October 2018 Financial Markets Summary

Falling leaves, pumpkins, mums, harvest, pumpkin spice lattes, apple cider, postseason baseball (not for the Reds), and Big Ten football play are all signs of fall. As the seasons change and the third quarter closes, we pause to review.

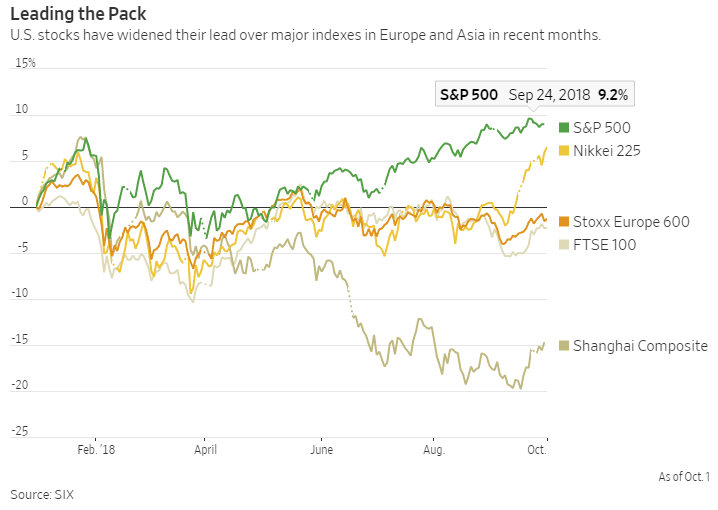

Domestic stocks rallied with the strongest quarterly return in almost five years with a +7.2% gain. Technology, healthcare and consumer discretionary sectors led the way. However, most of the other asset classes continued to struggle with commodities and emerging markets in negative territory for the quarter. Developed market international stocks (Europe, Japan, Australia, Canada, etc.) are still down -1.5% for the year, while emerging markets (China, India, Brazil, Russia, etc.) are down almost -8%.

The Federal Reserve continued their plan to gradually raise interest rates with another +0.25% increase in late September. They expect another increase by year-end and potentially three more hikes in 2019. This is certainly a sign of a strong economy with record low unemployment levels and solid growth. These rising rates are, and will likely continue to be, a headwind to long-term bonds. This is the main reason why we advocate short and intermediate-term bonds in this rising rate environment.

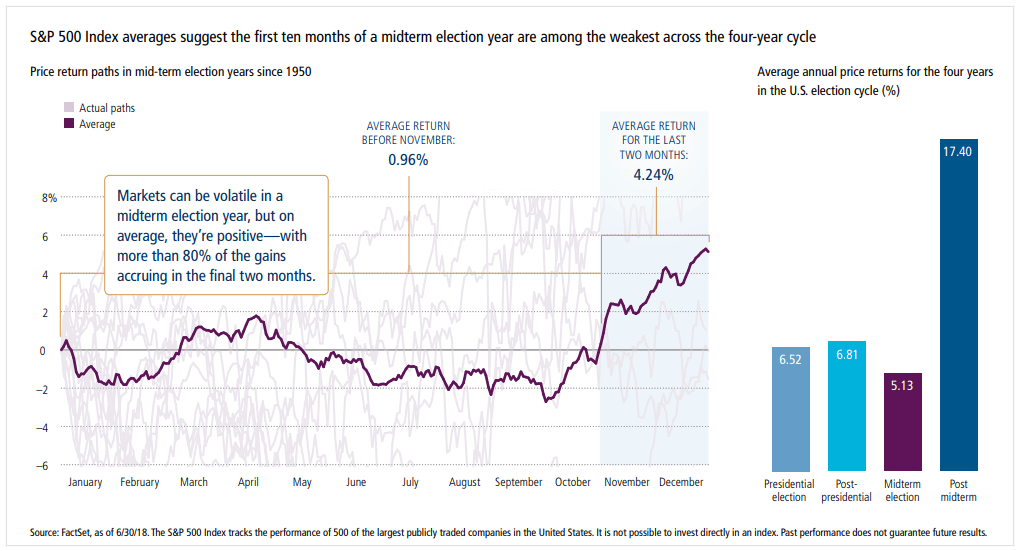

Unless you completely avoid the news, I’m sure you are well aware of the highly contested upcoming mid-term elections. Only time will tell if the Republicans maintain control of the House and the Senate. However, markets usually do not like this uncertainty. In the post-World War II era, domestic markets have averaged a +5.1% return in midterm election years with more than 80% of the gains taking place in the final two months. This year might be an exception with the +7.2% gain already, but we expect volatility to tick up over the next few months as uncertainty creeps into the markets.

Fall is a great time to remember the Greek philosopher Heraclitus’ quote “The only thing that is constant is change.” Domestic stocks have outperformed for almost ten years and the Fed has been raising rates since 2015, but any of this can change in no time at all. Diversification is the best defense for this inevitable change.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

| 3 Months | 2018 YTD | Average | Average | |

| S&P 500 Index – Large Companies | 7.2% | 9.0% | 11.6% | 9.6% |

| S&P 400 Index – Mid-Size Companies | 3.5% | 6.3% | 10.1% | 10.7% |

| Russell 2000 Index – Small Companies | 3.3% | 10.5% | 9.6% | 9.6% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) | 3.7% | 2.1% | 6.5% | 5.9% |

| MSCI EAFE Index – Developed Intl. | 1.4% | -1.4% | 4.4% | 5.4% |

| MSCI EM Index – Emerging Markets | -1.1% | -7.7% | 3.6% | 5.4% |

| Short-Term Corporate Bonds | 0.5% | 0.4% | 1.2% | 2.5% |

| Multi-Sector Bonds | 0.0% | -1.6% | 2.2% | 3.8% |

| International Government Bonds | -2.5% | -2.8% | -0.1% | 2.0% |

| Bloomberg Commodity Index | -2.0% | -2.0% | -7.2% | -6.2% |

| Dow Jones U.S. Real Estate | 0.6% | 2.1% | 9.4% | 7.4% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.