October 2021 Financial Markets Commentary

Now that the first three quarters of 2021 are in the books, the holiday season will be here before you know it! If you are a last minute shopper, you may want to start the process earlier this year. Experts are warning of significant shipping delays.

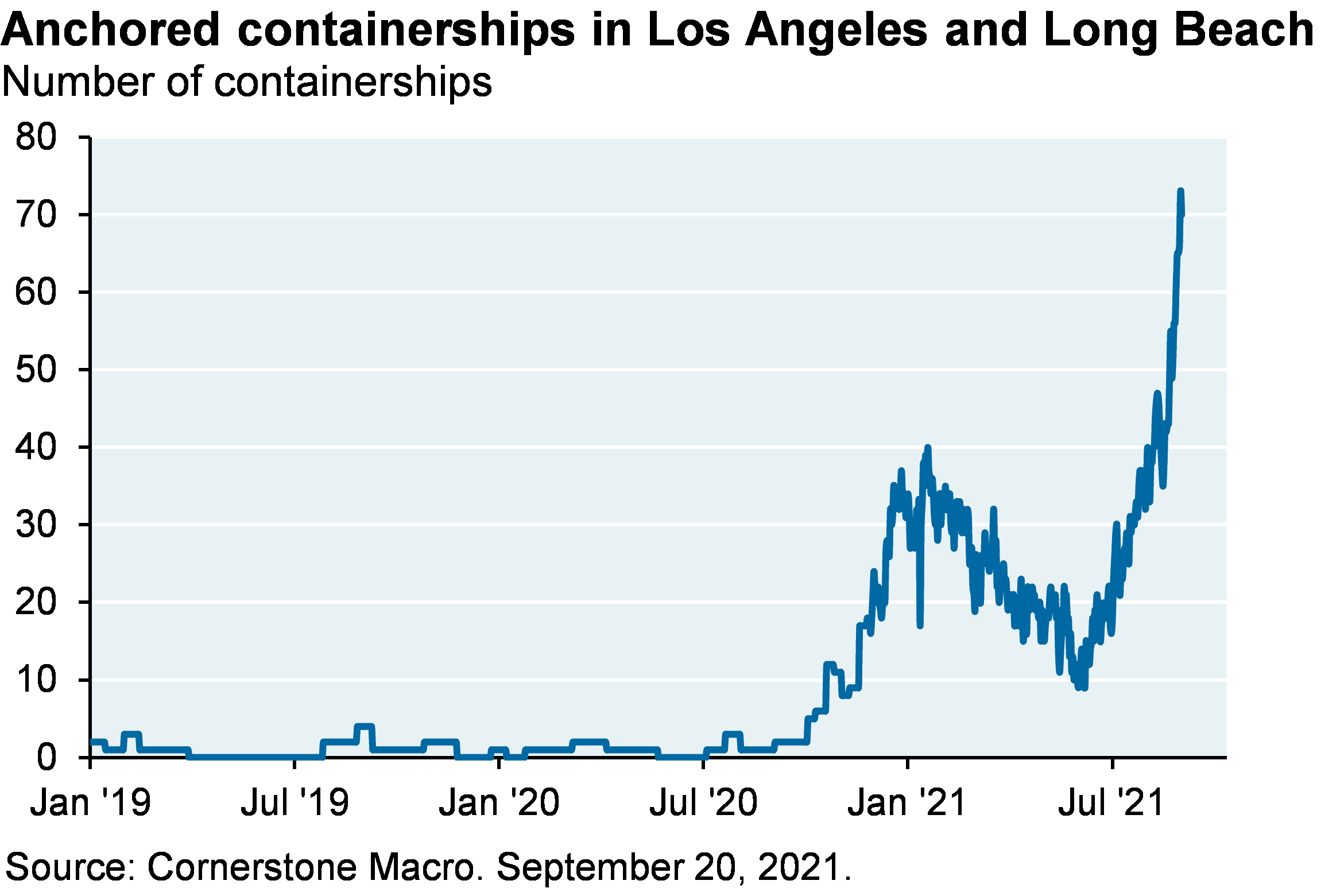

COVID exposed the downside of the just-in-time inventory management across the globe. Now that economies are opening back up and consumers are spending, the shipping industry has not been able to keep up. We just returned from a family vacation and I couldn’t believe the number of containerships sitting outside the Savannah port waiting to be unloaded. One shipping president recently said, “the American supply chain has so far failed to adapt to the crush of imports as businesses rush to restock pandemic-depleted inventories. Tens of thousands of containers are stuck at the ports of Los Angeles and Long Beach. More than 60 ships are lined up to dock, with waiting times stretching to three weeks.” Nike executives also said “the amount of time it takes to move a cargo container from Asian factories to North America is now about 80 days, or twice as long as it was before the pandemic.”

