It’s December and we find ourselves in the middle of one of the most tax inefficient times of every year – capital gain distribution season.

Investing in a diversified portfolio of stocks and bonds is paramount to the success of a financial plan. The not-so-secret weapon that is compound interest can only happen when dollars can generate any sort of return. But, choosing to invest in mutual funds within a taxable account (i.e., individual brokerage, joint, trust) can force investors to dig into their pockets come tax time without doing anything!

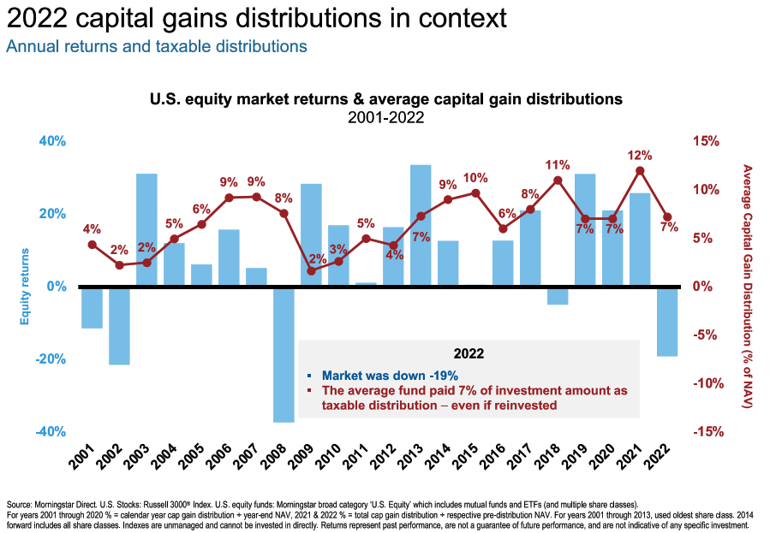

Not all mutual funds are the same – some are more tax efficient than others – but even despite fund managers’ best efforts, outflows can force their hand. Even during a down market, funds can be forced to realize gains.

Throughout the year, fund managers are buying stocks and bonds when money comes in, rebalancing their holdings when they deem necessary, or are forced to sell from positions to cover investors’ redemption requests.

ETFs and mutual funds are very similar, but a key difference is how they are bought and sold. ETFs are sold on the open market like an individual stock. Investor A can sell to Investor B. Mutual funds are redeemed with the fund itself. If Investor A wants to sell and Investor B wants to buy, they can’t just swap on the open market. A redeems his shares with the fund company – potentially forcing a liquidation even if cash is not readily available within the fund portfolio – and B buys directly from the fund company. Because of this difference, ETFs are usually able to bypass forced liquidation events and tend to be a more tax efficient investment choice.

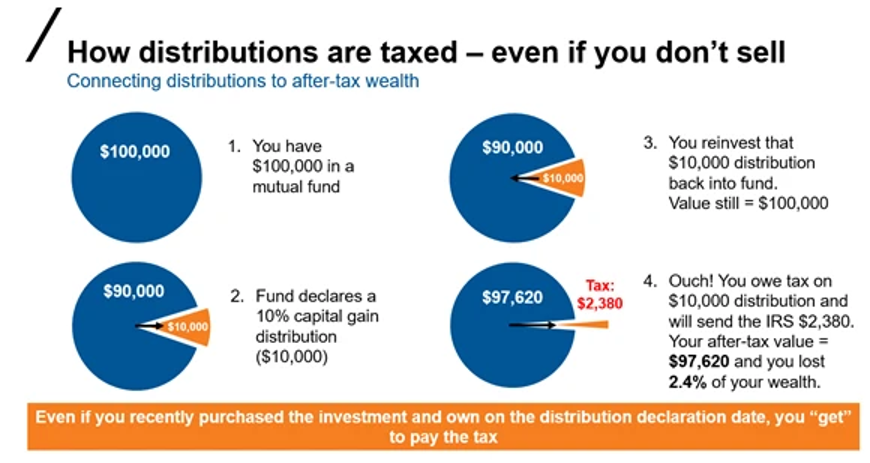

If the positions sold result in a realized gain, that gain is passed through to the investors as a capital gain distribution. Which, on the surface, sounds pretty great! The investors all share in the gains and growth, right?

