What is Inflation and What are Common Responses?

The news cycle can spit out new and exciting headlines faster than they can be printed resulting in some information being overlooked or missed. Financial news is no different. Even still, it comes as no surprise to many that inflation has withstood the churning and remained headline news for the past number of months. With so much local and national coverage with their attention-grabbing quick hitters, we wanted to provide a summary to help think through inflation – this time.

What is Inflation?

The cost of goods and services increases while the value of one dollar remains one dollar. In essence, the purchasing power of money decreases, meaning your money will buy less today than it could yesterday. Like death and taxes, the impact of inflation is felt by nearly everyone. Prices go up. We’ve heard our parents and grandparents talk about buying milk for $1.00 in 1950 while today it costs $3.50, on average. The issue we are dealing with today is not that we have inflation, but how quickly inflation has increased.

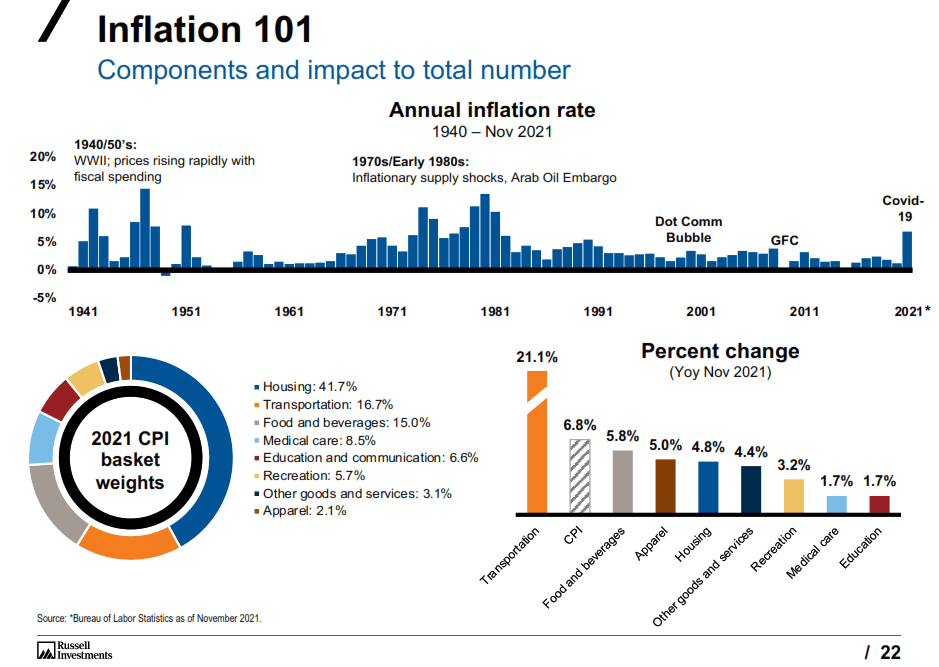

The Consumer Price Index [CPI] is what the Federal Reserve uses to measure inflation. It’s the weighted average of a basket of consumer goods, like food, shelter, and electricity. In 2021, the year-over-year change in the CPI was a 7% increase, the largest yearly change since 1981. If you spent $150 on groceries at the beginning of 2021, the same items would likely cost about $160.50 today.

What is Happening This Time?

A common phrase to explain why excessive inflation is happening is, “too many dollars chasing too few goods”. It’s a very simple, one-sided view explaining demand is greater than supply. Inflation is the result of prices increasing to meet the shifting equilibrium. From PIMCO, “as spending outpaces the production of goods and services, the supply of dollars in an economy exceeds the amount needed for financial transactions. The result is that the purchasing power of a dollar declines.” Many factors leading to these levels of supply and demand have come from – our favorite phrase – unprecedented times.

Businesses had to react quickly to the pandemic. When the economy was shut down, businesses had to shut down factories, lay off workers, and get rid of excess inventory. The economy then quickly reopened and businesses had to restart with turning the factories back on and hiring back their employees. But it was further complicated by extended unemployment benefits incentivizing workers to stay at home. As supply slowly started to come back, demand surged due to the government stimulus and consumers increased savings.

In the case of today, an additional factor is the Federal Reserve. As an answer to the economy closing due to the pandemic, and all the concerns throughout 2020, the Fed voted to increase its balance sheet and bring interest rates to zero. They bought up government and corporate bonds to flood the system with more and more money. They’ve since begun to slow the buying down, (quantitative easing) but the money supply is still booming, exacerbating the idea we started with, “too many dollars chasing too few goods.”

