May 2019 Financial Markets Summary

The Columbus Blue Jackets have been the talk of the town with their shocking sweep of the #1 seeded Tampa Bay Lightning and their current 2-1 series lead against the Boston Bruins. However, many experts discarded the Jackets late in the season as they struggled to find their rhythm with the newly acquired players from trades made at the deadline. It all changed after a players only meeting on a west coast road trip in late March. Since then, the Jackets have snapped back by winning 13 of their past 15 games.

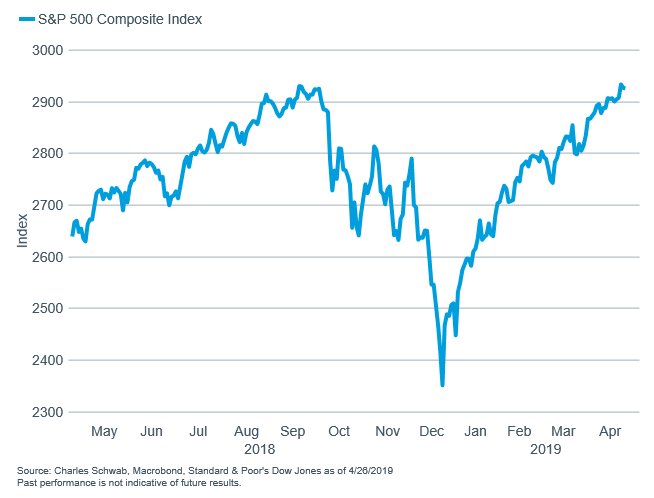

This echoes the recent pendulum swing that we experienced in the domestic stock market. Some economists were predicting a recession after the 19.9% drop in the 4th quarter of 2018. However, the Federal Reserve adjusted their interest rate policy and the markets roared right back to surpass their all-time highs this week.

We would love to see the Jackets and the markets continue their hot streak, but now is not the time to rest on our laurels. The Jackets goalie, Sergei Bobrovsky, has played incredible defense between the pipes during their recent run, but the rest of the team needs to continue their defensive intensity in order to make a deeper run in the playoffs. Even though bond returns are nothing to get excited about, they continue to be critical for portfolios going forward. During the next correction, those investors will be glad they didn’t chase returns and maintained their allocation to bonds to help play defense.

Now is as important as ever to consider Wayne Gretsky’s famous quote “I skate to where the puck is going to be, not to where it has been.” Domestic stocks have trounced practically all other asset classes over the past 10 years, but we wouldn’t expect this to continue for the next 10 years. International and emerging market stocks may be where the puck is going next.

| Asset Index Category | Category | Category | 5-Year | 10-Year |

| 3 Months | 2019 YTD | Average | Average | |

| S&P 500 Index – Large Companies | 8.9% | 17.5% | 9.3% | 12.9% |

| S&P 400 Index – Mid-Size Companies | 7.4% | 18.5% | 7.8% | 13.4% |

| Russell 2000 Index – Small Companies | 6.1% | 18.0% | 7.1% | 12.5% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) | 7.2% | 15.9% | 6.9% | 11.3% |

| MSCI EAFE Index – Developed Intl. | 6.1% | 13.1% | 2.6% | 8.0% |

| MSCI EM Index – Emerging Markets | 3.2% | 12.2% | 4.0% | 7.5% |

| Short-Term Corporate Bonds | 1.3% | 2.0% | 1.4% | 2.6% |

| Multi-Sector Bonds | 1.9% | 3.0% | 2.6% | 3.7% |

| International Government Bonds | -1.1% | 0.6% | -0.3% | 2.0% |

| Bloomberg Commodity Index | 0.4% | 5.9% | -9.4% | -2.7% |

| Dow Jones U.S. Real Estate | 5.0% | 17.0% | 9.0% | 15.0% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.