The House of Representatives returned the evening of November 12th and voted on the amended bill to end the longest government shutdown in US history after 43 days. From the market’s point of view, this is positive news. Economists are going to start getting their data back, workers will get paid, and people can more comfortably start spending again. News of the possible end of the shutdown was released Monday, and markets reacted by rising between 1%-2%. A lot has been in limbo during the course of the shutdown, but what hasn’t stopped generating news has been artificial intelligence. In fact, without labor statistic and inflation data to analyze, AI stuff roared to the forefront of what was deemed newsworthy.

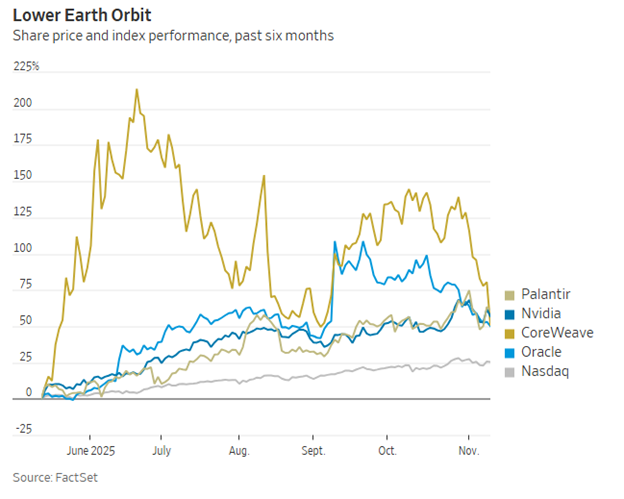

AI-related stocks have had a roaring 2025 such as Nvidia, Palantir, and Oracle generating returns of 43%, 141%, and 36%, respectively. But questions have started to rise about valuations, spending, even potential bubbles. Right now, AI stocks are getting hammered despite posting strong earnings. Meta is down 17% after solid results, Nvidia has slipped from its $5 trillion peak, and companies like OpenAI are projecting massive losses—$74 billion by 2028—even as they plan to spend $1.4 trillion over the next eight years, according to the Wall Street Journal article, “The AI Boom Is Looking More and More Fragile”.

The concern is warranted: there’s much more money going into AI infrastructure than coming out in revenue, and that gap keeps widening. Even so, the fundamentals haven’t changed. Tech companies are still planning to spend over $400 billion this year, and chip makers are projecting continued revenue growth. The reality is that transformative technology doesn’t pay off in 12 months. AI will likely reshape how we work and live but getting there means years of heavy investment before the revenue catches up. While this volatility may feel different (this time it’s different), it’s likely a familiar story we’ve seen before. Short-term pain for long-term innovation. The key, as always, is staying diversified, staying invested, and keeping perspective.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.