Common Reactions to Higher Inflation

One of the most talked-about reactions is from the Federal Reserve increasing interest rates. The interest rates refer to the amount of interest people and businesses are required to pay back on borrowed dollars. If the borrowing rate increases, more entities may choose to save money instead of spending or borrowing. This results in less money in circulation and more money stashed in savings, slowly reducing the supply of money and allowing the supply/demand equilibrium to start shifting back towards the target. For example, a business borrowing money may:

- Borrow less than planned on account of interest rates being higher than planned. With less money, their earnings may be lower than forecast and growth may slow.

- Borrow the same amount and pay more in interest than originally planned. This excess cost can cut into profits and again lead to lower than forecast earnings and potentially slower growth.

Businesses will react in their own way to high or increasing levels of inflation. The raw materials used become more expensive increasing company costs forcing consumer prices higher to compensate. When inflation increases suddenly, it can take a few months, even quarters, for companies to transfer the higher expenses through to consumers. This can result in corporate profits shrinking leading to a pause on hiring, or even firing.

How Inflation Can Impact a Portfolio

Unexpected or suddenly high inflation can be the bane for returns and equity valuations. It’s easy to look back and see our current inflationary environment wouldn’t be short-term, but hindsight is 20/20. For a while, the Fed and experts alike stood firm that higher prices would be transitory. That is, not permanent or short-term. As we can see now, it has remained more elevated for longer than predicted. It has led to depressed real returns, lower earnings forecasts, and volatility to take center stage.

Loss of Long-Term Purchasing Power

There are several ways inflation and the reactions to it can impact a portfolio. One is the loss of long-term purchasing power. A 2% total return in an environment with 3% inflation results in a -1% real return. This is particularly harmful to fixed income securities since the stated coupon is essentially the return. It’s slightly different when looking at bond funds since older bonds come due and new bonds are purchased, taking advantage of potentially higher interest rates and bond coupons.

Difficulty Forecasting Future Earnings

When it comes to stocks, it becomes difficult for companies to forecast future earnings when inflation is suddenly much higher than anticipated. Stocks are priced primarily based on the future earnings potential of a company. When they encounter unexpectedly high costs with an unknown time frame and lower purchasing power, future earnings forecasts come in much lower than initially stated leading to lower equity prices. Shares are perceived to be worth less when dollars can’t buy as much as they used to. It becomes very difficult for investors to get a clear picture of the true value of a company and may lead to prices see-sawing.

Growth Stocks Versus Value Stocks

Taking a deeper dive into stocks, we can review growth versus value. Even before the pandemic began, growth vs. value was a hot-button topic. As they relate to inflation and the reactions to it, growth tends to be more negatively impacted than value stocks. Growth stocks don’t generally have a consistent income stream, or if they do, their costs outweigh their revenue leading to negative net income. In a low-rate environment, growth companies can borrow money to fund their expenses and continue growing at breakneck speeds.

When monetary policy tightens and borrowing becomes more expensive all while the value of a dollar is decreasing with inflation, these growth stocks must adjust forecasts to account for higher expenses and slower growth. Value stocks, on the other hand, are not dependent on borrowing to facilitate their business. These companies largely have consistent cash flow and positive net income resulting in a more stable stock price and more reliable forecasting.

Stocks historically have provided a good hedge against inflation. Even though volatility may increase, the revenue and profits should rise at the same rate. With high inflation and the likelihood of interest rates increasing through the year, US stocks may produce returns lower than we’ve seen the last few years.

How PDS Can Help

At PDS Planning, we stress the importance of a diversified portfolio of US and International stocks and bonds coupled with strategically rebalancing when one area becomes out of balance from the target. Over shorter periods of time, asset class returns can vary widely; however, long-term investors are typically rewarded for thoughtful portfolio diversification.

Since 1985, PDS has worked with clients to eliminate the stress often associated with planning their financial future. With over 35 years of experience helping clients plan their investments, we’re experts at optimizing retirement and investment plans to each individual’s highly specific needs. We’ll work to understand your vision for the short and long term. And we will provide objective guidance on the proper path to help reach your goals. By charging our clients a flat, fixed dollar fee, we avoid the inherent conflicts of asset-based pricing models, which is the industry norm. It has been our experience that the compound effect of this savings over time can be substantial.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.