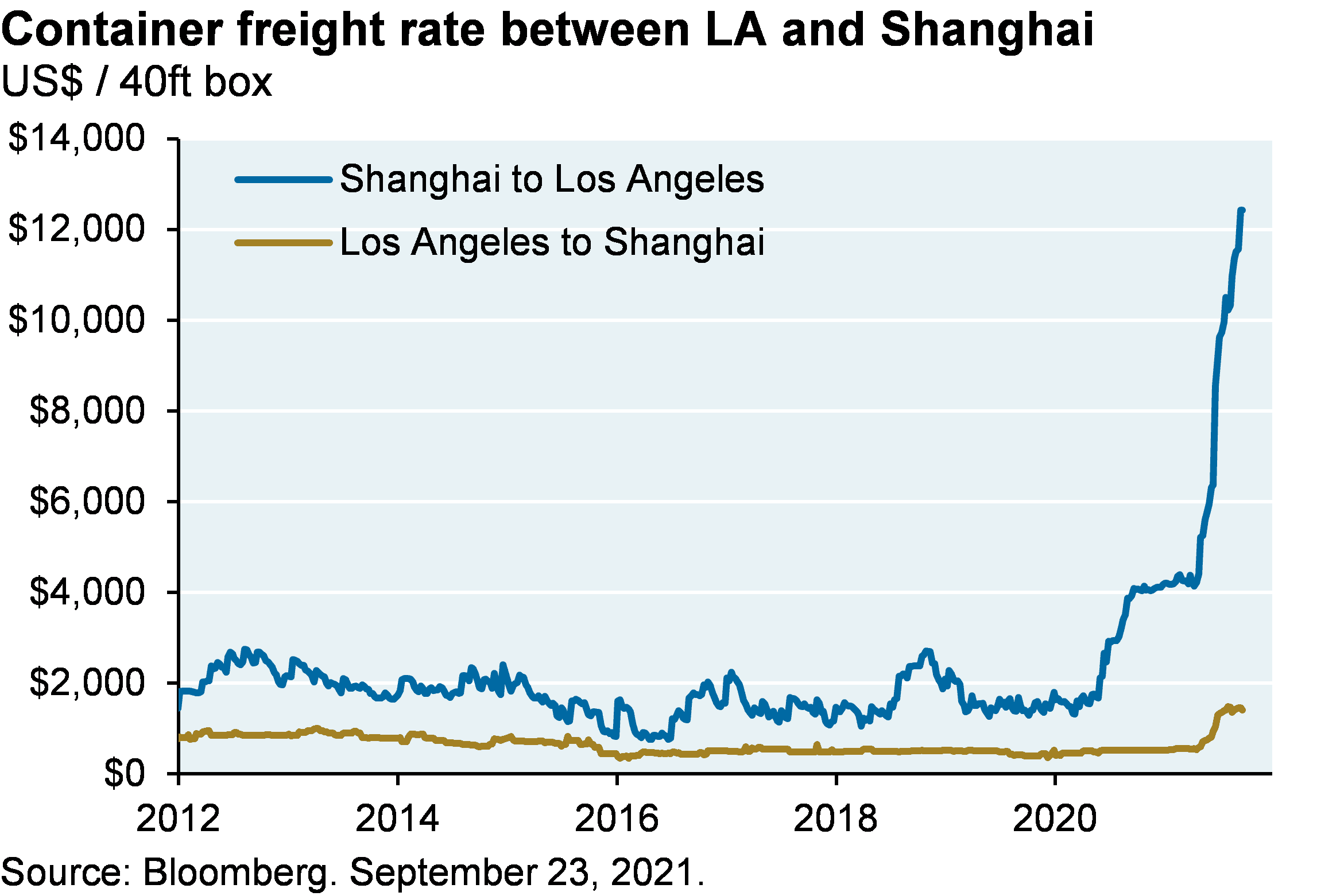

Given that the demand for US imports is so high, many of these ships are shockingly returning to Asia empty. They typically wait to be reloaded with goods to export out of the US, but the shipping rates from Asia to the US far outpace those paid to ship from the US back Asia. This creates a significant backlog of goods waiting to leave the US.

Finally, once the goods are offloaded from the ship, the next bottleneck is created by the trucking industry. The U.S. has faced a truck driver shortage for several years, but the pandemic pushed this over the edge as many took an early retirement to exit the industry. Companies are scrambling to find drivers, but the American Trucking Association still estimates a shortage of around 100,000 drivers.

This global shipping issue will not be resolved overnight and will continue to push higher prices and delays on to consumers. The Federal Reserve will attempt to keep inflation near their 2% target, but it will inevitable creep higher over the next few years. Even though it’s only October, you may want to start thinking about your holiday shopping. For those that don’t, you may have to resort to the classic gift cards!

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

0.2% |

28.1% |

14.7% |

14.1% |

| S&P 400 Index – Mid-Size Companies |

-2.1% |

41.9% |

11.2% |

12.6% |

| Russell 2000 Index – Small Companies |

-4.6% |

46.2% |

12.0% |

12.6% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

-1.1% |

29.1% |

13.1% |

11.8% |

| MSCI EAFE Index – Developed Intl. |

-0.5% |

25.7% |

8.8% |

7.3% |

| MSCI EM Index – Emerging Markets |

-8.1% |

18.2% |

9.2% |

4.8% |

| Short-Term Corporate Bonds |

0.1% |

1.6% |

2.4% |

2.0% |

| Multi-Sector Bonds |

0.1% |

-0.9% |

2.9% |

3.0% |

| International Government Bonds |

-1.7% |

-4.5% |

-0.4% |

-0.6% |

| Bloomberg Commodity Index |

6.6% |

42.3% |

4.5% |

-2.7% |

| Dow Jones U.S. Real Estate |

0.9% |

30.7% |

8.6% |

11.7% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.