Viewpoints: April 2021

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- U.S. Housing is a Sellers’ Market: To anyone looking for a home to purchase, this comes as no surprise. In a recent analysis by Freddie Mac, a mortgage-finance company, the U.S. is 3.8 million single-family homes short of what is needed to meet the country’s demand. Of those most hurt are first-time home buyers due to the lack of entry level homes. (Source: WSJ)

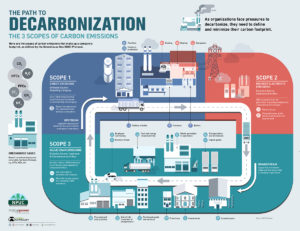

- BP has left Alaska: In 2019, BP finalized a deal to sell its Alaska oil complex to help meet their goal of zeroing out emissions by 2050. In March, BP announced it lowered their Scope 1 & 2 emissions by 16%. Great! But, the company who purchased the oil complex from BP is private and does not disclose carbon emissions. Plus, they have a history of risk-taking and oil spills. (Source: Bloomberg)

- The Fungible Collection: A digital artist known as Pak recently auctioned his Fungible Collection through Sotheby’s for a total of $17 million as the market for NFT’s continues booming. NFTs (Non-Fungible Tokens) amount to digital certificates of authenticity and allow images that exist only on screens to be traded and tracked. For many in the crypto world, Pak is regularly referred to as “our Picasso”. (Source: WSJ/The Block)

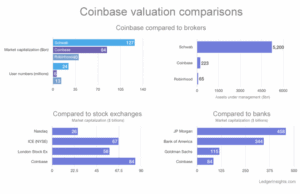

Crypto Exchange Coinbase Valued at $86 Billion

Coinbase Global [COIN] went public in a direct listing on the Nasdaq exchange yesterday. After receiving a reference price of $250, the stock opened at $381, peaked at $429.54 before finally closing at $328. Based on the closing price, the largest U.S. cryptocurrency exchange has a market capitalization of $86 billion. For reference, The Intercontinental Exchange (parent of the NYSE) is worth $67 billion while the Nasdaq Company is worth $26 billion.

The Coinbase online platform allows its users to buy, sell, and transfer digital currencies like Bitcoin, Ethereum, Litecoin, and more. Before going public, they announced an expected rise in year over year revenue of 847% to $1.8 billion. In the same time frame, the price of Bitcoin has increased around 550%.

Many expect COIN to be a high risk stock with frequent price movement.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.