Just two months ago, we wrote about the changing seasons and everchanging market dynamics. If we look back to September 1st, one could believe very little changed as the S&P 500 is priced almost exactly the same today. However, we’ve experienced significant change over the past two months. Large cap stocks, represented by the S&P 500, reached correction territory with a 10% pullback and small cap stocks dropped by 15%. This market turmoil coincided with a 20% spike in the 10 Year US Treasury yield from 4.1% to just over 5.0%. Quite an eventful two months to say the least!

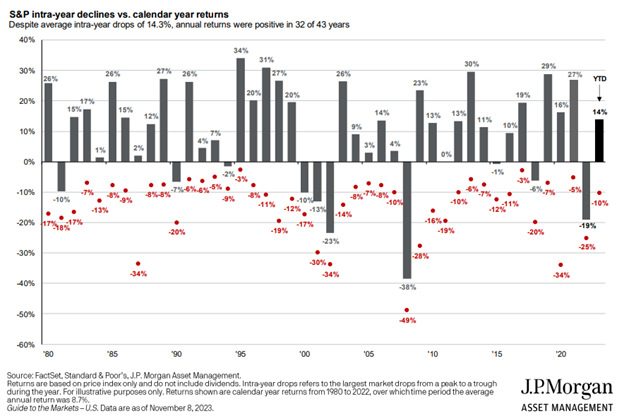

Many investors question if they should bail on markets during times of stress like this. However, corrections are normal market occurrences. In fact, the S&P 500 has averaged an intra-year correction of -14.3% over the past 43 years, represented by the red dots on the chart below. Despite these corrections, markets have generated positive returns in 32 of the past 43 years.

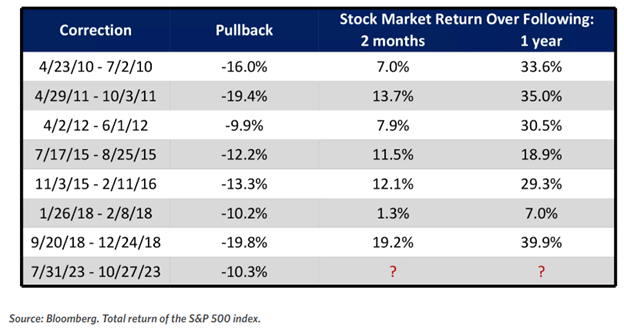

Fast forward from the October 27th low, and the S&P jumped by over 6% in just five days to its current 14% year-to-date. In fact, the last eight corrections were followed by market bounces 2 and 12 months later as shown below.

The lesson is to keep calm and stay invested during these times of stress to participate in the market bounce that follows.

One may also question what caused this correction and corresponding bounce? Clearly geopolitical risks spiked with Hamas’s attack on Israel. Our hearts go out to all impacted by this despicable act. Further escalation of this situation could cause more market volatility, but the main driver of the recent market movement is interest rates and the Federal Reserve. The Fed has continued to raise rates over the past 18 months in attempt to cool inflation and the economy. This caused 10 Year US Treasury bonds jump to just over 5% annual yield. This spooked many investors as these high rates typically cause a drag on the economy.

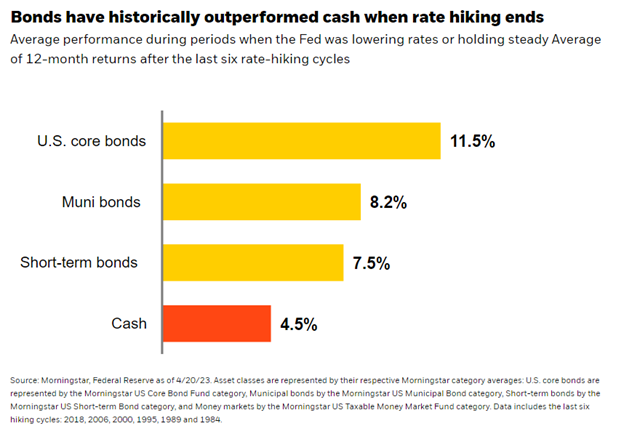

Many were worried of further rate hikes and the impact on the economy, but these concerns were eased when Fed Chairman Jerome Powell suggested a pause in rate hikes last week. This helped create the primary fuel for the quick stock and bond market recoveries. History would suggest better times ahead for the bond markets as they typically perform quite well at the tail-end the Fed’s cycle.

As I said two months ago, markets and economies will continue to change day to day, week to week, and year to year. PDS Planning will continue to adapt to change along the way, while still taking a diversified approach and staying true to our key investment themes.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.