March and April were rollercoasters for the stock market and potential reasons why can be found on either side of the aisle. Positive or negative. Tariffs, of course, have played a big role in market volatility. Though we’re in a period of waiting (90-day pauses), there’s little doubt we’re out of the woods from a tariff and volatility standpoint. Instead of trying to explain the markets using any handful of points from the left, right, or center, we’ll instead review investor sentiment for a “narrative-agnostic view of things” with the help of Schwab’s Chief Investment Strategist, Liz Ann Sonders.

Investor sentiment is typically viewed as a contrarian indicator. The market movement was sharply lower in early April pushed the S&P 500 near bear market territory and “was enough to send many investor sentiment metrics we track into “extreme pessimism” territory. As is typically the case when that happens, it created fertile ground for a positive catalyst to help jolt stocks into the opposite direction. We’d argue that the 90-day “reciprocal” tariff pause, followed by the initiation of trade talks with some of our major partners, acted as that catalyst.”

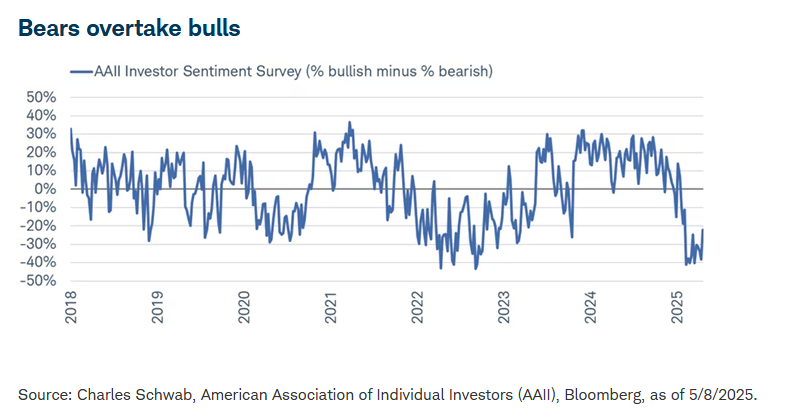

“Arguably, the most popular attitudinal metric is the weekly Investor Sentiment Survey put out by the American Association of Individual Investors (AAII), which asks investors whether they are bullish, bearish, or neutral on the market looking out over the next six months. Looking at the spread between the share of bulls and bears, which you can see in the chart below, it collapsed swiftly in April (meaning bears outnumbered bulls) to a level consistent with the lows seen toward the end of the bear market in 2022.”

As the catalysts for positive market shocks Liz Ann mentioned materialized and began to compound, the S&P 500 shot up 19% and came back to being 0% year-to-date.

A final word from Liz Ann Sonders which we firmly echo. “Animal spirits and recent price action are still in bulls’ favor for now, so we wouldn’t be surprised to see a continued grind higher for stocks from here. Yet, given the unique nature of the current volatility backdrop, we also wouldn’t be surprised to see stocks struggle at the first hints of deteriorating hard data. Up until this point, the market has priced in a panic and subsequent reversal of the worst-case tariff outcome; but the next phase is digesting a backdrop of tariff rates that are both well into double digits and a constant moving target. We expect significant index-level volatility to persist.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.