September 2019 Financial Markets Summary

Just as kids starting going back to school in Central Ohio, we noticed a slight increase in stock market volatility. The S&P 500 experienced at least a 1% move higher or lower during 11 out of the 22 trading days in August, with the three most severe at -2.6%, -2.9% and -3.0%. Stock markets are always moving, but recently interest rates and trade tensions seem to be impacting investors in a more pronounced way.

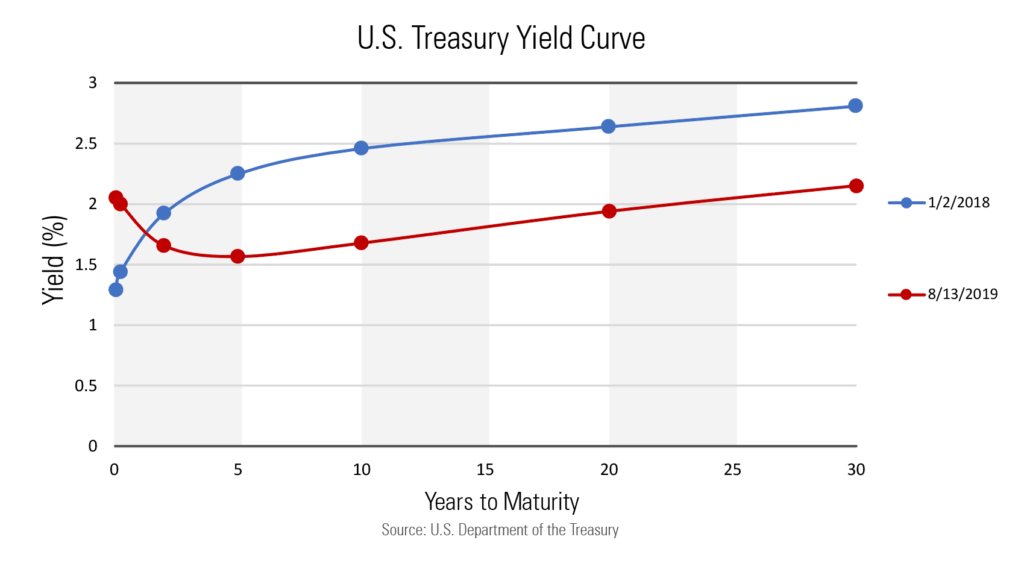

On August 13th, the yield curve inverted and spooked investors. What does this mean? In a normal yield curve, long-term yields are higher than short-term yields. For example, you would typically expect a ten-year CD to pay you more interest than a two-year CD. The inversion occurs when the interest rates on short-term bonds are higher than the interest rates on long-term bonds. The bond market is currently upside down where two-year Treasuries are actually paying more interest than ten-year Treasuries.

So the yield curve inverted, what is the concern? A flatter or inverted yield curve can hurt bank profits and their willingness to lend. Investors are also worried since the yield curve has inverted prior to every recession since 1955. However, this doesn’t mean that investors should run to the exits. Historically, markets have continued to grow for 10-24 additional months after the initial inversion to the start of the recession. The inverted yield curve is just a signal, not a cause for a recession. The U.S. consumer continues to drive the economy forward with increased spending and record low unemployment.

The trade tensions have also impacted markets as China devalued their currency and the U.S. added tariffs on another $112 billion of Chinese imports on September 1st. Talks are expected to continue in September, but both sides appear to be digging their heels into the sand.

The yield curve and trade tensions will continue to weigh on investors’ minds causing uncertainty and volatility. Just like you may have completed the back to school supplies checklist with a backpack, notebooks, pencils and a calculator to name a few, it’s also important to check your portfolio to make sure you maintain domestic stocks, international stocks and bonds for this next investment year.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

| 3 Months | 2019 YTD | Average | Average | |

| S&P 500 Index – Large Companies | 6.3% | 16.7% | 7.9% | 11.1% |

| S&P 400 Index – Mid-Size Companies | 3.9% | 13.1% | 5.5% | 11.1% |

| Russell 2000 Index – Small Companies | 2.0% | 10.8% | 4.9% | 10.1% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) | 4.0% | 13.4% | 5.4% | 8.7% |

| MSCI EAFE Index – Developed Intl. | 1.9% | 9.7% | 1.9% | 5.0% |

| MSCI EM Index – Emerging Markets | -0.2% | 3.9% | 0.4% | 4.1% |

| Short-Term Corporate Bonds | 1.3% | 4.0% | 1.7% | 2.3% |

| Multi-Sector Bonds | 4.1% | 9.1% | 3.3% | 3.9% |

| International Government Bonds | 4.7% | 7.1% | 0.9% | 1.7% |

| Bloomberg Commodity Index | -0.4% | 1.9% | -8.6% | -4.3% |

| Dow Jones U.S. Real Estate | 7.3% | 25.6% | 9.0% | 13.3% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.