The last few years have been a great reminder that predictions based on macroeconomic events can be very unreliable guides to the future.

If someone with perfect foresight in January 2020 told you the following would happen over the next 3+ years, how would you react?

- Global economic shutdown

- Worst pandemic in 100 years

- Highest inflation in 40 years

- Two 20% equity drawdowns

- Geopolitical conflicts

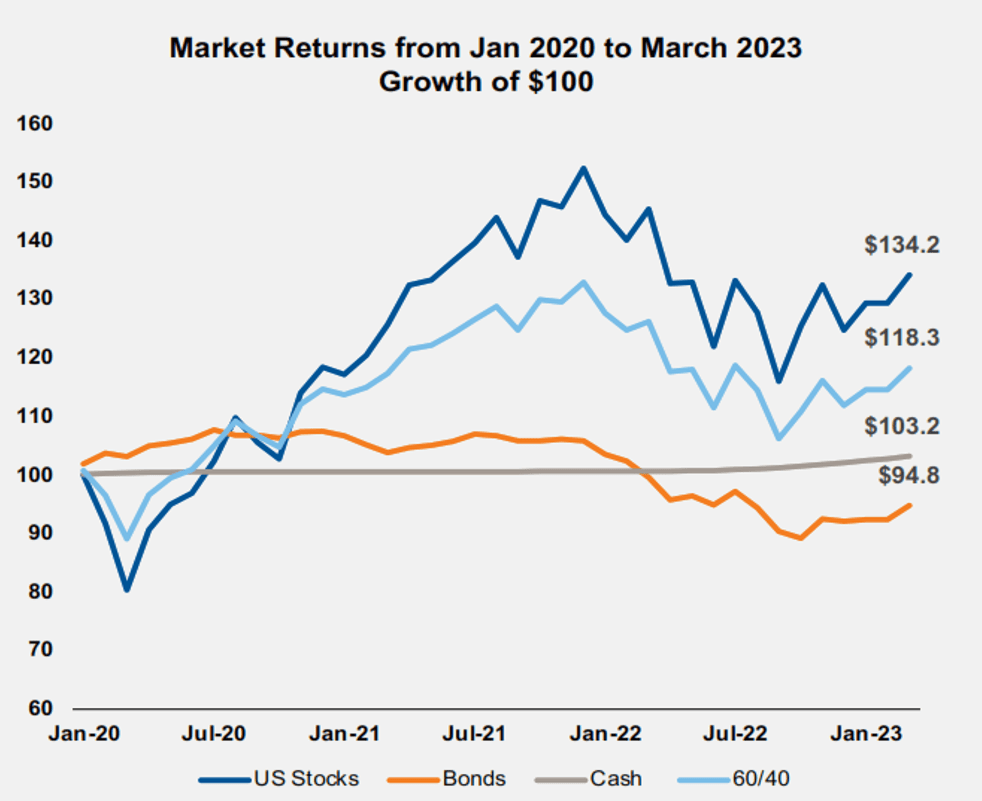

Many investors would likely be lured into making a “market timing” move to reposition into a much more conservative allocation. Most would expect stocks to really struggle in that environment. However, despite all of these macroeconomic events actually taking place, US stocks have gained 34% since January, 2020 and balanced portfolios (60% stock/40% bonds) have gained 18%. Investors who flocked to “safe” assets have significantly lagged with bonds losing -5% and cash only up 3%.

An even more recent example involves predictions regarding European stocks. Capital Group Portfolio Manager Andrew Suzman said it best with the following:

“A year ago, if I told you that the war in Ukraine would continue to drag on, that the European economy would produce virtually zero growth and that U.S.-China tensions would intensify, I doubt you would have expected a positive return for international stocks. And yet, despite the escalating war in Ukraine, skyrocketing energy prices, record high inflation and weak economic growth, European markets have staged a powerful rally, outpacing U.S. stocks over the past two quarters.

Even with the benefit of perfect hindsight, or a crystal ball, you might still have come to the wrong conclusion. Knowing all the macroeconomic facts in advance, we would have predicted negative returns. The headlines would have misled us.”

These events prove the difficult nature of successfully predicting macroeconomic events and market reactions. Rather than trying to time the market and drastically shift portfolios, we suggest sticking to the tried and true principals of diversification, rebalancing and tax loss harvesting.

Today’s headlines are dominated by the looming debt ceiling debate, potential government default, inflation, the Federal Reserve and an impending recession to name a few. Please don’t let the “expert” predictions cause you to make an emotional decision to change your long-term portfolio allocation. Markets have weathered the storm of events like this in the past and will continue to do so going forward. There will certainly be bumps along the road, but diversification can win over the long-term.

Condoleezza Rice summed it up best many years ago when I listened to her at a conference say “today’s headlines and tomorrow’s reality are seldom the same.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.