Votes are still being counted but the race is all but over. Donald Trump has been elected to be the next President. Markets were setting up for a big rally regardless of who won after a wave of de-risking took place in early fall. Once the election was called and the looming uncertainty became a certainty, the S&P gained 2.5% Wednesday while small cap rocketed up 5.8%. Small caps seemed to benefit more due to the easier fiscal policy expected and a continued decline in interest rates. So what about the rest of the market? What does the ushering in of a new administration mean for the markets?

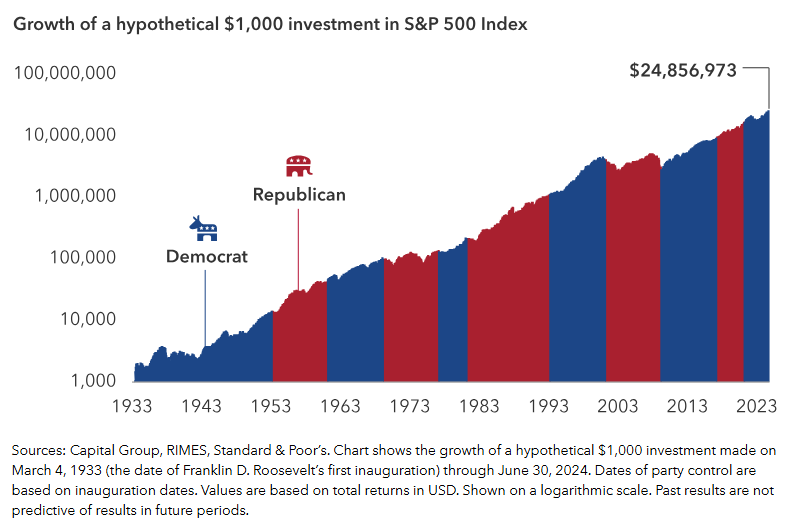

If history can tell us anything, the answer would be ‘not much’. Some policies will certainly change, and taxes could be adjusted, but over the long-term the President and their party affiliation tend to have little impact on the market as a whole. The main market drivers we are talking about today are the same ones we were talking about yesterday and will be the same ones we will talk about tomorrow.

- Interest Rates and inflation

- Jobs and unemployment

- The probability of a soft landing and/or recession

On Thursday, November 7, the Fed met and agreed to cut interest rates by another quarter (0.25%) point. The cut is an answer to the continually decline in inflation along with moderate to strong jobs and unemployment data. There’s already a 75% chance of another quarter point rate cut during the next Fed meeting on December 18th. Next year, though, is anyone’s guess. Experts from JPMorgan and BlackRock believe the campaign promises of tariffs and a stricter immigration policy could cause inflation to tick up.

In 2017, Jamie Menges wrote a series of posts on Investing in a Trump World – Rule #1, Rule #2, Rule #3. “Our objective is to make complex financial topics more approachable for our clients. No doubt the presidential election… made things seem more complex.” A lot of people are feeling a lot of emotions right now. From an investment perspective, “if you’re optimistic, I believe you need to stick to a tried-and-true investment strategy, and likely reign in your euphoria. If you’re on the edge of the cliff, I would also remind you that this market was not born and raised on Donald Trump’s watch, nor will it die on his watch.”

“A truth that you can hold onto – your portfolio will outlast any president, or congressional term. Portfolios are measured in decades. Politicians are measured in years.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.