield dropped anticipating rate cuts with more probability. THEN (there’s always more), the Bank of Japan surprised with a rate hike of its own, further sending equity markets into a tailspin as traders worked in a hurry to unwind their leverage. Many borrowed from the Bank of Japan at near 0% interest and invested in the US markets. The surprise increase to interest rates forced many to sell their leveraged positions which added to the red numbers in tech and the S&P. Further, because the yield curve has still been inverted with short-term rates paying more than long-term rates, the short end has more room to fall. And they have, leading to the brief un-inversion of the curve. Kathy Jones, Chief fixed Income Strategist at Charles Schwab writes, “Consequently, we continue to anticipate that the Treasury yield curve will “bull steepen,” with short-term rates falling more than long-term rates. In fact, the yield briefly un-inverted during the market turmoil—a trend we expect to continue.”

What Correction?

As mentioned, and possibly felt, stock volatility reared its head. The S&P fell -9.6% from the peak in only 14 days. But then, 15 days and +10% later, the S&P is sitting just below all-time highs. In short, it’s a good reminder of the importance of staying invested when stress and anxiety feel high.

Dog Days of Summer

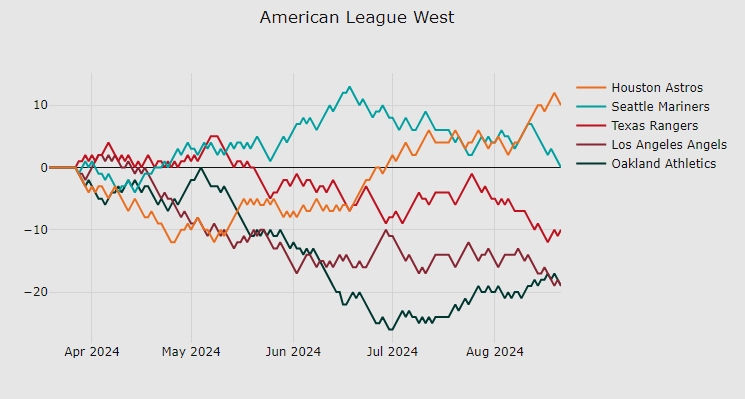

The MLB season is long, but it’s going to come down to the wire. The American League Central division race is heating up with the Guardians holding only a 2 game lead on the Twins and Royals. But one of the surprises of the season has been the Houston Astros. At the beginning of May they were in last place in their division and 6.5 games back from the Mariners. By mid June, they had climbed back to tied for second place but sat 10 games behind first place. Now? Now their comfortably in first place and on pace to win the division again. What a season so far!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.