September 2021 Financial Markets Commentary

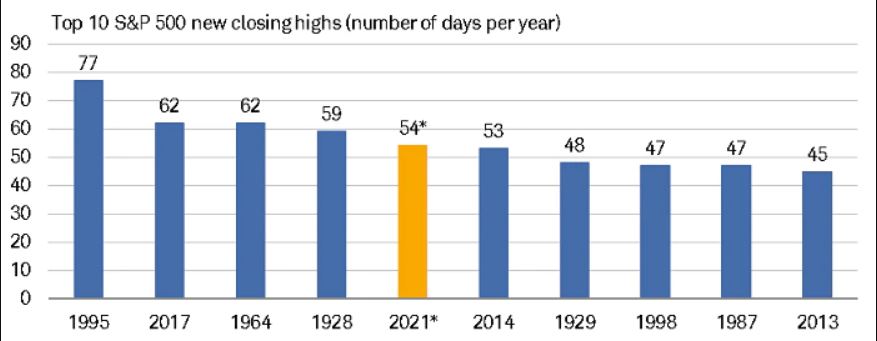

Despite all of the negative news and the present risks, markets have continued to climb higher. According to SPDR’s Head of Research Matthew Bartolini, we’ve seen “multiple hurricanes knocking large portions of the US off-line, increased tensions in the Middle East, softening economic data as measured by the continued decline in the CITI Global Economic Surprise Index, Federal Reserve taper talks, and the continued increase in COVID-19 cases leading to the approval of booster shots.” Most would expect to see volatility and potentially a pullback around these events. However, global equites, as measured by the MSCI All Country World Index, have now recorded seven straight months of gains, and have now gone 217 days without being in a 5% drawdown — the third-longest streak ever. The S&P 500 has also recorded 54 new closing highs so far this year, the fourth most in a calendar year.

Why have markets been performing so well around the world? Company earnings have continued climbing, consumers have picked up spending with fewer COVID restrictions, governments have stepped in with significant stimulus packages and Central Banks around the world have continued to keep interest rates near record lows, just to name a few.

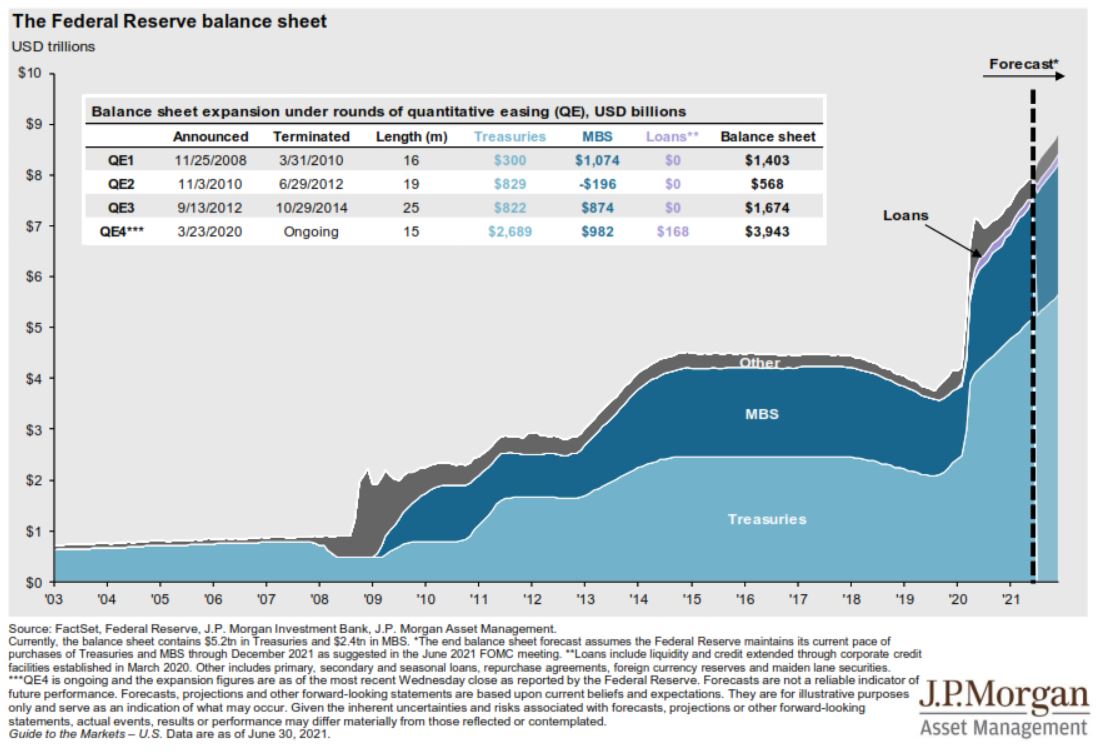

The Federal Reserve has been purchasing $80 billion in Treasury bonds and $40 billion in mortgage backed securities per month in an attempt to provide more liquidity into the system. This caused the Fed’s balance sheet to balloon to unprecedented levels over $8 trillion. Yes, that’s trillion with a T! For obvious reasons, it’s not sustainable to continue at this pace.

Given the economy has been performing so well, the Federal Reserve has announced a plan to start “tapering” their monthly bond purchases. You will likely hear more about this tapering concept from the media, but it is the beginning of a shift towards a less accommodative policy. Their plan is to start reducing these monthly purchases in December with the goal of ending the purchase program by mid-2022. This will allow the Fed to consider raising interest rates to help fight inflation late next year.

Clearly markets have powered through this tapering announcement, but we would expect to see some volatility creep back into markets towards more normal levels.

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

7.6% |

29.2% |

15.8% |

14.0% |

| S&P 400 Index – Mid-Size Companies |

0.9% |

42.9% |

12.0% |

12.1% |

| Russell 2000 Index – Small Companies |

0.2% |

45.6% |

12.9% |

12.1% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

4.2% |

30.2% |

14.1% |

11.3% |

| MSCI EAFE Index – Developed Intl. |

1.4% |

26.1% |

9.7% |

7.3% |

| MSCI EM Index – Emerging Markets |

-4.1% |

21.1% |

10.4% |

4.8% |

| Short-Term Corporate Bonds |

0.3% |

1.8% |

2.5% |

2.0% |

| Multi-Sector Bonds |

1.6% |

-0.1% |

3.1% |

3.2% |

| International Government Bonds |

-0.7% |

-1.9% |

0.4% |

-0.4% |

| Bloomberg Commodity Index |

3.4% |

31.0% |

4.2% |

-4.6% |

| Dow Jones U.S. Real Estate |

9.4% |

35.4% |

9.6% |

11.0% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.