Unfortunately, not quite. These capital gain distributions can be looked at like a dividend. If mutual fund ABCDX is worth $10.00 per share and issues a 10% cap gain distribution, investors will receive a distribution of $1.00 per share. At the same time as the distribution, the per share value of the fund will fall by an equal amount, because there’s no such thing as a free lunch.

Using the example above, if Investor Mary owns 1,000 shares of mutual fund ABCDX Mary will receive a payment of $1,000 ($1 x 1,000 shares). At the same time as the distribution to Mary, the share price will fall to $9.00, meaning her investment value has not changed.

- Before: 100 shares x $10.00 = $10,000

- After: 100 shares x $9.00 = $9,000 + $1,000 capital gain distribution = $10,000

Whether or not this distribution is paid as cash or reinvested into the investment, it doesn’t result in an extra $1,000. But it DOES result in a taxable event (within a taxable account). The $1,000 cap gain distribution is essentially realized gains passed through to the investor and the IRS isn’t going to let it slide. It gets added to the tax return on Schedule D, line 13. Below is a great visual representation of capital gains distributions and taxes from Russell Investments.

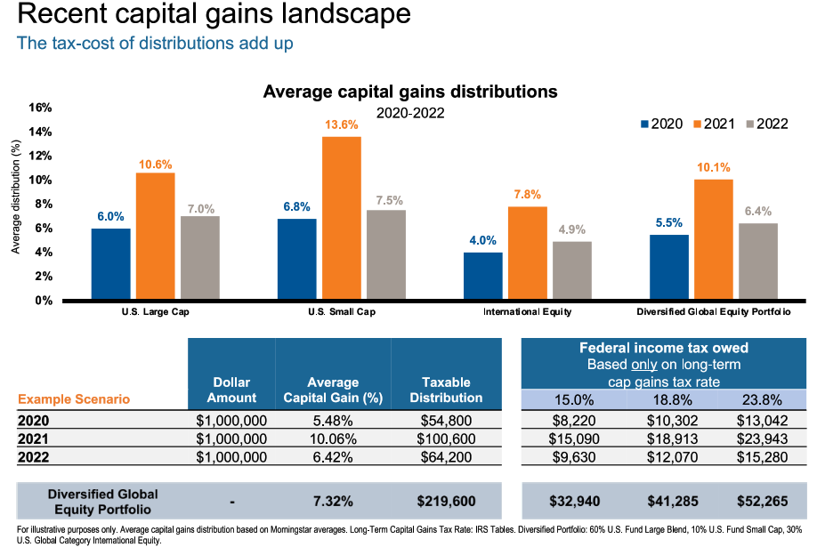

The examples above describe relatively mild situations and the one in the chart, though more significant, may be able to be offset by other losses throughout the year. But for those who have worked hard and had the good fortune to amass a significant amount of investable assets, the next image below may help to drive the tax inefficiency point home.

In this example, the investor has a $1,000,000 taxable account invested in an average selection of mutual funds. In 2020, those mutual funds distributed an average of 5.48% resulting in a $54,800 taxable distribution total. Assuming long-term and highest tax bracket for this high-income earning investor, that’s $13,042 coming out-of-pocket come tax time. Then we move on to 2021 and 2022 where those mutual funds continue to generate cap gain distributions.

After 3 years, assuming no portfolio growth, the portfolio of funds has generated capital gains distributions of $219,000 and taxes paid of $52,265. $52,265 gone from the portfolio, paid to the IRS, no longer able to benefit from compound growth. If we assume the portfolio grew, that number only gets bigger.

There are plenty of ways and opportunities to make a taxable account more tax efficient. In fact, many capital gain distributions can be avoided before they’re ever realized. Fund companies begin releasing their estimated distribution rates around Thanksgiving. It allows investors time to review the estimated against their current holdings. If the unrealized gain is less than the estimated capital gain, it’s an easy tax win to sell the holding before the payment date. Or, if there are tax loss harvest opportunities in the portfolio, the losses can be used to offset other gains and minimize the potential tax burden.

These capital gains distributions are something PDS monitors each year for all our clients to help reduce unnecessary tax consequences this year and to increase tax efficiency for the years to come. PDS believes Tax efficient investing is paramount to the success of a financial plan.

If you think you’re paying too much in taxes a result of your investments, don’t hesitate to reach out. We’d like to start a conversation.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.