Fall is a great time of the year as the kids go back to school, weather begins to cool, leaves start to change, football season begins and pumpkin spice lattes are added to menus. It’s also a reminder of the only constant: change.

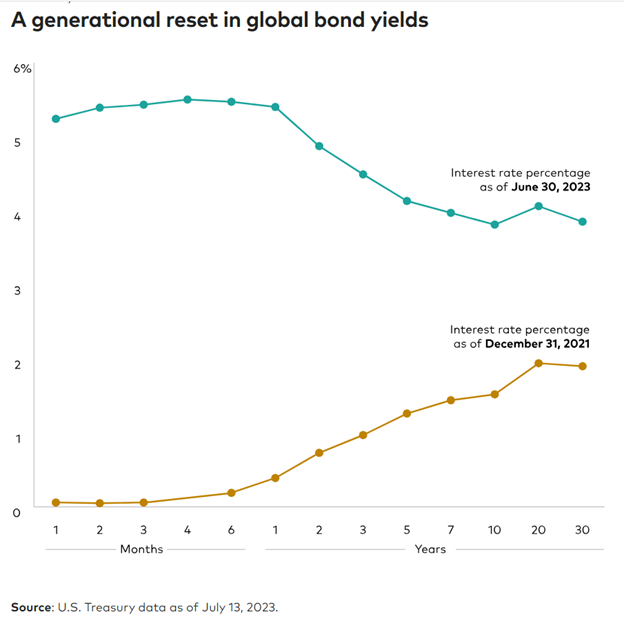

We’ve seen an incredible amount of change these past few years in markets and economies around the world. Inflation was benign and quickly rose to record highs. The Federal Reserve reacted by increasing interest rates at the fasted pace on record in attempt to cool inflation and the economy. This chart shows the massive change in the interest rate yield curve. Yields have significantly spiked, but especially those for short-term bonds. A 12 month US Treasury bond was paying under 0.5% interest just 18 months ago and is now paying almost 5.5%. However, with inflation subsiding, many are expecting the Federal Reserve to change their stance and pause any future rate hikes. If the economy slows, we may even see them cut rates in the next 12-18 months.

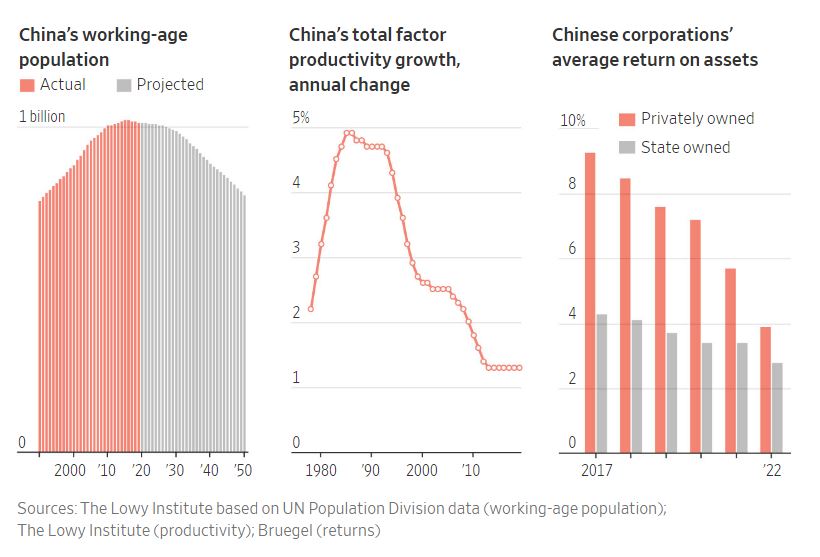

China has also experienced considerable change, albeit in a negative way. This was once the main growth engine in the world with 7-10% annual GDP growth, but has slowed to under 4%. Drew Potosky’s recent post showed how their population of working age individuals is expected to shrink, productivity has remained stagnant, and their corporations return on assets is steadily shrinking.

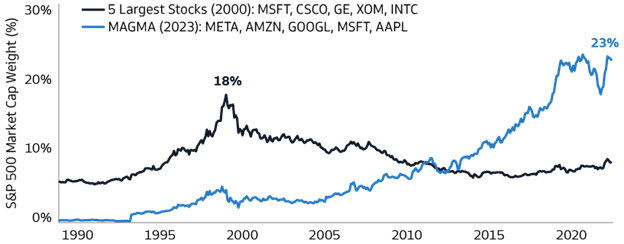

Change may be an understatement when it comes to stocks. Last year, value stocks outperformed their growth counterparts by almost 25%. The tides quickly turned back in favor of growth in 2023 where they’ve outperformed value by over 10%. In fact this year, the largest 5 stocks in the S&P 500 (MAGMA) Meta, Amazon, Google, Microsoft and Apple have returned 52% collectively while the remaining 495 index constituents have delivered just 10%. These 5 companies now account for almost one quarter of the index, while they were well under 3% of the index 20+ years ago.

And lastly, the Cleveland Browns started their season off with a nice change and a victory last week – the teams first home opener win since 2004! I’m sure we’ll be let down again just like past years, but here’s to a nice positive change coming out of Cleveland for once!

All kidding aside, markets and economies will continue to change day to day, week to week, and year to year. PDS Planning will continue to adapt to change along the way, while still taking a diversified approach and staying true to our key investment themes.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.