Posted: 3/12/2024

Artificial Intelligence Mania

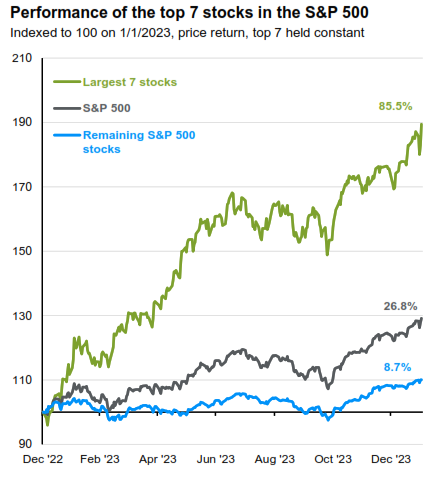

Stock markets around the world performed quite well in 2023 and so far in 2024, especially those involved in artificial intelligence. The “Magnificent 7” (Microsoft, Amazon, Meta, Apple, Alphabet, Nvidia & Tesla) have a focus on AI and have driven the majority of the S&P 500 performance. These 7 stocks rose over 85% from 1/1/23 to 1/31/2024, while the other 493 stocks in the S&P 500 only delivered 8.7%.

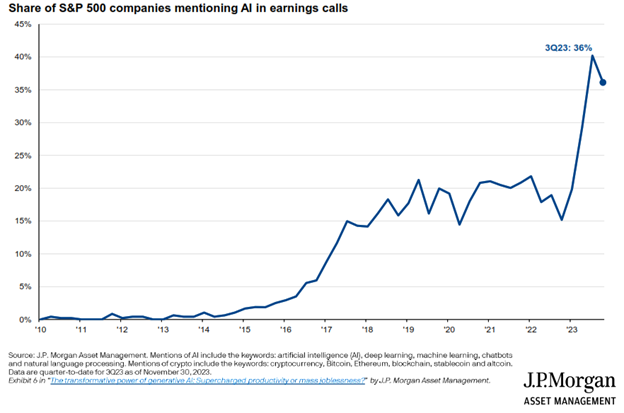

Many companies are attempting to join the AI craze as over a third mentioned it in their earnings calls last year, compared to less than 1% from 2010-2014.

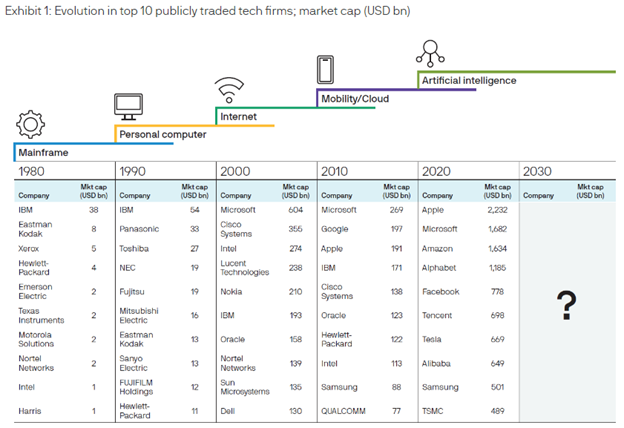

J.P. Morgan suggests, “every decade, a technology platform shift is accompanied by a major disruption in tech leadership. As these shifts play out, some businesses can sustain their leadership, but they are few and far between. The strongest companies today can be disrupted if they fail to capture the next platform or lose market share in their core business,” as shown below.

Time will tell if the 2020 decade turns out to be the AI theme, but it is certainly trending in that direction so far.

J.P. Morgan goes even further by suggesting, “artificial intelligence (AI) technologies appear likely to revolutionize the way we work, innovate and create. Generative AI can create novel, human-like output across various domains, making it highly versatile and intuitive. As such, it has the potential to become a “general-purpose technology” like the steam engine and computer, transforming the global economy. When Apple had its iPhone moment in 2007, it set off a series of incremental yet meaningful iterations in the mobile phone market. Those iterations made mobile phones more useful and deepened our historical understanding of what made Apple’s innovation so powerful. As waves of innovation moved in a cycle, entirely new industries were created. We think the same process is now underway with AI and when we look back in 10 years, we expect to see profound change.”

We are continuing to keep a close eye on how these types of changes impact the stock market and ultimately the impact on client portfolios. We’ve said it before, “today’s headlines and tomorrow’s reality are seldom the same”. But it doesn’t mean we aren’t paying close attention!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.